Consolidation, rationalisation and profits: Air France-KLM, IAG and Lufthansa Group

Mar/Apr 2013

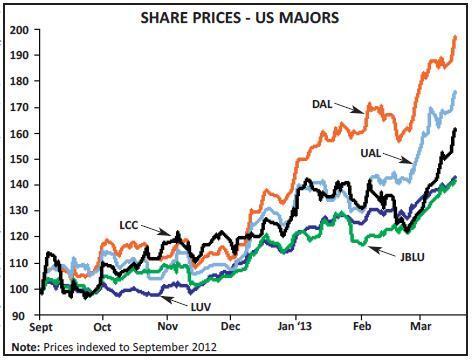

Since last September the stock markets appear to have re-rated the major carriers in Europe and the US. The shares of Delta, Air France and easyJet have all doubled in the past six months, while United Continental, IAG and Lufthansa have seen their shares rise by over 60%. In part this may be due to an increasing optimism in the markets for a long-awaited return to growth in the subdued western economies and a natural shift towards cyclical stocks in this stage of the market cycle. In part also it may reflect an increasing belief that the industry consolidation in the two largest aviation markets — and on the North Atlantic as the route connecting them — is about to allow real returns in a new oligarchic marketplace.

The three major European network carriers produced their annual results in the past six weeks — and each emphasised a return to rational behaviour in some of their major markets. In particular the North Atlantic generated strong increases in unit revenues against a drop in overall capacity. By the time Virgin joins in its JV alliance with Delta this year, the North Atlantic market will be effectively controlled by four (possibly three) joint venture groups: IAG, American; Air France-KLM, Delta, Alitalia; Delta, Virgin; Lufthansa, United Continental, Swiss, Austrian.

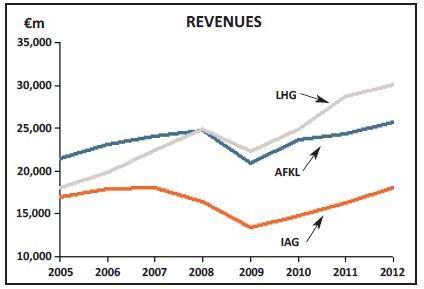

Lufthansa, meanwhile, highlighted that the fierce competition within Europe also appears to be abating. Market conditions it suggests are determined by the three major network carriers and the two main low cost players (easyJet and Ryanair). With the slowdown in the rate of expansion at both LCCs, cuts in capacity by the network carriers (and the failure of others), European capacity may possibly only grow by around 1% in summer 2013 — the lowest rate of growth since 2001. (Lufthansa’s statement preceded the Ryanair announcement of its 175-unit order for 737s allowing it to continue growing at around 5% a year). Over the past five years it is only Lufthansa that has grown in seat capacity terms (by an average of 2.5% a year, albeit that this reflects acquisitions of SWISS and Austrian and acquisition and disposal of bmi), while IAG (and its precursors BA and Iberia) and Air France-KLM have flat-lined.

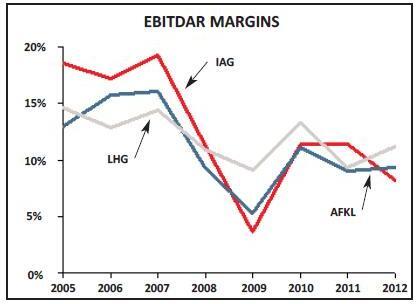

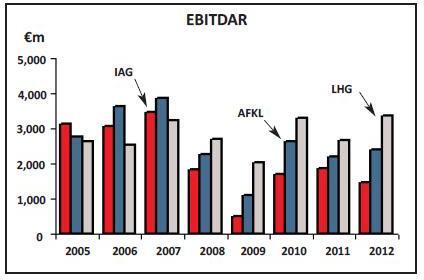

Although this may give a level of optimism in the short run, none of the three major European network carriers produced a stellar return in 2012; nor indeed a major improvement on 2011, despite the Euro weakness, all their restructuring, cost cutting (and in the case of IAG, synergy generating) programmes. However, although total fuel costs increased by a further 17% in Euro terms, both Air France-KLM and Lufthansa managed to achieve a small improvement in EBITDAR margins — although IAG troubled by the performance in the Spanish economy and the negative impact of the London Olympics saw its margins dip below the prior year and below its competitors for the first time since 2009.

IAG — Iberian woes

In 2012 IAG saw revenues grow by 11% with a year-on-year increase in seat capacity of 2.8% and a 9% improvement in unit revenues. At the underlying operating level (before exceptional items) the group returned a modest €23m loss down from the prior year’s €485m operating profit. This admittedly included a trading loss of some €98m in the bmi operations which Lufthansa had in effect paid IAG to take over early last year. Total fuel costs were up by 20% year-on-year (3% of which due to bmi) and now account for 34% of revenues. On a constant currency basis unit revenues were up by 3.9%, roughly the same as non-fuel unit costs, but not sufficient to cover the 5.2% increase in fuel unit costs.

There was a significant difference in the operating performance of the two airlines. At British Airways revenues were up by 8% in sterling terms on capacity higher by 5% (mostly bmi) with unit revenues growing by 2.9%. Operating profits almost halved to £274m (again including the €98m trading losses at bmi) with a major portion of the shortfall from the prior year relating to the impact of the London Summer Olympics (during which time there was significant weakness in premium and non-premium unit revenues). At Iberia in contrast capacity fell by 3.4% while unit revenues grew by 2.8% and total revenues fell by 0.6% year on year. The operating losses widened to €351m (7.5% of revenues) down by €253m on the year before.

The group highlighted the regional performance only for the fourth quarter of the year. It stated that on its North Atlantic operations there was a 2% cut in capacity and a near 10% increase in unit revenues (in constant currency terms); on the Latin American routes capacity fell by 3.5% and unit revenues grew by 3.6% and in Europe capacity and unit revenues grew by 5%. The worst performing segments were the domestic operations (primarily Iberia’s Spanish routes) where capacity was up by 13% but unit revenues down by 2% and routes to the Far East where capacity was flat but unit revenues also fell by 3%.

Net non-operating costs swung from a €13m credit in 2011 to a €457m charge primarily due to a reversal in non-cash net charges relating to pensions (although sweetened by €73m bad will on the purchase of bmi) and underlying pre-tax losses swung in at €480m reversing the previous year’s €485m pre-tax profits. On top of this the group applied €590m exceptional charges: €87m for bmi restructuring, a provision of €202m for the restructuring of Iberia and €343m write-down of goodwill carried on Iberia. Net losses for the group touched €923m — a €1.5bn reversal from 2011’s net profits.

On outlook the group is concentrating on the restructuring plan at Iberia (and at least now with an agreement with the unions through mediation this may go ahead albeit with slightly lower cuts in headcount and wages than originally envisaged, see Aviation Strategy December 2012). For the group as a whole it is looking to reduce capacity by 2% in 2013 (with 3.5-4% cuts in main summer season capacity) but would only so far as to say that it expected a better pre-exceptional operating profit in 2013 than it achieved in 2012.

AF-KL — Short haul dilemma

Last year Air France KLM achieved a 5% increase in revenues. In the passenger business the group also reined back capacity from its original plans for a growth of 2% and total ASKs grew by only 0.6%, unit revenues on a constant currency basis increased by just over 3%. The growth in unit revenues was skewed specifically to long haul operations where the increase was nearer 5% while short and medium haul operations declined by 1.3%. Cargo results mirrored the weak air freight markets with fall in capacity of 3.5% (and 8% decline in full freighter capacity in the second half of the year) and a near 4% drop in unit revenues.

Fuel costs increased by 14% to €7.3bn, equivalent to 29% of group revenues but other costs increased by nearly 2% (or 0.5% in constant currency terms). Underlying operating losses improved from €353m in 2011 to €300m in 2012. On top of this the group threw into the results pot exceptional charges for restructuring and write-down of goodwill of €677m offset by a €97m gain from sale of shares in Amadeus. Group net income came in at a loss of €1.2bn compared with a loss of €809m in the prior year period. In each of the past five years Air France-KLM has lost serious amounts at the net level and has managed to rack up total net losses in the period of €4.2bn.

On a regional basis the North American routes also look to have performed well — Air France-KLM’s capacity on the route fell by 6% while unit revenues jumped by 12% in constant currency terms. Strength also was seen in the group’s natural markets — into francophone Africa and DomTom routes to the Caribbean and Indian Ocean — but domestic French routes, short haul European and long haul routes into the Far East continued to exhibit weakness.

The group is concentrating on its deep restructuring/cost saving plan (Transform 2015) designed in part to stem the significant short haul losses, bring its debt mountain down by €2bn over the next two years and (like the other major network carrier groups) to return to a “sustainable” level of profits by 2015. In 2011 it had announced that its medium haul operations were losing €700m a year. It appears that in 2012 these losses increased by an additional €100m.

The management stated that the medium-haul losses at the main hubs had been “stable” but that the planned launch of regional bases (with the idea of tackling non-hub intra-European point-to-point flying in competition with the LCCs) had been “challenging”. This is starting to suggest that the group is finally accepting that it was a stupid idea; and the management stated that they have reduced the schedules from these bases in 2013 and aim to re-evaluate the project at the end of the Summer season. Capacity on medium haul non-hub point-to-point services is set to fall by 6% in 2013, while capacity on medium haul feeder routes to the hubs is almost being maintained at 2012 levels. At the same time the group is consolidating its regional domestic operations (Britair, Regional and Airlinair) under a single umbrella brand (and trying to sell CityJet) while pushing more direct services into Transavia.

Meanwhile the new collective agreements come into force this April providing for improved employee productivity and flexibility. Along with hiring and wage freezes and voluntary redundancies at Air France, the group aims to reduce its staff costs by 5% by 2014 (which probably is not far enough). At the same time the group is introducing a new organisational management structure with group-wide common functions as an umbrella to the operating subsidiaries of Air France and KLM (similar to the structure that Lufthansa started putting in place from the time it acquired SWISS). This is being done to “capture all available synergies”.

On the outlook for 2013 the management appeared more sanguine than its two big European competitors and would only say that it would benefit from the full roll out of the Transform 2015 programme, that there continued to be a weak operating environment and that the objective for the current year was to achieve further reductions in unit costs and net debt.

Lufthansa

In 2012, Lufthansa’s total group revenues rose by 5% to over €30bn. The passenger airline group (encompassing Lufthansa, SWISS, Austrian and germanwings) — which accounts for 75% of group revenues — saw revenues grow by 5.7% on the back of a 0.6% growth in capacity and a 5.3% increase in unit revenues. Cash flow (EBITDA) at Lufthansa and SWISS saw little change year on year, but there was a substantial improvement at Austrian following the transfer of mainline operations to the lower cost Tyrolean AOC.

Consequently total airline group EBITDA improved by 11%. Operating results however (which nearly compare with the other major network carriers' pre-exceptional operating profits) fell by 26% to €258m — and while Austrian generated a positive operating result of around €65m (mostly from a one-off positive benefit from the transfer of operations), Lufthansa itself produced an operating loss of €45m. SWISS (the group’s successful airline acquisition?) achieved an operating result of nearly €200m albeit 26% down on the prior year. The Logistics division — with the background of continued weakness in air freight markets — experienced a 9% decline in revenues and a halving of operating result to €104m. The other divisions — Maintenance, Catering and IT Services all saw strong improvements in operating results of 24%, 14% and 11% respectively and provided a strong improvement to total cash flow — total group EBITDA rose by 28% to €3.3bn.

The company highlighted that its capacity discipline in 2012 contributed positively. Overall capacity grew by 0.6% and unit revenues improved by 2.5% on constant currency terms. On the routes to the Americas (although the group does not split out the North Atlantic, it has a relatively small exposure to the South Atlantic) and to the Middle East and Africa, capacity declined by 0.4% and 1.8% respectively while unit revenues (in actual currency terms) increased by 9.5% and 4.5%. Even in Europe the group increased capacity by 2% during the year while unit revenues grew by 4.3%.

Total fuel costs meanwhile rose by 18% (excluding bmi from the prior year comparisons) to €7.4bn accounting for nearly 25% of total revenues (up from 14% five years ago).

The management averred that the first year of the SCORE cost cutting programme generated over €600m positive benefits (but not enough to cope with the €1.1bn increase in fuel). It re-emphasised its aim to achieve total profit improvements through this programme of €1.5bn by 2015 with a target to generate operating profits of €2.3bn by that year. The effects are likely to accelerate in 2013 as the group increasingly integrates its germanwings “low cost” subsidiary into the Lufthansa non-hub flight plans within Europe and the benefits of the Austrian transfer to the Tyrolean AOC accrue for a full year. It has a target to achieve €740m improvement in 2013 — and ideas that could increase this towards €900m annual benefit — and appears to want to achieve similar levels of improvement over the following two years.

Net income meanwhile improved by around €1bn — helped by a €623m gain of sale of a stake in Amadeus (3.26% sold and 4% transferred to the group pension fund) — to €990m. In the light of continuing deterioration in underlying operating profitability the group waived its dividend.

On outlook the management stated that it expected total capacity to rise by 1% in 2013 — mainly driven by larger aircraft and higher capacity back-of-the-bus cabins on long haul. Short haul capacity is envisaged to fall by 2.6% in the current year and long haul by 2.9%. However, it looks as if the group is increasing its attention to seasonal variation with planned summer capacity up by 1.5% (4% on long haul and a 3% decline on short haul). The management, as usual, would not be drawn further than to say that they expect operating profits to be higher that the €524m achieved in 2012 and that the passenger airline division would generate more than half the profits.

Benefits of consolidation?

The three major European network players all believe in consolidation and the ability to generate synergies through acquisitions and mergers.

Air France-KLM — as the initiator of the cross-border merger trend in Europe and the development of the trans-Atlantic joint venture — was adamant that its 2004 merger did create real synergies (as indeed Delta has done with its merger with Northwest) — although it has been difficult to provide proof.

Lufthansa was fortunate in its acquisition of SWISS and may have been beguiled into thinking that further mergers (Austrian, bmi and potentially Brussels) could also provide benefits (in the end bmi turned out to be exceedingly costly).

British Airways no doubt followed the thought that since the others were stating that they were creating synergies, they would be able to do the same in the creation of IAG and the merger with Iberia. If this had been the case one would expect that there would have been a distinct difference in the financial performance of the three players.

However in the past five years the underlying “franchise” power of the three groups — reflected by their EBITDAR margins (see chart on page 5) — has shown no real disparity. (The net results all show wide variations depending on the capital structure and the vagaries of IFRS.) One of the two major changes in accounting standards coming into force from January 2013 is to require the disclosure of joint ventures on an equity accounting basis. This may at last allow us to see the real benefit of the transatlantic (and Europe — Far East) virtual mergers.

The past five years since the last peak of the cycle have been exceedingly difficult as fuel prices have risen sharply, and with high volatility, while the economies have been weak and yield improvements have lagged the resulting change in operating economics. The majors have all portrayed a reasonable restraint in capacity growth in the attempt to restrain the losses. They each entered this downturn in reasonable financial health — although both IAG and Air France-KLM have seen their equity bases eroded — and with continued strong cash balances. A second accounting standards change that came into force from January requires changes in the treatment of on balance sheet pensions. This will have the impact of reducing published balance sheet shareholders' equity even further (€2bn for IAG, €1.1bn for Air France-KLM and €3.5bn for Lufthansa) and increase to some extent the volatility in reported earnings — and incidentally reducing IFRS reported transparency and comprehensibility.

In time fares will catch up with the new fuel environment and as each of the three majors pursue their own latest cost saving and restructuring packages it is entirely possible that they will be able to achieve their (roughly) equivalent targets for profitability by 2015. Maybe even by then one of the three will provide proof that airline mergers provide real synergies.