The Skies are

Open

April 2016

Finally, more than two years after putting in its application, Norwegian Air Shuttle has been granted tentative approval from the DoT for a US foreign carrier permit for its Irish subsidiary Norwegian Air International. Congratulations to CEO Bjørn Kjos for his perseverance. The whole process has been a bit of a farce: the objectors have been using an obscure side article in the EU-US open skies agreement (17bis) designed to uphold labour standards, and developed emotive arguments referring to “flags of convenience” and “flight to the bottom”. All ironic considering that norwegian has two crew bases in the US (in New York and Fort Lauderdale) and that the sort of innovation that norwegian is developing is exactly what the open skies agreement was meant to be about.

The tentative approval is subject to possible objections, but all other things being equal should be made “final” by mid May: the DoT in its announcement blatantly stated that after taking legal advice there was no reason to deny the application (but failed to say why it took so long to decide). This decision does not affect the application made by norwegian's UK subsidiary in December last year for a similar permit, but suggests that it will be granted.

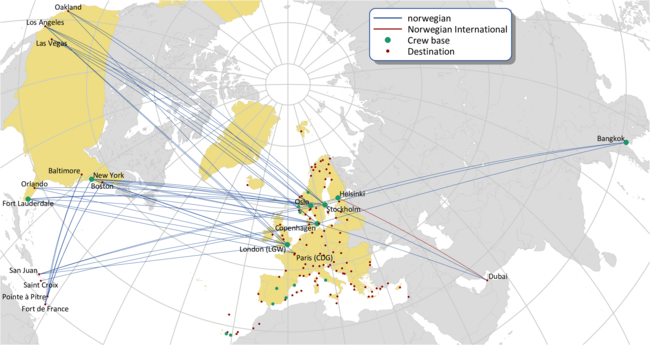

Why is this so important for norwegian? It is based in Norway, part of the EEA but outside the EU. It gained full rights under the EU-US open skies agreement as a European airline in 2011 when Norway (and Iceland) were co-joined into the treaty and therefore is allowed to fly between any point in the EU (plus Norway and Iceland) to any point in the US. However, an airline with a Norwegian AoC is only able to access route rights between Scandinavia and other parts of the world depending on Scandinavian bilateral agreements, limiting available services effectively to departures from Oslo, Copenhagen and Stockholm (not the largest conurbations in Europe); and must adhere to the terms of the Norwegian AoC regarding local employment.

Up to now norwegian has been operating effectively with the Irish registered 787s wet-leased to it under a dispensation from the Norwegian authorities to allow it to employ non-Norwegian crew. It does operate one long haul route using the Norwegian International Irish AoC — between Helsinki and Dubai.

Despite the delay in the grant of a licence, norwegian has concentrated on pushing its capacity on the Atlantic — in the process developing innovative route structures such as between New York, Boston and Washington to the French Caribbean (which, bizarrely, is part of the EU). Its only non-US long haul destinations are Bangkok (where it has a crew base) and Dubai.

Meanwhile, the company has upped its growth plans. In October last year it finalised an order for another 19 787s and ten options with the plan to operate 40 aircraft of the type by 2020. (Of course this order had nothing to do with the DoT's decision.) In its Q1 2016 results presentation norwegian highlighted its aim of growing by an average annual 20% in ASK terms over the next five years: 40% annually on long-, and 10% annually on short-haul.

With the grant of the permit to the Irish based carrier, (and the corollary that the UK based carrier will also gain a permit), it is likely that norwegian will start aggressively to develop routes available to it under the Irish and UK bilaterals to other parts of the world.

Feeding the growth

There are few good long haul O&D routes. Many airlines, to make sense out of running a long haul network, have to develop feed from short haul: the traditional legacy network model. norwegian already operates an intra-line transit service — charging passengers an explicit £7 per person per leg (or £15 at Gatwick) for the benefit of seamless bag transfer and the insurance of being placed on the next available departure in case of cancellation or delay. This is a significant move away from the traditional low cost model adhering to the KISS principle as it adds complexity and cost but it is necessary.

A couple of airports have developed their own transit product to facilitate self-connect transfers. Both London Gatwick (with Gatwick Connect) and Milan Malpensa (through ViaMilano) charge the passenger an insurance to guarantee connections.

The low cost model is evolving. Ryanair's CEO Michael O'Leary has recently been promoting the idea that Ryanair could be better suited to providing short haul feed to the Network carriers in Europe than they themselves — and has reputedly been in negotiations with IAG and TAP. The sticking point appears to be over which airline assumes responsibility for missed connections, cancellations or delays.

Ryanair is also going to start trialling an intra-line transit product through Stansted and Barcelona this Summer. This is in spite of article 17 of the Ryanair T&Cs which bluntly states "We are a point-to-point airline" (with the unstated exhortation "so there!").

O'Leary recently announced that Ryanair and norwegian were close to an agreement for Ryanair to do just this for norwegian's services out of Gatwick and Copenhagen (and presumably any future long haul departure point). Ryanair's own services at these airports are relatively limited (resulting from slot transfers on Irish routes at Gatwick after the IAG acquisition of Aer Lingus, and suffering union labour issues in Denmark). With norwegian's long haul operations at Gatwick (and now Paris CDG), easyJet might appear on the face of it to be a better potential partner. However, Carolyn McCall, easyJet's CEO, is unconvinced that LCCs can provide feed to long haul “simply and easily and make money at the end of it”.

Ryanair has made no secret of looking at the idea of moving into long haul — as long as the cost of the equipment were right. This may just be the way for the lowest cost producer in Europe to monitor the best way to enter the long haul low cost market.