SIA: Reconciling Premium tradition

with Budget growth

April 2017

Since the financial crisis a decade ago Singapore Airlines has been stuck in a rut of low growth, weak financial results (while remaining profitable as a group) and a mire of external competitive forces — beset by the pincer development of the growth of SE Asian LCCs on short- and medium-haul, the seemingly inexorable growth of the super-connectors undermining its 6th freedom hub in Singapore. In the background has been the relatively weak local economic performance.

SIA has been trying to establish a multi-brand group of airlines offering products in the low cost sphere as a complement to its traditional full service high-quality offering, while it anticipates a resumption of growth in the parent company airline as its new generation ultra-long haul A350s and 787-10s are delivered.

SIA’s financial year runs to end March, and in the first three-quarters of 2016/17 (the nine months ending December 2016), the Group saw revenue fall by 3.2% year-on-year to S$11.1bn (US$8bn). However, operating profit during the period increased by 13% to S$595.2m (US$425m) as fuel costs fell by 23% to S$2.78bn, while net profits fell by 14% to S$499m. Operating profit improvements offset by losses from associates, losses on disposal of aircraft and a writedown of the Tigerair brand and trademark.

This was on the back of a 3.4% increase in the total number of passengers carried by group airlines, a 2% growth in demand in terms of revenue passenger kilometres and a 3% increase in capacity in ASKs. The load factor dipped by 1.5 points to 78.5%.

On a divisional breakdown, the parent company Singapore Airlines itself increased operating profits by 10% to S$427m up from S$387m in the prior year period; Silkair — its regional full service carrier — by 25% to S$74m; Tigerair and Scoot — the low cost brand offering — reversed minor operating losses to operating profits of S$20m and S$26m respectively; while SIA Engineering saw profits decline by a third to S$48m, but SIA Cargo registered a modest S$8m profit for the period — and this is following Cargo losses of S$458m in total over the previous five financial years.

At the end of December 2016 the Group had total debt of S$1.6bn, some S$245m higher than the debt figure at the end of the last financial year. On the other hand, cash and cash balances fell from S$4.6bn at end March 2016 to S$3.7bn at the end of the period. This compares with a total net asset value of S$13.8bn.

Parent company pressure

The parent company Singapore Airlines remains the critical driver of the group’s performance, accounting for 85% of group revenues and profits. However, the airline is under significant pressure and has deliberately reined in growth plans in the past five years. As we show in the chart below, since the last cyclical peak in 2008 and the collapse in demand following the financial crisis, Singapore Airlines’ passenger numbers have stagnated. In the past four years growth in passenger demand has been lacklustre — and on a twelve month rolling basis annualised carryings of 18.9m to the end of February 2017 were still somewhat below the peak 19.4m achieved in the twelve months ending August 2008.

Further, up to the end of 2008, the Singapore economy had been motoring along with GDP growth averaging 7% a year. In the last ten years, under the “new normal” economic environment it has only managed a modest 4.5% growth a year — with the last two years generating a relatively insipid 2% growth reflecting the impact perhaps of the slower rate of growth in China. The latest IMF forecasts suggest that this lower rate of growth will continue.

In the nine-month period to the end of 2016 Singapore Airlines itself saw revenues fall by 6% year on year to S$8.4bn as fuel costs fell by a quarter (it effectively passed on all the fuel savings to the benefit of the passengers). It cut ASKs by 0.5% year-on-year, but with RPKs falling by 2.6%, the passenger load factor dipped by 1.6 percentage points to 78.4%. Yields in the period fell by 4.5% but unit revenues fell by 6.6% and unit costs dropped by 7%. The passenger breakeven load factor came down to 78.4% from 80.4%, matching that achieved. Disturbingly, ex-fuel unit costs increased by 3.7%.

Conundrum

Singapore Airlines was one of the industry disruptors when it developed 6th freedom services through the Changi hub through the 70s and 80s — attracting the same type of opprobrium currently being directed at the Superconnectors in the Gulf. With a population of less than 6m, the island state could not naturally support an airline of SIA’s size purely on O&D demand. SIA itself doesn’t give the figures, but Changi Airport has indicated 30% of passengers are in transfer through the Singapore hub, and with SIA and Silkair holding 34% of the slots at the airport it is reasonable to assume that 60% of the airline’s traffic is 6th freedom transfer.

It now itself is suffering from the competition on its mainstay Europe-Asia routes from the aggressive growth represented by the new competing models, as well as an attack on the Pacific from the development of Chinese international services.

The management is well aware of the changing fundamentals of the market, and recognises that these changes are structural and probably permanent. Taking the decision not to grow however puts pressure on unit costs that other expanding carriers avoid at the margin.

SIA has traditionally provided a quality product and, has been recently reducing the density of seating, adding premium economy to the new fleet acquisitions (and retrofitting existing aircraft in the fleet), presumably to try to reduce the number of seats available for the deepest discount buckets in the revenue management system.

At the same time it has been trying to bolster access to markets at the other end of its long haul routes and has been developing a plethora of code share agreements — currently on some 10,000 frequencies up from 2,000 six years ago.

Last year it signed a Joint Venture agreement with fellow Star Alliance partner Lufthansa Group (including SWISS, Austrian, Brussels and Silkair) to coordinate on pricing and capacity — cleared by the Singapore authorities subject to certain conditions in December 2016 — covering routes between Germany, Austria, Switzerland and Belgium (the “LH Home Markets”) and certain Asia/Asia Pacific countries (specifically Singapore, Indonesia, Malaysia and Australia — the “SQ Home Markets”).

Things don’t always go to plan, and Indonesia has rejected the JV agreement and blocked SIA’s proposal to operate a fifth freedom service between Jakarta and Sydney.

SIA prides itself on operating a young fleet (currently 7.5 years). It has started taking delivery of A350s. It currently has 12 of the type with a further 55 on order. It also has orders for 30 787-10s due for delivery from 2018. These will be used to replace the aging 777s in the fleet (see table).

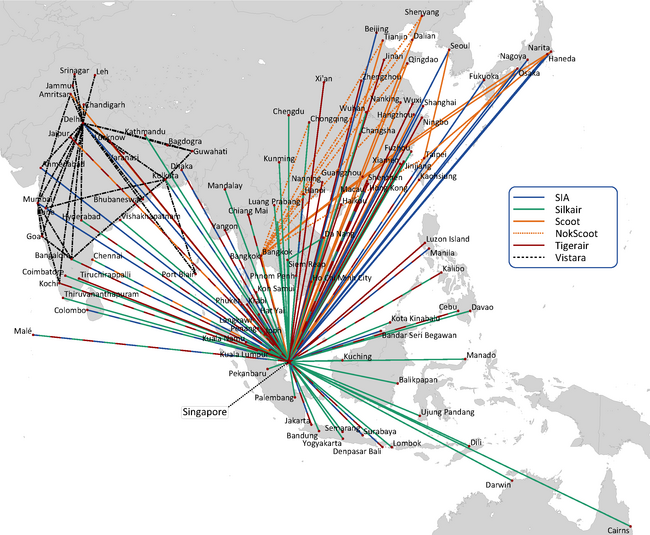

CEO Goh Choon Phong describes the new equipment as a “game-changer”. The extended range and lower seat density allows it to schedule services on some very long haul routes that conveniently overfly intervening sixth freedom hubs — seven of the aircraft on order are for the ultra long range version and will be delivered from 2018. It recently initiated a direct Singapore-San Francisco service (see map) and anticipates being able to return to operating direct services from Singapore to New York and Los Angeles — (which it used to operate with the less optimal four-engined A340).

Other recent route openings meanwhile appear less than optimal: tagged routes via Manchester to Houston; via Moscow to Stockholm; via Canberra to Wellington. And tagged routes are rarely very profitable, but may be a precursor of future direct intentions.

Meanwhile there may be questions of the long term future of the company’s A380 fleet. The first of these is approaching the end of its ten-year lease in the current year and SIA has stated that it does not intend to renew the lease. It has 19 A380s in operation and nominally has another five of the type on order. The airline currently operates the aircraft to 14 destinations with double daily flights to slot-constrained Heathrow and to Sydney aside from Auckland, Bombay, Paris, Frankfurt (tagged on to New York), Hong Kong, Kansai, Melbourne, Beijing, Shanghai, Sydney and Zürich.

The LCC future hope

In 2016 Singapore Airlines Group took full control of its associate short-medium haul low cost operator, Tigerair Singapore, with the aim of merging it fully with its long haul low cost operator Scoot. It has put them into a new holding subsidiary under the dynamic sobriquet of “Budget Aviation Holdings” with the idea of combining the two under a single AOC, single management and operational control. This is expected to take effect in the second half of 2017.

Scoot was launched in 2012 to operate medium- and long-haul routes from its base at Changi. It has fleet of 12 787s (with another 8 on order) and flies to 22 destinations. It has an average stage length of 3,600km (the longest routes being Singapore-Athens and Singapore-Gold Coast).

Scoot has been growing strongly. In the last twelve months it increased the number of passengers carried by 45% year on year and achieved a total number of passengers booked of 3.5m with an 81% load factor. It only started in 2012 but has become profitable relatively quickly — it registered a S$20m operating profit for the first time in the financial year ended March 2016. The published figures we have are sketchy, but it appears that it is operating on a unit cost base of around US¢3.5/ASK — not far from that achieved by AirAsia X albeit on a slightly shorter stage length — roughly half that of parent company SIA. And, as we mention above, it is now profitable.

One of the more interesting new routes starting this year is that to Athens (see map) — SIA itself used to operate the route with 777s until 2015 — seemingly a strange choice of a first destination in Europe. However, this does seem to signal the strategy to target a sixth freedom low cost operation through Changi, in this case perhaps focusing on low yielding VFR traffic of the Greek diaspora: Australia has one of the largest Greek communities in the world.

Tigerair operates 23 A319s and A320s out of Changi to almost 40 destinations in Asia (within a five-hour flying time), with a single class. It also has 39 A320neos on order. Its performance recently has been somewhat less than dynamic. In the past twelve months it carried 5.1m passengers with an average growth rate of 0.2%. After a couple of loss-making years it returned to profitability at the operating level in the financial year ended March 2016 and generated a modest S$20m profit in the nine months to Dec 2016. It encounters intense competition at its Changi base, not least from Jetstar Asia and AirAsia (which are after SIA, Silkair and Tigerair the fourth and fifth largest operators at the airport).

From SIA’s point of view, the rationale for the full Tiger acquisition was to “harness full synergies to benefit the SIA Group and the Singapore hub”, although it also argued that as an independent airline Tiger lacked the scale and network necessary to compete in the LCC market. By bringing the two under a single brand, the management is clearly signalling that a long haul low cost operation needs feed.

Multi-hub?

The SIA Group also has other airline investments; in January 2015 it launched Vistara, a full-service Indian airline (in which it owns 49%) in association with Tata Sons, part of the Tata Group — the giant Indian conglomerate. Though two previous attempts by SIA and Tata to start an airline in India had come to nothing, this effort appears to be more successful.

Based at Delhi’s Indira Gandhi airport, Vistara operates 13 A320s domestically in a three-class configuration (with 8 business class, 24 premium economy seats — becoming the first airline to introduce the class domestically — and 126 in economy) to 20 domestic destinations (see map). The medium-term plan is to increase the fleet to 20 aircraft by 2018 with the seven A320neos it has on order due for delivery from late 2017.

The airline has been a success (it carried 2.5m passengers in 2016, its second year of operation, on a 76% load factor) even though it may not yet be profitable. The longer term strategy has been given a boost by the recent changes to the Indian state’s so-called 5-20 rule, where new carriers had to operate domestically for five years and have a fleet of at least 20 aircraft before being allowed to fly internationally. The new 0/20 rule announced last June specifies that an indian airline has to have the lesser of 20 aircraft or 20% of its fleet dedicated to domestic indian routes.

We would expect that SIA will move quickly to expand Vistara further, enabling India to become a major source market for the SIA Group for passengers travelling west into the Middle East and Europe, and east into Asia.

The final airline in the group stable is NokScoot — a joint venture with Thai Air’s Nok subsidiary. Based in Bangkok’s older Dom Mueang airport it started operations in 2015 and flies 3 777s in a two-class configuration to six cities in China as well as Taipei — directly targeting inbound leisure travel. The SIA management appears to believe that this also fits in with a multi-hub strategy.

| Total | 117 | (90) | 30 | (37) | 12 | (8) | 3 | 13 | (7) |

| SIA | SilkAir | Scoot/Tigerair | NokScoot | Vistara | |||||

| In service | On order | In service | On order | In service | On order | In service | In Service | On Order | |

| 747F | 9 | ||||||||

| 777-200/300 | 53 | 3 | |||||||

| 787-8/9 | 12 | (8) | |||||||

| 787-10 | (30) | ||||||||

| A330 | 24 | ||||||||

| A350 | 12 | (55) | |||||||

| A380 | 19 | (5) | |||||||

| 737-800 | 17 | ||||||||

| 737MAX-8 | (37) | ||||||||

| A319 | 3 | 2 | |||||||

| A320ceo | 10 | 21 | 13 | ||||||

| A320neo | (39) | (7) | |||||||

Source: Company Reports

Note: Financial years ending March. † rolling twelve months to Dec 2016.

Source: Company reports. Notes: twelve month rolling total passengers carried parent airline only.

Note: Year end March. Data for 2016/17 four quarters to end December 2016.