JetBlue: Seizing more unique growth opportunities

Mar/Apr 2013

JetBlue Airways, New York’s hugely successful hometown airline, has started holding annual “analyst days” in an effort to persuade a sceptical investment community that its growth strategy will pay off. JetBlue keeps seizing unique growth opportunities, mostly resulting from legacy carriers’ withdrawal from its core markets. But many investors are unhappy because the strategy has meant sacrificing free cash flow (FCF) and ROIC in the short term.

At its latest analyst day, held on March 20 at the NASDAQ headquarters, JetBlue again made the case that sustainable, profitable growth at the right locations is one of the pathways to improved ROIC. The management presented plans for further significant expansion at three focus cities.

First, JetBlue wants to grow its already sizable and nicely maturing Boston operation from the current 120 to some 150 daily flights. Importantly, JetBlue now has evidence that the investments in Boston since 2009 and the risky strategy of focusing on business traffic there (while remaining “primarily a leisure player” in New York) have paid off in terms of operating margins.

Second, JetBlue is looking to grow its San Juan (Puerto Rico) operation — another gift from American — from the current 40 to around 50 flights a day. The management expects San Juan to deliver strong profits from 2014.

Third, JetBlue sees Fort Lauderdale as “the next big opportunity”. Already well-established and profitable, and with the cost-per-enplanement only a quarter of nearby Miami’s, JetBlue sees the potential to double daily flights there to around 100. It will be a staging post for significant new expansion to the Caribbean, Central America and northern parts of South America in the medium-to-long term.

The JetBlue executives also spoke of the benefits of the “open architecture” alliance strategy. Interline or one-way codeshare relationships brought in about $40m in

The big news at the analyst day was that JetBlue has decided to introduce a premium offering on its core transcontinental routes, where it has underperformed in terms of PRASM. The product will be announced later this year for 2014 launch. This move will take JetBlue even further away from the traditional no-frills LCC business model.

At the analyst day, JetBlue also sought to reassure the investment community that costs were under control and that deleveraging and “prudent capital deployment” would also contribute to improved ROIC.

But JetBlue again faced tough questioning and criticism from analysts about its priorities. The management team is committed to improving ROIC but by only one percentage point per year on average – a very modest goal by most standards. The management has argued that the one-point target is justified because of JetBlue’s relatively young age and different business model.

Lagging in FCF and ROIC,

otherwise successful

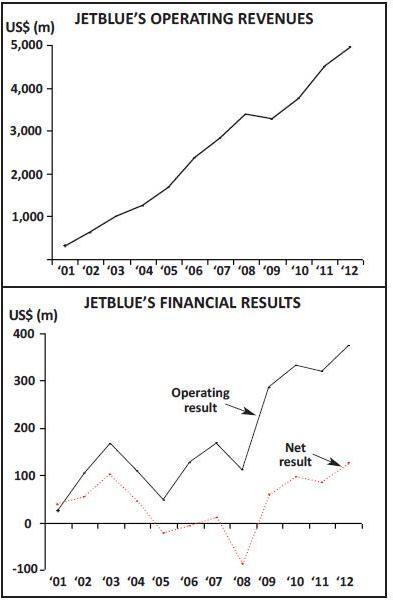

JetBlue has underperformed its peers quite markedly in terms of ROIC. At year-end 2012 its ROIC was only 4.8%, up 0.7 percentage points (falling short of the one-point target due to Superstorm Sandy).

The reasons for the underperformance are clear: continued ASM growth and rapid expansion and costly investments in Boston. After pausing growth in 2008-2009, JetBlue restored ASM growth to 6.7% in 2010, 7.2% in 2011 and 7.6% in 2012.

Last year, for the first time since 2008, because of capital spending JetBlue’s FCF

JetBlue executives dismissed that complaint, pointing out that while FCF was a useful tool for monitoring the rate of growth, it had its limitations. A temporary dip in FCF was perfectly acceptable if an airline was making value-enhancing investments.

However, BofA Merrill Lynch analysts argued in a late-January research note that “JetBlue shareholders would be better served if the company funded its growth by cutting underperforming routes”. The analysts noted that, given that JetBlue’s pretax margins averaged only 4.2% in 2012, there must be plenty of underperforming routes.

Analysts are so tough on JetBlue because the other large US carriers (legacies and Southwest alike) have all maintained tight capacity discipline since 2009 and are now intensely focused on FCF and ROIC. These days, FCF is almost a given, while 10-15% ROIC targets are typical and already being achieved by some carriers. Analysts in the US are obsessed about ROIC; also, in the back of their minds is a hope that the newly found financial discipline will lead to US airlines generating the kinds of returns other industries do, which would help broaden their shareholder base.

But the analyst pressure on JetBlue is not a bad thing, as it will keep the management striving for the right balance. JetBlue executives noted at the analyst day that the airline could have grown faster in Boston but then the 2010 and 2011 results would have looked much worse. “We do balance the short term and the long term, and we are serious about delivering on our ROIC commitment”, the executives said.

JetBlue has actually continued to report healthy operating margins: 8.8% in 2010, 7.1% in 2011 and 7.5% in 2012. It has lagged behind its peers in terms of net margins, though not significantly (2.6% in 2010, 1.9% in 2011 and 2.6% last year).

Now in its 14th year, JetBlue has weathered a few rough spots. After earning spectacular 17% operating margins in its initial years, JetBlue plunged into losses in 2005-2006 due to over-aggressive expansion. But quick actions to curtail capacity growth and capital spending restored profitability in 2007. JetBlue outperformed the industry in 2009, weathering the recession well in large part because it was able to expand rapidly in the Caribbean by switching capacity there from less profitable domestic markets.

Of course, JetBlue has been a huge success in the marketplace, offering not just low fares but also setting new standards in airline service quality in the US. Like Southwest, it quickly built a “cult following”, which has enabled it to attract price premiums and considerable customer loyalty.

Earnings growth is expected to continue in 2013. The management has been talking of significant margin improvement, helped by solid demand, a healthy pricing environment and lessening cost pressures. JetBlue expects its non-fuel CASM to increase by only 1-3% in 2013, compared to last year’s 3.3%. The current consensus forecasts are that JetBlue’s EPS will increase from last year’s 40 cents to 60 cents in 2013 and 71 cents in 2014.

JetBlue’s share price has reflected the investor concerns about the growth strategy. However, while the stock is currently mostly rated “neutral”, some analysts have turned more bullish in recent months. In late January JP Morgan raised its recommendation on the stock from “underweight” to “overweight”, based on the improved 2013 outlook. The analysts said that they were comfortable describing the stock (somewhat unglamorously) as “straightforward and comparatively low risk, with a gradual, long-term grind to higher ROIC”.

This year’s capacity growth is expected to be in the 5.5-7.5% range, as JetBlue continues to take advantage of opportunities that the management calls “unprecedented”. Those opportunities are in Boston and in the Caribbean/Latin America region, which are projected to see 15% and 10% ASM growth, respectively, with the rest of the network seeing flat or very modest growth. JetBlue’s longer-term plans call for average annual ASM growth in the mid-single digits.

JetBlue operated a 180-strong fleet at the end of 2012: 127 A320s and 53 E190s. This year the airline is scheduled to receive 14 aircraft – three A320s, its first four A321s and seven E190s. Four of the E190s were accelerated into 2013 in order to take advantage of unique growth opportunities in Boston and San Juan. The 190-seat A321s will be used to boost capacity on the transcon and in the seasonal peak to the Caribbean.

Boston success

Having served Boston since 2004, JetBlue seized an opportunity to step up growth there in 2009 as a result of an across-the-board contraction of legacy carriers, led by American. Since Boston had been a “fragmented” market, lacking a dominant carrier, it was relatively easy and not too expensive for a newcomer to enter and grow the market. JetBlue also seized the obvious opportunity to cater for the business segment.

Nevertheless, tapping the business segment successfully required a significant investment and a rapid build-up of service, both in terms of destinations and frequencies. JetBlue needed a sufficiently large network and attractive schedules to attract business customers and corporate contracts. It needed to upgrade systems, acquire additional gates, remodel facilities (to make them more acceptable to business customers), participated in GDSs, revamp its FFP and refresh its basic product offerings. JetBlue also found that the Boston business markets take quite a bit longer to mature than its traditional leisure/VFR markets.

The result has been that JetBlue has grown significantly in Boston. Its ASM growth has averaged 15%-plus annually since 2009. It is the largest airline at Boston Logan, having grown its seat share from 15% in 2009 to 24% in 2012.

Another result has been that the benefits of the investment have been relatively slow to materialise. At its analyst day in February 2012, JetBlue’s management conveyed the message that the Boston network was reaching a certain level of maturation, which would enable the airline to start reaping financial benefits. The executives stated at that time: “We really are reaching a tipping point in some of the network investments we made”.

Indeed, JetBlue was able to present data on March 20 confirming that the Boston investment is finally paying off. Compared to “very low single-digit” operating margins in 2009 and losses in 2011, last year JetBlue achieved high single-digit operating margins in the Boston markets. “Everything we did in Boston was the right thing for ROIC improvement”, the executives noted, adding that Boston was now at the stage where the airline could really start harvesting the benefits.

In 2012 the Boston market benefited from the addition of three new destinations (including Dallas Fort Worth), increased service to Washington DC, schedule and frequency adjustments to better accommodate business travellers and product enhancements. All of that helped build revenue momentum from corporate share gains. East Coast short-haul markets out of Boston were JetBlue’s best-performing region in terms of RASM growth in 2012.

While the growth rates at Boston will be lower in 2013 and 2014, JetBlue expects Boston to be a significant source of further growth over the next few years. The operation will be ramped up from the current 120 daily departures to 150-160 by 2015-16. This will be facilitated by planned expansion of Logan Airport, which will give JetBlue a total of 24 gates, more than enough to accommodate its plans.

San Juan:

Investing “responsibly”

Like Boston, San Juan was an early JetBlue destination (2002) and the opportunity to grow there also arose because of American’s sharp contraction. 2011 and 2012 were significant growth years for JetBlue in San Juan, each recording around 30% ASM growth. In early summer 2012 JetBlue was able to move into new and larger terminal facilities at the Luis Munoz Marin airport and subsequently named San Juan its sixth focus city.

JetBlue is now the largest airline in Puerto Rico, serving three airports there and operating some 40 flights a day from San Juan to 14 destinations, including ten in the US mainland and four in the Caribbean. In May two more Caribbean points will be added (Punta Cana and Santiago in the Dominican Republic). Chicago will follow as the 17th nonstop destination in November.

San Juan is a perfect market for JetBlue as the US routes in particular have a nice combination of leisure, VFR and business traffic. Competition continues to lessen; in the current quarter, competitive capacity in San Juan was down 7% year-on-year. JetBlue has already been able to cash in on its leading market position by offering a co-branded loyalty credit card programme in Puerto Rico.

JetBlue sees an opportunity to go up to about 50 flights a day in San Juan. It has managed to maintain a breakeven operation while growing significantly. San Juan is a couple of years behind Boston in the investment/development phase and is expected to start delivering strong profits from 2014.

FLL: The next big opportunity

JetBlue sees a “tremendous” opportunity to grow at Fort Lauderdale (FLL), one of its earliest focus cities. The current operation of 50-plus daily flights already offers a good network to both north and south and is profitable today. Fort Lauderdale is a large population centre, has numerous communities from many Caribbean and Latin American countries that travel frequently and has significant business travel. The executives described it as a “very rich demographic for us”. The airport’s enormous cost difference with Miami gives JetBlue an important competitive advantage.

JetBlue will need to make some investments in the infrastructure and is hoping to replicate the template it used in Boston in terms of working with the airport and phasing investments. The timescale envisages FLL operations ramping up consistently “as we move towards 2017”.

Fort Lauderdale will play a major role in extending JetBlue’s presence in the Caribbean and Latin America. Since 2008 the airline has entered or doubled capacity from FLL to Nassau, Santo Domingo, San Juan, Cancun and Bogotá, and service to Medellin (Colombia) and San Jose (Costa Rica) is due to begin in June. The analyst day presentation included a map showing 19 potential FLL growth markets.

JetBlue has been exceptionally successful in the US-Colombia market. The airline chose Colombia as its first South American landing spot, introducing Orlando-Bogotá flights in 2009. Passengers in that market tripled in the first year or so. The FLL-Bogotá route, introduced last summer, became profitable within the first month and is now one of JetBlue’s top performing markets. The JFK-Cartagena route, added in November, is far exceeding expectations. The FLL-Medellin route (the airline’s third Colombian destination) is expected to follow the pattern of the Bogotá route and be profitable virtually from the outset. JetBlue can be expected to continue growing in the US-Colombia market, benefitting from the open skies ASA implemented this year.

Following its success in the Caribbean and Colombia, JetBlue is believed to be looking at markets such as Ecuador and Venezuela. Unsurprisingly, it is reportedly interested in Brazil, though that would probably be a longer-term move because the A320s cannot make it nonstop that far.

This year the Caribbean/Latin America region (including Puerto Rico) will account for 30% of JetBlue’s ASMs, up from 6.4% at the end of 2005. Transcon will also account for 30% of ASMs, down from 55.1% eight years ago.

Unusual alliance strategy

The presentation at the analyst day made it crystal clear, as in previous occasions, that JetBlue will never join a global alliance. The management views them as too complex and expensive, while the “open-architecture” type alliance is well suited to JetBlue’s network strategy and business model. (Brazil’s GOL has been sending exactly the same message for quite some time.)

The management mentioned two key benefits of JetBlue’s alliance strategy, compared to global alliances. First, JetBlue collects roughly the same yield as it would sell independently on its website; it does not do standards proration agreements. Second, JetBlue focuses its alliance efforts on the gateways where it can get the strongest returns; it will decline to link up at airports where it does not have enough critical mass.

JetBlue says that its alliance-building efforts are still at a relatively early stage, in terms of both the number of partners and the depth of the relationships. The partnerships start as interline agreements and may progress to one-way codeshares, of which there are currently 5-6. The coming months are likely to see the first two-way codeshares. JetBlue has been cautious about taking that step because of the complexity it adds, but the management believes that they have found a way of managing it so that it will be “very advantageous from the revenue and margin perspective”.

JetBlue executives said at a recent conference that they viewed the planned AMR-US Airways merger as a positive for the company, because JetBlue is looking to expand its relationship with American. It is currently only an interline partnership, though an “extremely important one”. The connecting experience at JFK is not very convenient because it involves changing terminals, but according to JetBlue it has not been an issue because of the competitive total elapsed journey time and the richness of the schedules at JFK.

This was not part of the analyst day presentation, but JetBlue was asked about the state of the relationship with Lufthansa, which currently holds around 16% of JetBlue’s stock and has a board seat. The CFO described Lufthansa as “active and hugely useful members of the board of directors”. The convertible offering of JetBlue shares that Lufthansa completed last year was described as a “brilliant” transaction, a great way for Lufthansa to raise a lot of funds.

Tapping the high-yield segment

JetBlue has always been well-positioned to attract business traffic because of its unique value proposition, strong brand and great customer service. However, like Southwest, in the mid-2000s JetBlue realised that it needed to do more – namely upgrade systems, revamp revenue management and introduce specific products – in order to effectively tap the higher-yield segment. On the product front, the result was “Even More Space”, a product offering a more generous seat pitch in the front rows of aircraft for an additional fee.

“Even More Space” has been a huge success, and last year JetBlue enhance the offering with an expedited security lane at airports, “Even More Speed”. Revenues from the “Even More” products have grown from $45m in 2008 to $150m in 2012.

JetBlue has chosen not to follow the example of the US legacies and introduce a “first bag fee”. The management believes that its revenue contribution is “much lower than people think”, and there are operational costs of collecting it. Besides, JetBlue has some of the shortest aircraft turn times in the industry.

Last year JetBlue introduced a new tier within its TrueBlue FFP called “TrueBlue Mosaic”, to better recognise and reward its most frequent and loyal customers. The FFP is still in its infancy; some two-thirds of the airline’s customers are still not members.

JetBlue will soon become the first airline in the world to equip its fleet with full Wi-Fi that is free to everyone on board. The offering, called “Fly-Fi”, is significantly faster than competitors’ products and offers promising monetising opportunities through media partners and advertising.

When analysing its RASM underperformance on the transcon, JetBlue found out two things. First, many of the customers who fly it on the shorter sectors shun it on the transcon because it does not have a Wi-Fi offering. Second, JetBlue found out that there is a fairly significant paid premium market to and from Los Angeles and San Francisco, which the legacies (as well as Virgin America) capture with their premium or up-market products.

Consequently, JetBlue decided that, in addition to Wi-Fi, it must have a premium offering on the transcon. The product, which will be announced later this year, will be done “in a very JetBlue way” (meaning cost-effective, etc.).

Balance sheet considerations

JetBlue has started to manage its balance sheet more aggressively, which has helped improve its credit profile. In December S&P lifted the company’s outlook to “positive”. In February Fitch upgraded the credit rating from B- to B. Both agencies cited factors such as JetBlue’s stable operating performance, consistent profitability and recent debt reduction.

The key moves have included dialling down the cash position in favour of investing in the business. JetBlue’s cash and short-term investments have fallen from 27% of annual revenues at year-end 2011 to “a more rational, reasonable level” of 15% at year-end 2012. This move reflected improving industry and economic fundamentals, JetBlue’s own strengthened operating performance – its operating cash flow was a record $698m in 2012 — and the number of value-creating opportunities that presented themselves last year.

JetBlue used the excess cash, first, to reduce long-term debt by $300m on a net basis. This included a $220m reduction of very high-interest debt and prepayment of $200m of 2013 aircraft-related payments. Second, JetBlue decided to fund the international arrivals terminal it is building at JFK entirely with cash. Third, JetBlue repurchased some $78m of its shares.

JetBlue is also growing the number of unencumbered assets. It increased the number of unencumbered A320s from one to 11 during 2012 and expects this number to increase to 18-21 by the end of 2013. In addition, JetBlue is in the process of enhancing its credit facilities. The management called credit lines a “very inexpensive form of liquidity” and also beneficial because cash reserves can then be utilised in more intelligent ways. So JetBlue is now looking at liquidity not just as cash but as a stack of items – cash and short-term investments, long-term investments, unencumbered assets, credit lines, etc.)

Last year JetBlue’s total debt declined by $285m to $2.85bn. But deleveraging has in fact been a multi-year process. Since 2008, the debt-to-capital ratio has fallen from 73% to 62% and the net-debt-to-EBITDAR ratio from 7.8x to 4.0x.

All of this has given JetBlue more manageable debt maturities, better returns and more flexibility. For the next two years, the current plan is to fund much of the incremental growth internally and any new debt that might be taken on would merely replace scheduled debt maturities.