Gol: Now a

Delta/Ryanair hybrid?

April 2018

Gol Linhas Aéreas Inteligentes, Latin America’s largest LCC, has seen a strong financial recovery in recent quarters as Brazil’s economic growth has gathered pace. With operating margins already in the low-double digits, the São Paulo-based airline is outperforming its larger peers in the region.

Gol is doing so well in large part because between mid-2015 and early 2017 it implemented what may have been one of the strongest and fastest restructurings by an airline outside of bankruptcy.

Among other things, Gol raised new equity from key shareholders, renegotiated supplier contracts, slashed capacity, restructured its network, downsized its fleet, negotiated concessions from lessors, deferred aircraft deliveries, and reduced and deferred debt obligations.

All of that gave Gol a much stronger balance sheet and reinforced its position as the lowest-cost airline in Brazil and South America.

However, while restructuring, Gol also aggressively sought to capture more premium traffic. Those efforts have been so successful that in 2016 Gol took the lead in Brazil in terms of revenues earned from corporate travellers (ABRACORP data). Its share of corporate revenues is about 30%.

Gol’s success in the premium segment is not totally surprising. In Brazil, the bulk of air travel has always been for business purposes, and Gol is the largest carrier domestically, with 35% of RPKs. Gol has gained business traffic share also because of LATAM Brasil’s sharp contraction since 2012.

But Gol’s business model has clearly changed. Intriguingly, Gol seems to have achieved the impossible: being both a true LCC (with ULCC-level costs) and a full-service airline with a product that appeals to business travellers.

In November 2016, following Gol’s investor day, Bradesco analysts wrote a note titled “More Delta and more Ryanair”. They commented that an efficient revenue management system allows Gol to serve both leisure and corporate customers. Delta’s influence is clearly visible here. But how does Gol really pull it off?

Gol’s next big focus will be international expansion, facilitated by the start of its 737 MAX 8 deliveries this summer. International ASK growth could be as high as 30-40% in 2019.

There are also interesting new developments with strategic partners. A new joint hub with Air France-KLM is in the works in Fortaleza. An immunised JV will soon be in the works with Delta.

Accelerating financial recovery

Gol was hit hard by Brazil’s economic troubles, because its operations are primarily domestic (still 85.5% of its revenues in 2017). The airline incurred net losses for five consecutive years (2011-2015). However, only 2012 saw a heavy operating loss, because Gol was quick to contract in size and also benefited from industry capacity discipline from 2012 onwards.

In 2014 Brazil slid into its worst recession in decades and the economy contracted by 3.8% in 2015 and 3.6% in 2016. But Gol had only a marginal operating loss in 2015 and turned a corner financially in 2016, achieving a 7.1% operating margin and its first annual net profit since 2010. The early turnaround was mainly a result of the restructuring, which saw Gol slash its operating fleet from 144 to 121 and ASKs by 6.9% in 2016.

Gol consolidated the recovery in 2017, achieving a 9.4% operating margin, though net income declined due to unfavourable foreign exchange effects. The fleet restructuring was officially completed in April 2017 with the final leased aircraft returns.

The latest quarterly results illustrate the accelerating recovery momentum. In Q4 2017 Gol’s revenues rose by 12%, operating profit doubled and the operating margin surged by 5.6 points to 13% — the highest Q4 operating margin since 2011.

According to Gol’s April 5 guidance, in the first quarter of 2018, PRASK rose by 10.5-11% and the operating margin was as high as 15-15.5% (the results will be released on May 9).

Gol forecasts its full-year operating margin to increase to 11% in 2018 and 13% in 2019. The airline is resuming modest growth this year, with ASKs increasing by 1-3%, followed by 5-10% growth in 2019. But nearly all of the growth will be international: up 7-10% in 2018 and 30-40% in 2019. Domestically, Gol will remain disciplined with only 0-3% ASK growth this year and 1-3% in 2019.

This year’s main themes are, first, continued economic and demand recovery. Brazil emerged from recession in June 2017. The IMF currently forecasts Brazil’s GDP growth to accelerate from last year’s 1% to 2.3% in 2018 and 2.5% in 2019. Inflation has returned to historic lows: just 3% in 2017, with 3.8-4.2% projected in 2018-2019.

Brazil is seeing a gradual return of business travellers. The corporate segment contracted sharply in 2015-2016 but started to pick up in the second half of 2017, helped by a combination of GDP growth, low inflation and low interest rates. The recovery is set to accelerate in 2018.

The past two quarters have also seen a strong rebound of international travel out of Brazil, especially to the US and Europe — also likely to continue in 2018. A new US-Brazil open skies regime could provide a major boost (in late April the deal still needed President Michel Temer’s signature).

Importantly, capacity discipline is set to continue in the Brazilian airline industry. That and the demand recovery should ensure continuation of healthy revenue trends.

Gol’s profits will also benefit from higher ancillary revenues. Like its Brazilian peers, Gol was able to introduce first checked bag fees domestically in June 2017. Earlier this year it added fees for seat assignments. Both of those are optional items for passengers in the two lowest fare categories (Promo and Light) but included in the airfare in the higher fare categories (Max and Plus).

With its Gollog cargo and logistics subsidiary (R$300m revenues in 2017), Gol is also well positioned for the continued recovery in the cargo segment. “Cargo and other” revenues (cargo, FFP, ancillary fees) grew by 16.2% in 2017.

Finally, Gol’s costs are under control. Its ex-fuel CASK declined by 4.6% in Q4 (though it partly reflected normalisation of maintenance costs after earlier spending associated with aircraft returns).

But there are challenges and risks. S&P and Moody’s both recently downgraded Brazil’s credit ratings in part because of lack of progress in legislating reforms. Upcoming presidential and congressional elections in October 2018 create political uncertainty.

Gol executives said last month that they had kept the 2018 capacity plans fairly conservative because of the elections.

Balance sheet deleveraging

Gol was never a near-term bankruptcy candidate, but in mid-2015 it faced ballooning debt, increasing cash burn and a deteriorating economy. All three main rating agencies had warned of a cash crunch in 12-18 months as debt payments were coming due and demand and yields in Brazil continued to deteriorate.

Gol’s US dollar-denominated debt had ballooned because the Brazilian real almost halved in value relative to the dollar in the three years to December 2015 (from 2.04 to 3.9). During 2015 alone the real weakened by 47%, which had devastating impact on Gol’s balance sheet: debt soared from R$6.2bn to R$9.3bn and lease-adjusted debt from R$12.1bn to R$17bn. The airline’s short-term liabilities also increased dramatically during 2015.

So Gol embarked on a comprehensive financial restructuring (for details, see the October 2016 issue of Aviation Strategy). The result: an effective deleveraging that also eliminated any liquidity risk in 2016-2017, giving Gol breathing space while its earnings recover. But Gol remains relatively highly leveraged by industry standards, so continued debt reduction remains a priority.

The deleveraging process was greatly helped by the reversal of the R$/US$ trend at the end of 2015. The real strengthened by 16.5% during 2016 (from 3.9 to 3.3) and has since then stabilised in the 3-3.5 range.

In the two years to December 2017, Gol’s total debt fell by 24% to R$7.1bn ($2.1bn) and lease-adjusted debt by 21% to R$13.7bn ($4bn). Adjusted gross debt/EBITDAR declined from 12.7x in 2015 to 5.4x in 2017; the ratio is expected to reach 5x in 2018-2019.

The past two years’ refinancings have driven down Gol’s cost of debt, reducing interest payments. Gol’s dollar-denominated debt amortisation schedule also looks manageable, with R$354m ($104m) of maturities in 2018, R$68m ($20m) in 2019, R$1bn ($294m) in 2020, R$108m ($32m) in 2021 and R$3bn ($882m) thereafter (as of January 31).

Gol plans to fully pay down its local currency debt when it comes due. The next maturity (R$400m) is in October 2018, with the remaining R$625m maturing in 2019.

Gol’s cash position has fluctuated but is currently very healthy. At the end of 2017, total liquidity amounted to R$3.2bn or 30.1% of annual revenues.

The improvements have been recognised by the three main credit rating agencies, all of which upgraded Gol’s ratings in 2017 (some did it twice). S&P raised Gol’s ratings by two notches to B-, Fitch by two notches to B, and Moody’s by four notches to B2.

As a result, Gol now enjoys more financial flexibility. It can access the international debt capital markets at attractive terms to refinance more debt.

The two-part US$650m bond offering that Gol completed in December-January was a good example. The senior notes, which have a 7% coupon and mature in 2025, partly refinanced 8.9-9.5% notes that were due in 2020 and 2022.

Gol now generates free cash flow (FCF), but the amount may decline in 2018-2019 as the airline starts growing its fleet and expanding internationally. Any excess cash in the near term is likely to be used mainly to pay down debt. The management said recently that dividends would only be considered when the annual operating margin exceeded 15%. However, regulatory filings in April indicated that Gol was planning some modest share repurchases.

Gol has 120 737 MAX 8s on order, with deliveries beginning in July 2018 (six this year). The type will replace the 737-700s and 737-800s and provide for growth through 2028. This year Gol’s operating fleet is projected to increase by six units to 121; after that the fleet will grow by 3-5 units annually (see table).

Some of the MAX 8s will come directly from Boeing and some will be on operating leases. In 2018-2019 at least, it will be all operating leases. Gol has already done some sale-leaseback deals with GECAS and AWAS.

New international focus

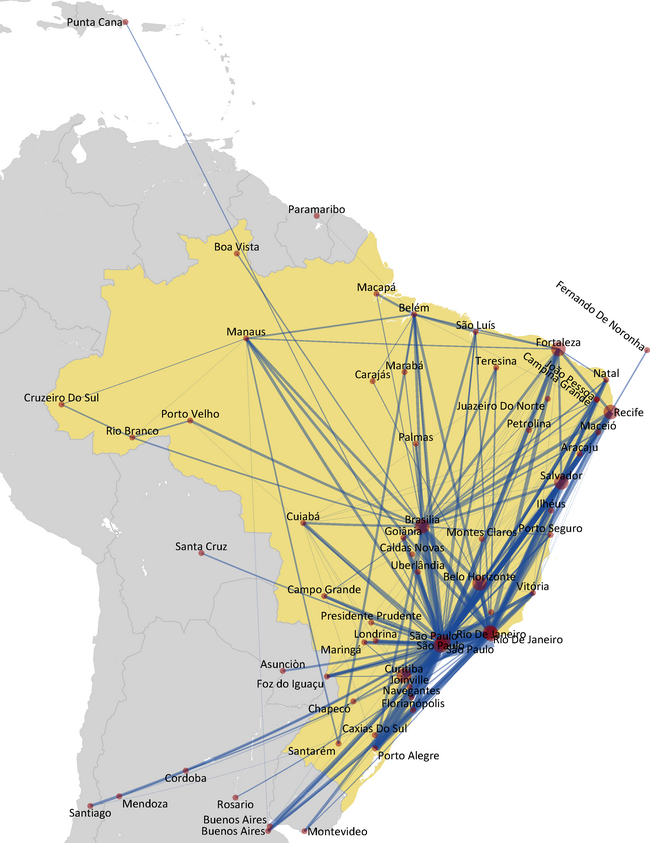

Gol’s network restructuring in 2016 involved the following: culling lots of unprofitable routes (including its US services); adding more long-haul flights out of São Paulo’s Congonhas to Brazil’s north and northeast; reducing short-haul leisure operations; adding more business-oriented routes at Congonhas; and working with partners Delta and Air France-KLM to strengthen presence at Rio de Janeiro’s Santos Dumont and Galeao airports.

The Brazil-Florida services, which Gol had operated via the Dominican Republic because the 737-800s needed a fuel stop, were terminated in early 2016 after Brazil-originating demand had fallen sharply due to recession.

In 2017 Gol focused on keeping its dominant position in Rio; improving connectivity in Galeao, Guarulhos and Brasilia; developing new markets in the north and northeast; and adding new international services within South America and to the Caribbean.

The focus has now shifted to international expansion, which will kick off in November 2018 with Gol’s return to the US market — this time on a nonstop basis. Gol will serve Miami and Orlando from Brasilia and Fortaleza — gateways that make sense geographically and offer good connectivity with the rest of Gol’s network.

The new Florida flights are possible because of the MAX 8’s 15% longer range (6,500km), which will also enable Gol to serve new markets in Central America, southern Mexico and the west coast of South America. Gol has identified more than 16 potential new destinations. The management expects international revenues to grow to around 20% of total revenues (currently 13%).

US expansion will help diversify Gol’s revenue sources and give it a natural exchange rate hedge (through an increase in dollar revenues). The flights will of course benefit from feed from Delta’s vast US network.

This year will also see further development of the Gol-Delta partnership. The airlines have had an exclusive codeshare relationship in the Brazil-US market since 2011, when Delta acquired a 3% stake in Gol (now 9.5%). Delta played a pivotal role in Gol’s restructuring (equity injections, loan guarantees, taking over leases, etc.) and product revamping.

Taking that relationship to the next level will be just a formality: When the Brazil-US open skies regime comes into force, Gol and Delta are likely to quickly seek approval for an immunised JV.

Gol does not plan to operate flights to Europe, but it is fortunate in having an enthusiastic partner in Air France-KLM that is keen to grow Europe-Brazil services and engage in creative collaboration. In 2014 Air France-KLM invested US$100m in a 2% equity stake in Gol, which also created a (mostly) exclusive codeshare relationship in the Brazil-Europe market (TAP is also listed as a codeshare partner).

In a major collaborative venture, Gol and Air France-KLM are launching a new joint hub in Fortaleza in Brazil’s northeast on May 3. The hub will initially have five flights a week from Europe, with KLM operating three from Amsterdam and Air France’s Joon two from Paris. Gol is boosting its flights at Fortaleza by 35%; it already is the largest carrier there with 40% of the traffic.

The concept is brilliant because of Fortaleza’s geographical position. All flights to Europe from Brazil go over Fortaleza, so travellers from many parts of the country can save considerable time by rerouting via that airport, also avoiding the congested main hubs in the south. There is an opportunity to generate significant new demand. Gol also sees Fortaleza serving as a connecting hub for traffic between Europe and Florida, the Caribbean and all major cities in South and Central America.

The management confirmed again recently that Gol is not interested in joining SkyTeam; it remains committed to the “open architecture” type alliance strategy in markets other than the US and Europe. It currently has around 12 codeshare partners.

Unique competitive strengths

Gol seems uniquely well positioned for the future for four reasons: being the lowest-cost LCC; having a strong business-oriented network and product offering; having extensive slot holdings at key airports in Brazil; and having two very successful strategic partnerships with staying power.

Gol has retained its position as South America’s lowest-cost airline. According to a recent company presentation, its 2017 ex-fuel CASK was 4.41US¢, which was 18.3% below LATAM Brasil’s and 9% below US ULCC Spirit’s (on a stage-length adjusted basis). In the Americas, only Mexican ULCC Volaris had lower unit costs than Gol.

The cost advantage arises from a standardised single type fleet, which enables Gol to obtain lower crew costs, higher utilisation and better spare parts management. Gol has one of the lowest fixed cost structures among LCCs globally.

Gol’s unit costs will benefit from a seat densification project, which increases the seat count on the 737-800s from 177 to 186 and is due to be completed by July. Otherwise Gol will rely heavily on its fleet modernisation and the larger size of the MAX 8s to mitigate cost pressures in the future.

Improving offerings to the business segment has been a multi-year process involving heavy investment in products and services. The airline has introduced Gol+ Conforto seats with more legroom, domestic premium lounges in São Paulo and Rio (the only airline to offer that) and onboard Wi-Fi in Brazil (the first airline to offer that). Gol has the industry’s best on-time record (though Azul makes the same claim, citing OAG data). And Gol has an attractive loyalty programme, Smiles, which is Brazil’s largest FFP with 13m members.

Having bolstered its presence at key Brazilian cities, boosted frequencies in the main business markets and improved schedules all around, Gol believes that it offers the “best network for business travellers”.

So having the best network, the right combination of products and the most reliable operation puts Gol in a strong position to continue to attract corporate traffic — the segment that collapsed during the recession and is now recovering at the fastest rate.

Gol has vast slot holdings at Brazil’s key airports for historical reasons: it was founded in 2001 and it pioneered the development of leisure travel in Brazil, stimulating demand with low fares. Domestic passengers in Brazil have roughly tripled since 2003. Later, Gol strengthened its slot holdings through two acquisitions — Varig in 2007 and Webjet in 2011.

Gol is the number one or number two carrier at the 12 key airports that represent 75% of Brazil’s traffic — a formidable market position. It has a 41% share of the total traffic in São Paulo (CGH and GRU), 50% in Rio (SDU and GIG) and 35% in Brasilia. Those are all slot-constrained airports.

The Delta and Air France-KLM partnerships represent another great strength. The relationships are probably permanent (or as permanent as an airline marriage can be) because Gol offers something special to the global carriers: long term access to the huge Brazilian market.

Whether the equity stakes are raised or not is probably irrelevant — Gol has a strong support network. Incidentally, the Brazilian Constantino family still holds a 61% stake (with only 28% being publicly held; Gol is listed in both New York and Sao Paulo), but that helped Gol during its restructuring in that it provided stability and the founders also contributed additional funds.

The Brazilian market has high barriers to LCC entry, but competition is set to intensify with the implementation of the US-Brazil open skies ASA. Gol has three strong competitors at home that are making the exact same moves as Gol: capturing business traffic, building new hubs in the northeast, growing in the US market, seeking immunised JVs with foreign partners and possibly getting more equity injections from those partners (when foreign ownership restrictions are abolished).

Brazil is a huge underpenetrated market with significant long-term growth potential, so there may be enough traffic for everyone. Gol is well positioned to capture the growth, but because of the competitive scene, its annual operating margins may never get back to the high-double digits of the earlier years.

| Number of aircraft at year-end: | ||||||

|---|---|---|---|---|---|---|

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| 737-700 | 24 | 25 | 22 | 21 | 16 | 16 |

| 737-800 | 91 | 91 | 89 | 86 | 83 | 78 |

| 737 MAX 8 | 5 | 13 | 21 | 34 | 43 | |

| Total | 115 | 121 | 124 | 128 | 133 | 137 |

Source: Gol (March 7)

Note: Gol's forecasts (March 7)

Source: Company reports

Source: Company report. Note operating leases capitalised at 7x.

Notes: Gol's forecasts. Mid-points of ranges. Source: Company reports

Note: São Paulo quote in R$