Allegiant: An ever-expanding niche

April 2015

Allegiant Air, a Las Vegas-based ultra-low cost carrier, has achieved fame for its unusual but highly profitable strategy of operating cheap fuel-guzzling MD-80s in low-frequency service between small cities and popular leisure destinations and deploying Ryanair-style revenue strategies.

Now Allegiant is in the news for two additional reasons this spring: becoming the first sizable airline in memory to earn a 33% operating margin (in the first quarter), and getting perilously close to becoming the first US airline since 2010 to be hit by a pilot strike.

Adding to the intrigue, Allegiant is stepping up growth significantly this year, in what some sceptics had argued was a limited niche. The airline plans to grow its ASMs by 16-20% in Q2 and by 21-25% in Q3, following only 6.1% growth in Q1. In full-year 2015, ASMs are projected to increase by 15-18%, after 10.1% growth in 2014.

Some of those plans, however, could be scuppered by a pilot strike. Allegiant obtained a temporary restraining order that averted a strike over the Easter holiday. On April 22 the management stated that they were confident of securing, within a week or two, a preliminary injunction ruling that would bar the pilots from staging a strike, sick-out, slowdown or any other actions. However, in some press interviews the pilots painted a very different picture of the situation.

There are obviously two imperatives: the need to avert a strike and the need to properly resolve the issues with the pilots’ union for the longer term. If the latter is not accomplished, Allegiant’s growth plan could still be jeopardised.

Allegiant Travel Company, the airline’s parent, has been profitable for 12 consecutive years. It achieved double-digit operating margins through the challenging industry years in the late 2000s. In 2014 it had the US airline industry’s second-highest operating margin (17.6%, just below Spirit’s 19.2%). In the fourth quarter, Allegiant took the lead with a 20.8% margin.

In this year’s first quarter, Allegiant was in a category of its own with a stunning 32.8% operating margin. Its operating profit almost doubled to $108m, net income surged by 90% to $65m and revenues rose by 9% to $329m.

Because of its lack of fuel hedges, limited profit sharing and leisure traffic focus, Allegiant is one of the biggest beneficiaries of the decline in fuel prices. In the first quarter, its average fuel cost per gallon declined by 40% and its total CASM fell by 15% to 8.73 cents.

Allegiant is also benefiting from strong ancillary revenue growth, which has helped offset weakness in its yield and average ticket revenues. In the first quarter, ancillary revenue per passenger reached a record $52. Total revenue per passenger fell by 2.9% to $142.

Allegiant is able to step up growth, in the first place, because lower fuel prices have improved the economics of operating its old fleet. The carrier has also resolved the pilot availability and training issues that plagued it last year. And there are plenty of good used aircraft available, enabling Allegiant to pick up A320s for just $10m each.

Importantly, Allegiant has enhanced its growth prospects by making some major changes to its business model since the late 2000s. When Aviation Strategy last took an in-depth look at the company in the Jan/Feb 2007 issue, investors were concerned about two things that could limit Allegiant’s growth. First, there was the question of how long the airline could rely on an aircraft type that was no longer in production (the MD-80). Second, there were fears that Allegiant was beginning to reach the limits of its small-cities-to-Las Vegas/Florida niche.

Allegiant has successfully resolved both those issues. It has diversified its fleet from MD-80s to three types (also 757-200s and A319s/A320s). It has diversified its network to include the East Coast, medium-sized origin cities and many new leisure destinations, including Hawaii. (The 757/Hawaii plans were covered in the July/August 2010 issue of Aviation Strategy.)

Allegiant’s background

Founded in 1997, the airline initially operated charters and a small network of high-frequency services focusing on the business traveller in the West using DC-9s. The strategy was unsuccessful and the company filed for Chapter 11 in December 2000. After two-years' restructuring, Allegiant emerged from bankruptcy in March 2002 with a new strategy.

The company’s two largest original investors — CEO Maurice Gallagher and Robert Priddy — were the founders and top executives at ValuJet, the hugely successful early 1990s LCC that was grounded following its DC-9 crash in 1996. (That said, the executives were not directly blamed, and Priddy oversaw ValuJet’s successful transformation into AirTran and remained CEO for many years.)

As part of Allegiant’s reorganisation, Gallagher’s debt was restructured and he injected additional capital, becoming the majority owner, with a stake of about 80%. He took over as CEO in August 2003.

In subsequent years, Allegiant sold equity to four of its senior officers and brought in additional investors through private placements. A holding company structure was introduced in April 2006. Allegiant went public in December 2006, which reduced Gallagher’s ownership stake to around 23%.

Gallagher remains Allegiant’s largest single shareholder, with a 21% stake at year-end 2014. Such a holding by a CEO is unusual for a major carrier; Allegiant is the tenth largest US airline, with $1.1bn revenues in 2014. But it aligns the management’s interests well with those of other shareholders, keeping the financial community happy. Analysts often comment on how “shareholder-friendly” Allegiant’s management is.

Allegiant has been a steady buyer of its stock. As of March 31, it had returned around $514m to shareholders through share repurchases since 2007. After many years of paying special cash dividends, in January Allegiant’s board approved the payment of a regular quarterly dividend of $0.25 per share, which started in March.

Allegiant has a healthy balance sheet. At the end of March, unrestricted cash was $438m (38.5% of last year’s revenues), total debt $617m and stockholders’ equity $302m. Return on capital employed in the 12 months ended March 31 was 21.3%.

But debt has crept up in recent years, with the result that Allegiant’s credit metrics, which used to be similar to Southwest’s, are now measurably worse. For example, Allegiant’s year-end 2014 debt/adjusted EBITDAR ratio was 2.3 times, compared to Southwest’s 1.5 times.

The debt has increased mainly because of higher aircraft capex, which was $279m in 2014 and is expected to be around $260m this year. Allegiant stresses that it only raises debt “opportunistically”, when it can secure attractive terms.

Target markets

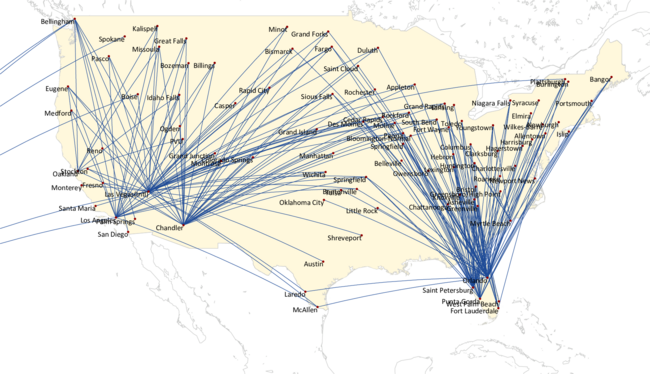

Allegiant targets price-sensitive leisure travellers in underserved cities that otherwise have few options to travel to what the company calls “world class leisure destinations”. There are a large number of “origin cities” throughout mainland US (81 as of February 2) and a relatively small number of “destination cities” (15 currently).

The markets targeted by Allegiant are typically too small for nonstop service by legacies or traditional LCCs, or they are so low-yield that they are not a priority for other carriers. While some of the markets might be suitable for RJs, Allegiant’s CASM is significantly lower and its larger aircraft offer a comfortable alternative to travellers. Consequently, Allegiant has competition on only 24, or 11%, of its 229 routes (as of February).

Since the late 2000s, there have been three notable network developments. First, the number of destination cities has increased significantly. In 2007 there were only three: Las Vegas, Orlando and Tampa/St. Petersburg. Now the list also includes places such as Honolulu, Phoenix, Los Angeles, San Francisco, Palm Springs and New Orleans, as well as additional Florida destinations.

Second, Allegiant has expanded its network to include medium-sized origin cities, seizing opportunities that arose from the US legacy consolidation. Allegiant noted in a recent presentation that between 2007 and 2014, medium-sized hubs in the US saw a 20.9% reduction in total domestic seats, compared to 15.3% and 3.3% reductions for “small” and “large” hubs, respectively.

This new strategy has brought Allegiant to larger origin cities such as Indianapolis, Pittsburgh and Cincinnati. The latter has apparently been the carrier’s “fastest-ever growing city”.

Third, Allegiant has made a major — and evidently very successful — push for the East Coast. Most of last year’s growth was in the East, which now accounts for more than 50% of the airline’s system ASMs.

All of those changes meant not just revenue opportunities but risk diversification. Allegiant is now more protected from regional variations in the economy, airport issues or competitors’ actions.

The East Coast continues to be the focus of Allegiant’s expansion in 2015, seeing almost 20% ASM growth, while the Las Vegas markets will see flat capacity. Growth will kick off in May, when Allegiant adds five new cities and 22 new routes. Based on the published schedule, total routes will increase from 233 at year-end 2014 to 271 by November. There will be another batch of city and route announcements in the autumn.

So Allegiant’s niche is showing no sign of reaching its limits. It is evidently a very large niche. In the longer term, the management envisages annual ASM growth in the “mid-teens”, based on a net addition of around seven aircraft per year.

Flexible, low cost model

But Allegiant’s “small cities, big destinations” niche is only possible because of a unique fleet and operating strategy. Profitable operation of 150-seat or larger aircraft in relatively small markets calls for very limited frequencies. Depending on the period (peak or off-peak), 60-80% of Allegiant’s routes have only two weekly frequencies.

This gives the airline very low average daily aircraft utilisation — just 5.3 hours in 2014, compared to 11-13 hours typical for LCCs. But Allegiant compensates for that by buying or leasing used aircraft at extremely low prices. Its earlier MD-80 acquisition and introduction costs averaged less than $6m per aircraft — up to 80% below what other LCCs paid for new 150-seaters.

The low aircraft ownership costs give Allegiant exceptional flexibility to fly when demand dictates. The airline can tailor flight frequencies to the needs of the market on a daily and seasonal basis. It can more easily enter or exit markets.

Despite the low utilisation and higher maintenance costs associated with the old fleet, Allegiant is one of the lowest-cost producers in the US, with ex-fuel CASM of 6.61 cents in 2014. This is because it employs many aspects of the LCC model.

In addition to the low aircraft ownership costs, Allegiant’s low cost structure stems from a highly productive workforce, a simple product, a cost-driven schedule, low distribution costs and the use of cheaper small airports.

The cost-driven schedule is an interesting concept. The airline designs its flight schedule so that most aircraft return to the crew bases at night, thereby reducing maintenance and flight crew overnight costs and providing a “quality of life” benefit to employees.

Evolving fleet strategy

After operating only MD-80s, in March 2010 Allegiant signed an agreement to acquire six used 757-200s for the purpose of serving Hawaii. The airline obtained ETOPS certification for the 215-seat aircraft, which were all delivered by the end of 2011.

In mid-2012 Allegiant began acquiring A320-family aircraft for growth. The first transaction was for nine leased 156-seat A319s from GECAS, for delivery from mid-2013. The management noted that A319 asset values had declined significantly to “mirror the environment we saw when we first began buying MD-80s”.

Later that year Allegiant announced the purchase of nine 177-seat A320s, which averaged 12 years in age and had been operated by Iberia. The deal was described as a “tremendous opportunity to purchase a sizeable fleet of sister-ships with CFM powered engines at very attractive price”.

Since then Allegiant has grown its A320-family fleet and commitments in a series of opportunistic transactions. Most of the aircraft have been purchased with cash, but the airline has often subsequently raised debt secured on the A319/A320s.

In June 2014 there was a series of transactions that included the purchase of 14 additional A319/A320s, conversion of future operating lease obligations to forward purchases, a $300m public debt offering and an interesting sale-leaseback type deal.

The latter involved Allegiant buying 12 A319s that were already subleased to a European carrier, keeping that arrangement until the leases expire in 2018 and then using the aircraft for growth. In the short term it is collecting $30m annually in lease revenues. However, Allegiant does not intend to become a leasing company; the rationale is that sale-leasebacks can “provide aircraft commonality and greater fleet plan certainty than spot market transactions”.

In recent months Allegiant has been extremely active in the used A319/A320 market. Since the beginning of this year, it has committed to 15 additional aircraft, including an April 22 purchase of three A320s that were repossessed from Hamburg Airways. The 15 aircraft will be delivered from late 2015 through 2017.

At the end of March, Allegiant’s 73-strong operating fleet consisted of 53 MD-88/82/83s, six 757-200s, five A319s and nine A320s. The MD-80s’ age range is 19-29 years and the 757s’ 21-23 years.

Allegiant does not anticipate much, if any, reduction in its MD-80 fleet over the next two years — unless good A320 acquisition opportunities arise. The MD-80’s maintenance costs have been stable and the aircraft are nowhere near their FAA-approved cycle or flight hour limits.

However, Allegiant took a $43.2m write-down on the value of its 757 fleet in December. Residual values were reduced from $6m to $3m, based on what the company believed was a permanent decline in the used 757 market. Allegiant is now projecting its 757 fleet to decline from six to four units by year-end 2016.

Allegiant remains on the lookout for high-quality used A319/A320s that fit its specifications. Because of that, it does not have exact fleet projections. Current plans suggest that it could operate 44-46 A320-family aircraft by 2018, accounting for around 45% of its total fleet of perhaps 99-103 aircraft.

The Airbus aircraft can fly longer routes and make marginal flying profitable. They also achieve higher average daily utilisation (7.9 hours in 2014) than the non-Airbus fleet (4.9 hours).

Expedia with wings

Another key piece in the puzzle that makes Allegiant successful is that it is more than an airline: it is in the business of selling travel. Some years ago the management described it as “Expedia with wings”. It has the ability to access and sell inventory for hotels, cars and other third-parties at wholesale rates, sell it combined with an air seat and manage the margins as it sees fit.

Allegiant owns and manages its own air reservation system, which makes it easier to fine-tune product offerings. The company believes that the control of its automation systems has allowed it to be an industry innovator with travel services and products.

Last year Allegiant derived 36% of its revenues from non-ticket sources — a little less than Spirit’s 41%. But Allegiant has an unusually diversified non-ticket revenue structure. Its activities also include fixed-fee flying and aircraft leasing.

There are many ancillary revenue initiatives in the works that should sustain growth in non-ticket revenues. At its investor day the airline talked about fare buckets, seat assignments, prepaid bag pricing, a charge for check-in and “TripFlex” pricing. Growth areas include convenience fees and priority boarding fees.

Labour risks

Allegiant’s pilots unionised in August 2012, electing to be represented by the Teamsters (IBT). Two years of negotiations produced no contract (which is not unusual for airlines), but the two sides have not talked since October or November. It is not all about pay. IBT claimed that Allegiant’s management unilaterally changed existing work rules in violation of the Railway Labor Act, especially when they implemented a new flight duty crew scheduling system in January 2014. IBT filed a lawsuit in federal district court, which last summer ordered Allegiant to restore the work rules. Allegiant has not complied because it is appealing against the court ruling.

In January 2015 IBT asked the National Mediation Board to proffer arbitration with respect to the contract talks, to which the management objected. The pilots then voted overwhelmingly in favour of a strike. The NMB has ordered the two sides back to the negotiating table.

The management has spent a lot of time in the courts trying to prevent strike action. Moreover, in a unilateral move, in late April the management also granted the pilots a 5-7% rise in their hourly rate, citing Allegiant’s strong operating margin performance in the past 12 months. But IBT could see such an offer as another attempt to circumvent the normal contract negotiating process. The management appears not to have budged at all on the crew scheduling issue.

Because of the labour situation, Allegiant is under heightened surveillance by the FAA, which will not approve additional growth plans for the carrier at least as long as a strike threat remains.

When the strike threat first surfaced at the end of March, Allegiant’s share price plummeted by 17% over three days, and the price has remained at the new low level. But many analysts still rate Allegiant as a “buy”, based on a belief that the management will avoid a strike. In that case Allegiant may well see the industry’s best operating margin expansion in 2015. There will be a huge fuel windfall. Non-fuel CASM is expected to fall by 4-7% because of the acceleration of ASM growth. And demand for Allegiant’s low-cost leisure product remains strong.

| Aircraft Type | In service |

|---|---|

| 757 | 6 |

| A319 | 5 |

| A320 | 9 |

| MD-80 | 53 |

| Total | 73 |

† Note: Adjusted for a $43.3m writedown of the 757 fleet.

† Note: Mid-point of the 15-18% forecast