Europe's charter industry: Tui Travel and Thomas Cook Group

Mar/Apr 2013

The structural decline of the All Inclusive Tour (AIT) market is continuing, but Europe’s “Big Two” tour operators — TUI Travel and the Thomas Cook Group — are now attempting to cut costs and become differentiated in an effort to stay relevant to Europe’s holidaymakers. But can they succeed?

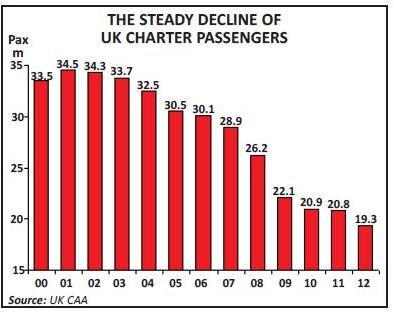

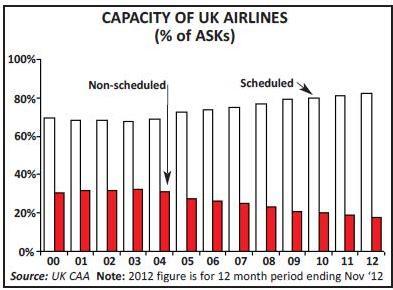

Since 2002, Aviation Strategy has been analysing the slow death of the AIT market (see June 2012 issue for our last article), and year-after-year the pattern remains clear. As can be seen in the chart on page 8, UK charter passengers fell yet again in 2012 (for the 11th year in a row), by some 1.5m passengers, and the total has dipped below 20m for the first time in decades. In terms of the split of scheduled versus non-scheduled capacity offered by UK airlines (see chart, page 9), non-scheduled ASKs fell to 17% in the 12 month period ending November 2012, its lowest ever proportion.

The core underlying driver for holidays is the economy and clearly 2012 was a challenge for the whole of Europe — and in particular for the main outbound markets. In its latest quarterly report, the European Travel Commission (ETC) says that “tourism demand from the UK was mixed during 2012 with some large destinations, such as Spain, reporting robust growth, while other destinations saw lower arrivals. However it is hard to determine a clear trend for the year as a whole, as UK demand was disrupted in 2012 by the London Olympics which may have prompted some potential travellers to remain in the UK for the event instead of taking a trip abroad.”

Out of Germany there was growth through much of 2012 according to the ETC, though this was most significant to smaller East European destinations, and it adds “there have been some reported falls in travel demand and notably for some large destinations”.

Looking forward, though there are signs

Regardless of the economic backdrop, it shouldn’t be forgotten that the decline in the AIT market remains structural, with increasing numbers of travellers not only having the means to put their own packages of flights and hotels together from LCCs and endless travel websites, but also being increasingly confident in doing this themselves rather than relying on what many see as the outdated concept of a high street travel agent.

That structural change was largely ignored for years by the last two giants of the European AIT industry – TUI Travel and the Thomas Cook Group – but under new management both have embarked on a race to transform their businesses, largely by ditching lower margin holidays in favour of more profitable “specialist” services and products.

TUI Travel

Of the Big Two, TUI Travel has been the fastest to react to the changing fundamentals of the AIT market. In its last full financial year – the 12 month period ending 30 September 2012 — TUI Travel reported revenue of £14.5bn (1.5% down year-on-year), operating profit of £301m (18% up) and a net profit of £137m (compared with a £87m net profit in FY 10/11).

In its first quarter results for FY 12/13 (covering the period October to December 2012), TUI Travel reported a revenue fall of 4.4%, to £2.7bn, with operating losses increasing from a £131m loss in Q1 11/12 to a £149m loss in October to December 2012. The net loss similarly increased, from £103m to £118m.

However, most western tour operators post losses in the first-half of their financial

The turnaround at TUI Travel since it was formed by the merger of the UK-based First Choice Holidays and the tour operating division of TUI AG in 2007 has essentially been based on a strategy of building up differentiated, flexible and higher margin product, though the journey from 2007 to the TUI Travel of 2013 has not been easy, and there is still much to do.

As to the key summer holiday season, as can be seen in the table, page 10, efforts to increase prices of mainstream holidays appear to be working, and total mainstream booking revenue for the summer is up 6% as of February compared with sales for summer 2012 (as of February 2012).

In the key UK market revenue is up an impressive 13% year-on-year, and this is undoubtedly the biggest success story for the group. This is partly thanks to an aggressive drive to direct distribution, which reached 87% in the quarter, and with online bookings accounting for 44% of all bookings in the three month period, two percentage points up year-on-year. Another factor is the economy as ironically TUI is benefitting to some extent from the recession, as with fluctuating exchange rates more people are booking all-inclusive holidays, which TUI specialises in through its First Choice brand. Peter Long, chief executive at TUI Travel, said recently that although his sense was that the overall UK market was flat, he believes there is a “renaissance” in package holidays as “a lot of people are actually seeing that it’s a lot of hassle to organise your own holiday. It’s not necessarily cheaper and can end up more expensive. And when there’s any problem there’s no one to look after you.”

But with a flat market, increased revenues can only come at the expense of competitors, and TUI claims that figures from market research company GfK Ascent show it had increased its share of the UK summer holiday market by 2% (as at January) — though Harriet Green, chief executive at Thomas Cook Group, disputed that, saying: “What I’ve learnt since coming into this industry is how remarkably fact-free certain aspects are.”

TUI’s summer 2013 booking revenue out of Germany is up by 3% as of February, but in France however revenue is down 11%, due primarily to TUI cutting capacity by 12% (largely to long-haul destinations). More worrying is a 4% year-on-year fall in revenue from specialist and activity holidays, which is a blow for a company that Long says is “very much focused on innovation in terms of our product development”. Indeed for the 2011/12 financial year while 47% of TUI Travel’s products were what it deems “differentiated”, that’s only a 17% increase compared with 2008, and the over dependency on non-differentiated mainstream AIT product (that can also be bought at rival operators’ brochures) still needs to be broken.

As for the TUI Travel fleet, the group has a total of 130 aircraft (with 13 on order), comprising 49 A321s, 737s, 757s and 767s at Thomson Airways (with eight 787s on order); 34 737s at TUIfly; 20 737s, 767s and Embraer 190s at Jetairfly; eight A330s and 747s at Corsair; nine 737s, 747s and 767s at TUIfly Nordic; and 10 737s and 767s at ArkeFly. There are another five 787s on order that are currently unassigned to a specific airline.

Starting this year Condor (and Condor Berlin) is overhauling its entire narrowbody fleet, replacing A320s and 757s with approximately 30 leased A320s and new A321s over a five year period.

Of the group’s 787s, TUI said until recently it had no plans to cancel or postpone orders given the recent battery problems, with two aircraft due to be delivered and in operation by May and with the rest coming gradually over the next three years. Inevitably however, in March Thomson Airways announced it was activating “contingency plans” for 767s to operate routes it had intended to use with 787s on in May and June, with the airline refunding passengers the extra fees they had paid to travel on the new 787s.

With the turnaround of TUI Travel looking solid at the moment, TUI AG — the German travel and shipping conglomerate that owns 56% of TUI Travel (the rest is owned by various financial investors) — began merger talks with its subsidiary in February. However, the negotiations quickly came to nothing after the two parties “failed to reach agreement”, probably due to the low market cap currently for Hannover-based TUI AG (where it trades at approximately a 30% discount to net asset value). But a merger of the two remains a goal of TUI AG as it believes many synergies could be realised through such a move (it also tried – and failed in completing – a similar move back in 2008). However many analysts are sceptical of the benefits of a merger, with one saying that it had “more risk than reward”, with only a few cost savings being apparent as an upside.

Ownership issues aside, TUI Travel is bullish for the full year, with Long saying that “based on current trading we expect to be towards the top end of our roadmap guidance of 7 to 10% underlying operating profit growth for the 2013 financial year”. Interestingly, at a call with analysts on the Q1 figures Long said: “I think we are also taking business from those people who have self-assembled and actually find it not as good as they thought it would be. And they cannot get our unique holiday offerings because they are clearly only available exclusively with us when we're offering our packages.” Whether TUI Travel really has managed to halt and reverse the structural changes that are affecting the AIT industry is open to much doubt, but what is certain is that TUI has faced the challenges in the industry far better than its great rival.

Thomas Cook Group

Over the last two financial years, ending on September 20 2012, the Thomas Cook Group brought in £19.3bn of revenue but made £586m of operating losses and a staggering net loss of £1.1bn.

Despite attempts at a turnaround and after £1.4bn of refinancing last year the group was going nowhere fast, and in what was effectively its last chance of salvation it appointed Harriet Green as chief executive last summer (coming from electronic parts distributor Premier Farnell).

While her immediate priority was to offload certain non-core assets (including its Indian subsidiary and some Spanish hotel properties) in order to reduce the debt mountain, her main focus has been to put together a credible long-term plan for the group – and this long-awaited “strategy presentation” was unveiled in mid-March.

At its launch Green gave the message that although the group has been stabilised and is “ahead of where we said it would be”, it still has four major problems, which are: no growth in revenue; not delivering a positive net margin; significant losses after exceptionals; and not generating enough cash.

To address these challenges, the heart of the group strategy going forward is a significant programme of cost-cutting and revenue enhancement. In a 2011 turnaround programme £140m of costs cuts were identified for the UK only (on an annual basis, as are all the following figures). Of these, £60m had been fully implemented by FY11/12 (the 12 months ending 30 September). Turning around the UK is critical for the group; in the last financial year, ending September 2012, Thomas Cook won £3.1bn of revenue in the UK market yet made a paltry £0.8m operating profit on those sales.

Last November the company identified another £100m of cost savings on an annual basis (across the group – i.e. not just in the UK), which are currently being implemented, and in February yet another £60m across the group was identified, arising largely from an airline reorganisation (see below) and from “streamlining” other parts of the group structure. The March strategy announcement added another £50m of cuts across the group on an annual basis, making a total of £350m of cost cuts to be targeted (of which £140m are specifically for the UK business and £210m are group-wide).

Of that total £210m group-wide figure, £65m will come from the company’s airlines, £55m from organisational restructuring elsewhere, and £90m from “product”, IT, technology and other categories. In terms of airline savings, in February the group announced a reorganisation of three of its airlines over the next 12 months into what it deems “a single, cohesive operating structure”. Starting this March, the UK-based Thomas Cook Airlines, Germany’s Condor (to include Condor Berlin) and Thomas Cook Airlines Belgium will retain t heir AOCs but will now co-ordinate just about everything from procurement and finance to HR and IT. This new airline “segment” at Thomas Cook will also examine the potential for linking booking platforms and connecting with GDSs. Altogether by FY14/15, £16m bottom line benefits on an annualised basis will be saved from unified maintenance; £14m will come from “overhead and crew” (via better productivity and “new agreements” with crews); £23m will come from increased revenue from codesharing between Condor and the UK airline, plus more ancillary revenue; and £12m will arise from other savings, to include fuel, ground handling and aircraft costs.

The unit will chaired jointly by Christoph Debus, the group head of air travel and CEO of Thomas Cook Airlines, and Ralf Teckentrup, the CEO of Condor. However, strangely, Thomas Cook Airlines Scandinavia will not be part of the new unified segment as it has fewer seat-only sales, although the airline will "explore ways to integrate more fully in the medium term".

Currently Thomas Cook Airlines has 31 aircraft of six different types, including A320s, A330s, 757s and 767s, and with six A321s on order. In addition Condor has 26 A321s, 757s and 767s; Condor Berlin has 12 A320s; Thomas Cook Airlines Belgium operates five A319s and A320s; and Thomas Cook Airlines Scandinavia has 14 A320s, A321s, A330s and 757s, with 12 A321s on order. That’s a total of 88 aircraft across a bewildering assortment of different models, with 18 aircraft on order.

These airlines employ a total of 6,500, although they currently provide just 55% of total Thomas Cook required airlift each year – the group obtains 23% of its lift from charter carriers and 22% from scheduled airlines. Going forward, air capacity sourcing decisions will be reviewed on a route-by-route basis, but the group admits that it is “discussing ventures, deals and programmes around the asset light model to drive mutually symbiotic strategies with other major carriers”.

Elsewhere, in order to achieve £55m of group-wide organisational savings, in early March Thomas Cook revealed that is was cutting 2,500 positions in the UK (around a fifth of its workforce there), of which 1,600 would come from the closing of another 195 travel agencies in the UK. The group has already closed 168 units (with 1,100 job losses) since 2011, but even after the extra 195 go it will still have an astounding 874 travel agencies across the UK, well ahead of the 700 UK stores that TUI Travel has. Many of the travel agencies being shut in the new round are Co-operative Travel stores, a business that was merged into Thomas Cook in 2011. 900 other jobs will go from other parts of the group in the UK, with back office locations reducing from the current 18, including the closure of a call centre in Lancashire. In other changes those remaining 874 shops will be run with a simplified management structure, including “cluster managers” running several branches, and the elimination of some managerial positions, while many branches will open into the evenings and on Sundays and bank holidays .

Finally, £90m of other group-wide cost-cutting will derive from the renegotiation of hotel and travel agency contracts (to generate £44m); consolidated and reduced marketing spend (£18m); rationalisation of IT teams and company websites (£17m – for example in the UK, 44 consumer-facing websites will be slimmed down to just three core sites); and the cutting of travel and other overheads (£11m).

Green presented a pretty detailed plan of cost savings, but of course these now have to be delivered in actuality. As an indication of the challenges facing the group, the £350m of cost savings on an annual basis aren’t expected to be fully realised until FY15, and they will cost around £90m over the next three financial years to implement (on top of £36m already spent) – and a total of £163m of cash flow.

In fact just £25m of group-wide cost savings on an annual basis (out of the group-wide target savings of £210m) will come into effect in the current 2012/13 financial year (ending on September 30 this year), and the pace of cost savings appears glacial. And other parts of the company’s strategy still lag behind the pace of changes introduced at TUI Travel. Thomas Cook is still clinging on to the mantra that it must have a substantial high street presence – what the group calls an “omni-channel strategy”, with Peter Fankhauser, Thomas Cook’s chief executive for the UK and continental Europe, insisting that the stores were a "shop window" for its products. But while agency presence is still an important part of the overall distribution mix, Thomas Cook relies on its high street presence far more than its rival does — travel agencies account for around 65% of revenue at Thomas Cook Group, compared with approximately 50% at TUI Travel. And while in FY 11/12 just 34% of Thomas Cook’s booking were made online, the target is to raise this to 50% by 2014/15. But that seems unambitious; for example within that there is a very low target of 12% online bookings in continental Europe (Germany, Austria and Switzerland) by 2014/15.

In the short-term the overriding concern is the group’s massive net debt burden, which stood at £1.6bn as at the end of December 2012 – just £86m down on a year earlier. After a spate of asset sales after Green arrived last year, the group recently decided not to sell its loss-making French business — which has been hit by political unrest in north Africa and the Middle East — as a buyer reportedly could not be found, and now it has no option but to try and turn the business around. The French business includes around 560 Thomas Cook travel agencies and 100 Jet Tours outlets, with more than 1,500 employees.

As part of the new overarching strategy, the group is reviewing its entire portfolio of businesses, categorising them all as either core and strategic (which the group will invest in and grow); under-performing (which will be fixed); smaller non-strategic (to be sold or merged with other units); or “good” non-strategic (which will be sold). Effectively this means that among those businesses up for sale will be skiing specialist Neilson; Thomas Cook Sport; insurance and airport parking company Thomas Cook Essentials and upmarket operator Elegant Resorts — though analysts expect no more than £100m-£150m to be raised from these assets, which will barely dent the debt burden.

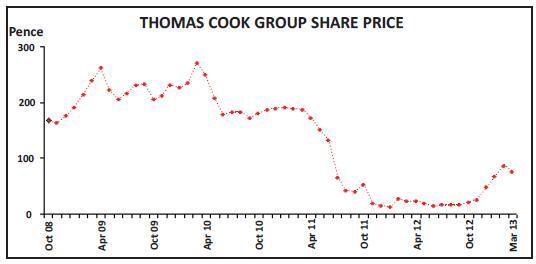

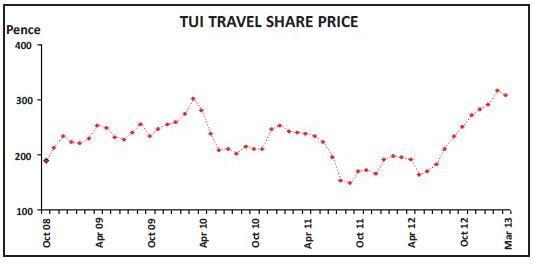

As can be seen in the charts, on the left and below, while TUI Travel’s share price has rebounded strongly in the last 12 months, investor confidence in the Thomas Cook Group is far less optimistic. Indeed shareholder disquiet was shown at the group’s AGM in February when 30% of votes were cast against the company’s remuneration report (Green could receive a total package worth as much as £3m this financial year). However it’s fair to say that some of this stems from the general backlash from investor reaction against excessive pay in the UK, and Thomas Cook was one of the first large UK-based companies to hold its AGM this year.

It’s too early to see whether the pace of Green’s strategy is sufficient enough. For the October-December 2012 period (the first quarter of its 2012/13 financial year), Thomas Cook’s revenue fell 7.3% to £1.7bn, though the operating figures improved from a £119m loss in Q1 FT11/12 to a loss of £93.8m in October to December 2012. The loss before tax for the period was £127.9m, compared with £151.7m a year previously. But figures for summer 2013 bookings are mixed (see chart, page 10).

To implement the transformation of the business, the group has also overhauled its senior management, and out of the top 100 executives in Thomas Cooks’ “Leadership Team,” no fewer than 36 are new hires. One analyst says that 2013 will be a “honeymoon period” for Green and her new management team, but that honeymoon will end pretty abruptly if results for the financial year ending this September – including this crucial summer season – do not show significant improvements.

| Capacity | Average selling price |

Customers | Revenue | |

| TUI Trave | ||||

| Mainstream holidays | ||||

| UK | 4% | 9% | 13% | |

| Nordic Europe | 5% | 10% | 15% | |

| Germany | 5% | -1% | 3% | |

| France | -3% | -8% | -11% | |

| Other | 0% | -3% | -3% | |

| Total mainstream | 4% | 2% | 6% | |

| Specialist & activity | ||||

| holidays | N/A | N/A | -4% | |

| Online accommodation | 6% | 3% | 9% | |

| Thomas Cook Group | ||||

| UK mainstream | -5% | 3% | 4% | |

| UK specialist & | N/A | N/A | -7% | |

| independent | ||||

| Continental Europe | -14% | 0% | 1% | |

| Northern Europe | 0% | 2% | 17% | |

| Airlines Germany | 2% | 3% | 8% |