SIA’s true position

flattered by fuel prices

April 2016

SIA Group’s results for the first three-quarters of 2015/16 were good, but they were driven largely by a 12-year low in fuel prices. With increasing competition from LCCs and full-service Asian and Gulf carriers continuing to drive down yield at the mainline, can the Group build up the LCCs in its portfolio as quickly as it needs to?

SIA’s financial year runs to end March, and in the first three-quarters of 2015/16 (the nine months ending December 2015), the Group saw revenue fall by 1.4% year-on-year to S$11.5bn (US$8.3bn). However, operating profit during the period increased by 66.3% to S$528.0m (US$382.5m), with profit before tax reaching S$729.2m (US$528.3m), compared with S$386.3m in April-December 2014.

The drop in revenue was due to reduced business in cargo, mail and engineering services, but this was more than compensated for by the fall in fuel prices, which lowered Group fuel costs by a hefty S$692m (US$501m) over the nine-month period.

The majority of Group operating profit in the first three-quarters of the year derived from the mainline (S$387m, which rose 43% compared with April-December 2014), followed by SIA Engineering (S$77m, up 26%), though SilkAir saw operating profit more than double, to S$59m. All the other airlines in the Group portfolio made operating losses — SIA Cargo (S$10m), Scoot (S$4m) and Tiger Airways (S$1m) — although all but Tiger improved their position year-on-year.

At the end of December 2015 the Group had total debt of S$1,376.4m (US$971.9m), some S$363m better than the debt figure at the end of the last financial year. On the other hand, cash and cash balances fell from S$5.3bn at end March 2015 to S$4.3bn (US$3bn) at the end of December 31.

Mainline pressure

The mainline remains the critical driver of Group performance, and as noted in our last analysis (see Aviation Strategy, April 2014), it is coming under increasing pressure from competitors that range from various flag-carriers (Cathay Pacific, BA, MAS etc), to the “Big Three” Gulf carriers flying east-west routes, and increasingly from Asian LCCs.

In the nine-month period to the end of 2015 the mainline reduced its ASKs by 1.7% year-on-year, and with RPKs falling by lower rate of 0.8%, the passenger load factor improved by 0.7 percentage points, to 80.0%. But as can be seen on the chart, the mainline load factor trend line has steadfastly remained flat (and under 80%) over the last four years and — critically — that unrelenting competitive pressure has resulted in mainline yield continuing to fall ever since 2010. Yield per RPK has fallen from S¢12.1 in October-December 2010 to S¢10.4 in July-September 2015, though it recovered to S¢11.0 in October-December 2015.

SIA is trying to stem the reduction in yield, and is attempting to shore up its traditional high-margin first-class and business passengers by enhancing those products/services through revamped cabins and lounges. The latest effort is the introduction of a new class — premium economy — that was launched in August last year, with US$80m being spent on introducing the product initially on 19 A380s, 19 777-300ERs and the first 20 A350s. SIA’s core strategy is clear: as expressed by Mak Swee Wah, EVP Commercial, it is to “hold on to our loads and our market share — and this has come at the expense of yield”.

With yield falling away and without any substantial improvement in load factor, the result has been continuing erosion of unit revenue, and so much of SIA mainline’s focus has been the continuing battle to cut unit costs. And that where SIA has struck lucky, thanks to the fall in fuel prices since late 2014 that has underpinned a significant cut in unit costs over the last few quarters.

Excluding the fuel effect, the situation is worrying. Even though mainline revenue fell by 5.5%, unit costs ex-fuel rose from S¢5.2 in October-December 2014 to S¢5.5 in the last three months of 2015, with costs increasing in multiple areas, from LPO — landing, parking and overflying — (up 1.6% year-on-year), to handling charges (+3.1%) to staff costs (+5.0%) to aircraft maintenance and overhaul costs (+10.8%). Part of the reason for increased costs in aircraft depreciation and lease rentals is the strengthening of the US dollar against the Singapore dollar, which has increased the S$ cost of those items.

Total unit costs at the SIA mainline fell below unit revenues in October-December 2015 for the first quarter since the same three-month period of 2011 — exactly four years ago (see chart) — but it’s likely that when fuel prices rise again then the mainline will plunge back into an operating loss.

The Group is well aware of the changing fundamentals of the market, and that its traditional reliance on premium traffic as the bedrock of performance is now a liability rather than an asset. Or as Goh Choon Phong, SIA Group CEO, puts it: “To have a success formula that has enabled us to continue to be successful for more than 60 years — and to move from there to something else quite different requires quite a bit of mind-set change”. He also talks about “the need for all of us to now move on and move into new models so that we can build the right foundation for the next 20 years”.

The portfolio

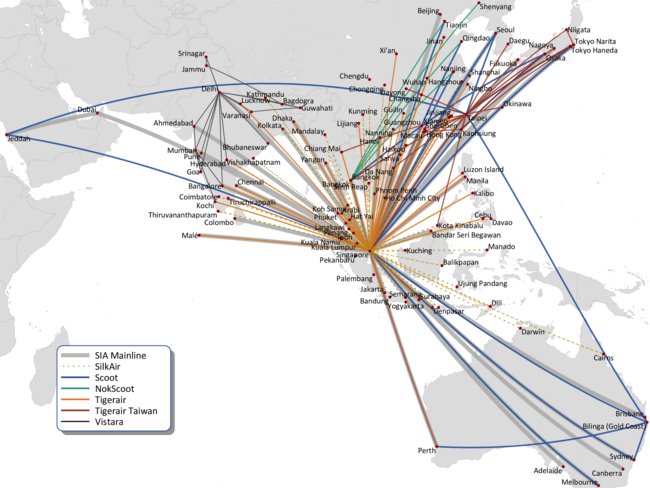

The SIA mainline operates to more than 60 destinations globally out of its hub at Singapore with a fleet of 109, comprising 30 A330s, one A350-900, 19 A380s and 59 777s. The fleet is starting to age (it has an average age of more than seven years), and on order are 101 aircraft, including five A380s, 66 A350s, and 30 787-10 — with the last two models slated for replacement of the A330s and older 777s.

SIA is the launch customer for the 787-10 model, which arrive from 2018 or 2019 onwards, as well as for the A380-800, which will be delivered in 2018 and 2019.

The first A350-900 from an order for 67 of the model arrived in March this year and will be utilised on a new Amsterdam route from May with 253 seats in three classes — 42 in business, 24 in premium economy and 187 in economy. Seven of the A350s on order are the ultra-long-range variant (the -900ULR, for which SIA is the launch customer), which will arrive in 2018 and will be used to relaunch non-stop routes to New York and Los Angeles, as well as a third (as yet unnamed) US destination. The A350 could also be used on routes to Europe, where its smaller size (compared with the 777) could make more routes economically feasible.

The group’s short-haul feeder airline is SilkAir, which operates a two-class service to more than 40 regional destinations with four A319s, 11 A320s and 14 737-800s (the latter configured with 12 business class and 150 economy seats). It has 37 737 MAXs and three 737-800s on order.

SIA Cargo, the Group’s standalone cargo business, has eased back its fleet over the last few years in the face of tough market conditions, and today operates nine 747 freighters. SIA Cargo reduced its operating losses in the first three-quarters of the 2015/16 financial year, from S$17m to S$10m, but in the September-December 2015 period its profit fell from S$17m to S$2m thanks to a substantial overcapacity in the cargo market to/from and within Asia, which resulted in yield plunging 13.5% year-on-year.

Multiple LCCs

The SIA Group’s main growth focus has been in the LCC business model, with separate airlines set up for short- and long-haul.

In the latter category is Scoot, which was launched in 2012 to operate medium- and long-haul routes from its base at Changi. Its fleet of 10 787s and two 777-200ERs fly to 17 destinations in China (six), Australia (four), Japan (two), Taiwan (two), plus Hong Kong, Seoul and Bangkok.

Another destination will be added in May with the launch of a service from Singapore to Jeddah, taking over a route currently operated by the mainline SIA with A330-300s. Scoot’s first route in the Middle East will use larger capacity 787-8s, and the airline plans to gradually increase frequency from the three-times-a-week operated by SIA. The transfer of service from the mainline to Scoot may be a sign of things to come, with routes that are marginally profitable under mainline operation presumably becoming more profitable when operated by a LCC.

The first aircraft from an order for 20 787s (initially placed by the SIA Group, but now allocated to Scoot) arrived at the LCC in January 2015, and they are replacing an initial fleet of 777s borrowed from SIA. 10 aircraft have now been delivered, with six 787-8s and four 787-9s still to come.

In the nine months ending December 31st 2015 Scoot recorded a S$4m operating loss, although in the September-December quarter it posted its best quarterly operating result ever — an S$18m profit — thanks to “continued expansion and deployment of a more fuel-efficient 787 fleet”. However, as with the mainline SIA operation, Scoot is coming under fierce competitive pressure, and yield plunged 6.7% year-on-year in the quarter.

The main competitor on medium- and long-haul LCC routes is AirAsia X, which currently operates 20 A330-300s from its Kuala Lumpur base to 19 destinations across Asia and the Middle East within a four- to eight-hour flying time (see Aviation Strategy, February 2016). But AirAsia X will provide even more competition once it receives the 76 aircraft it has on outstanding order, comprising 66 A330-900neos and 10 A350-900s.

Despite (or because of) the growing competitive threat, Scoot is pushing into new territories — Thailand-based LCC NokScoot is a joint venture between Scoot (which owns 49%) and the LCC offshoot of Thai Airways International, Nok Air (51%). Based at Don Mueang international airport in Bangkok, it launched in May last year and operates three 777-200ERs on six medium- and long-haul routes to China, Taipei and Japan in a two-class configuration — “ScootBiz” and economy.

Scope for merger?

The SIA Group now owns more than 90% of LCC Tiger Airways Holdings (and which it plans to delist) after it made an initial offer for the shares it didn’t own (44.2%) in November 2015 at S$0.41 per share (at a time when the market price was S$0.31), thereafter improving its offer to S$0.45 in January.

The main asset of the holding company is Tigerair, which operates 25 A319s and A320s out of Changi to almost 40 destinations in Asia (within a five-hour flying time), with a single class. It also has 39 A320neos on order. Tiger Airways Holdings also owns 10% of Tigerair Taiwan, with China Airlines owning 80% and Mandarin Airlines 10%. Based at Taoyuan airport near Taipei, the airline was launched in September 2014 and operates eight A320s to 12 destinations in Asia.

From SIA’s point of view, the rationale for the full Tiger acquisition is to “harness full synergies to benefit the SIA Group and the Singapore hub”, although it also argued that as an independent airline Tiger lacked the scale and network necessary to compete in the LCC market.

With Tiger under full ownership, the obvious next step would be to merge the carrier with Scoot, and though SIA says that “at the moment these two companies will be operated in parallel”, in the long-term such a move is inevitable. Not least because the SIA group portfolio is becoming unwieldy (for example all four of the mainline, SilkAir, Scoot and Tiger operate to some markets — such as China).

The SIA Group also has other airline investments; in January 2015 it launched Vistara, a full-service Indian joint venture (in which it owns 49%) with Tata Sons, part of the Tata Group — the giant Indian conglomerate. Though two previous attempts by SIA and Tata to start an airline in India had come to nothing, this effort appears to be more successful.

Based at Delhi’s Indira Gandhi airport, Vistara operates nine A320s domestically in a two-class configuration (with 36 premium economy seats — becoming the first airline to introduce the class domestically — and 96 in economy) to 15 domestic destinations, including three that launched in April — Jammu, Srinigar and Cochin. Four more A320ceos will come in on lease this year, and the medium-term plan is to increase the fleet to 20 aircraft by 2018.

The airline has been a success (it carried 1m+ passengers in its first year of operation) but is hampered by the Indian state’s so-called 5-20 rule, where new carriers have to operate domestically for five years and have a fleet of at least 20 aircraft before being allowed to fly internationally. Strenuous efforts continue at multiple aviation and political levels to overturn this regulation, and once it is the SIA Group will move quickly to expand Vistara, enabling India to become a major source market for the SIA Group for passengers travelling west into the Middle East and Europe, and east into Asia.

SIA Group also owns 23.1% of Virgin Australia, which operates 124 aircraft to 50 destinations domestically and within Asia with a two-class service. This March SIA and the other major shareholders (Air New Zealand, Etihad Airways and the Virgin Group) had to loan the airline a combined US$324m (on a 12-month term) in order to bolster its stretched balance sheet, and there is speculation from some analysts that SIA may be interested in acquiring ANZ’s 25.9% stake, which the latter wants to sell.

LCC or bust?

As can be seen in the graph, SIA’s share price has been sliding since late 2010, and a rally in the first-half of 2015 petered out by the summer although the price has recovered following good results for October-December 2015. However, to some extent the SIA Group can ignore short-term fluctuations in its share price given that Temasek Holdings — the Singaporean state holding company — owns 56.5% of equity.

Other shareholders, however, may be less patient, particularly if the mainline unit revenues/cost gap turn substantially negative when oil prices start to rise. At that point, much will depend on how well diversified the SIA Group is — and most particularly how much revenue and profit is being driven by the LCCs in the portfolio.

| Total | 118 | (101) | 29 | (40) | 12 | (10) | 3 | 24 | (39) | 8 |

| SIA | SilkAir | Scoot | NokScoot | Tigerair | Tigerair Taiwan | |||||

| In service | On order | In service | On order | In service | On order | In service | In service | On order | In service | |

| 747F | 9 | |||||||||

| 777 | 59 | 2 | 3 | |||||||

| 787 | (30) | 10 | (10) | |||||||

| A330 | 30 | |||||||||

| A350 | 1 | (66) | ||||||||

| A380 | 19 | (5) | ||||||||

| 737 | 14 | (40) | ||||||||

| A319 | 4 | 2 | ||||||||

| A320 | 11 | 22 | (39) | 8 | ||||||

Source: Company Reports, Ascend

Note: FY end March. † Rolling twelve months to December