AirAsia: Facing IPO challenges in 2012

April 2012

In relative terms 2011 was a challenging year for the AirAsia group, thanks to tough economic conditions, higher fuel costs and increasing competition from Asian LCCs and full service airlines alike. The result was net profit falling by almost half at the core Malaysian airline, a postponement of planned IPOs for Thai and Indonesian subsidiaries, and an AirAsia X retreat from Europe and India. Can Asia’s largest LCC bounce back in 2012?

Malaysia AirAsia is where the AirAsia group began (back in 2001 – see Aviation Strategy, March 2008), and today it operates a fleet of 56 A320-200s to 49 destinations across the Asia/Pacific region in 14 different countries.

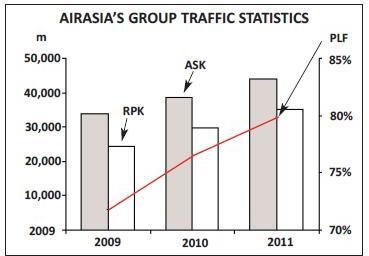

In 2011 Malaysia AirAsia saw a 13% rise in revenue to RM4.5bn (US$m1.5bn), when a 7% increase in capacity was met by a 13.7% rise in traffic, with load factor up by 4.8 percentage points to 80.7%. However, while operating profit was up 12% to RM$1.2bn (US$0.4bn), net income fell 46.8% to RM564m (US$188m) thanks partly to forex losses on currency translation.

At Malaysia AirAsia fuel consumed rose just 4% in 2011 but the average fuel price paid per barrel increased 36%, and as can be seen in the table, (page 11), Malaysia AirAsia’s fuel costs per ASK rose by a third in 2011 compared with 2010, and while AirAsia managed to cut costs in other categories and increase productivity, its overall unit cost rose by 15%.

The airline introduced a fuel surcharge in May last year but this hasn’t managed to claw back enough of the extra fuel costs incurred. AirAsia says that a US$1 rise in the price of a barrel of oil can be offset by an increase in ancillary income per passenger of RM0.77 (25 US cents), but last year the Malaysian carrier managed just a 2% rise in ancillary revenue per passenger (compared with respective increases of 29% and 11% at Thai and Indonesia AirAsia) to RM45

Last August Tune Air — the 26.3% shareholder of Malaysia AirAsia that is co-owned by AirAsia CEO Tony Fernandes — agreed a share swap with Khazanah Nasional, the Malaysian sovereign wealth fund that owns most of Malaysian Airline System (MAS), whereby Tune Air acquired a 20.5% stake in MAS from Khazanah, while Khazanah in turn acquired 10% of AirAsia from Tune Air. It was a deal that puzzled some analysts: although MAS is a fierce rival it is also loss-making, and while the share swap would ease competition between the two airlines at best, it might divert AirAsia management attention in Malaysia, and at worst AirAsia might be dragged into propping up MAS financially. The future of the share swap deal is in jeopardy with opposition from unions, the Malaysian government and Competition Commission mounting and a corporate announcement from MAS is imminent.

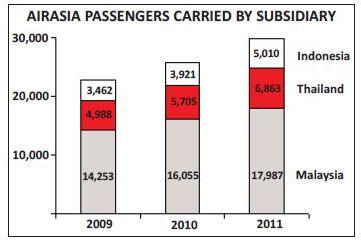

Of the three main areas of operation for the AirAsia group, Malaysia remains by far the most important in terms of passengers carried (see chart, page 11), followed by Thailand and Indonesia. But the Malaysian market is more mature for AirAsia, with passengers carried rising by (a still respectable) 12% in 2011 year-on-year (to 18 million), compared a 20.3% rise in Thai AirAsia passengers and a 27.8% increase in Indonesia AirAsia passengers.

Delayed IPOs

Both Thai AirAsia and Indonesia AirAsia had planned to undertake IPOs in 2011, but these were postponed due to the global recession and volatility in stock markets.

Malaysia AirAsia holds a 49% stake in Thai AirAsia, with 50% owned by Asia Aviation (a company controlled by the airline’s Thai management) and 1% owned by Tassapon Bijleveld, Thai AirAsia's CEO. Based in Bangkok and with bases at ChiangMai and Phuket, Thai AirAsia serves 23 destinations domestically and in China, India, Cambodia, Indonesia, Malaysia, Myanmar, Singapore and Vietnam with afleet of 25 A320-200s.

Passengers carried at Thai AirAsia rose by a fifth to 6.9 million in 2011, with load factor breaking through the 80% level after a 21% rise in capacity was beaten by a 25% rise in RPKs. But like its sister airlines, Thai AirAsia struggled to convert increasing revenue into better profitability, although at least this went in the right direction in Thailand. A revenue rise of 33% in 2011 to THB15.9bn (US$0.5bn) translated into a 5% rise in operating profit to THB1.9bn (US$65m) and a 1% increase in net profit, to THB2bn (US$68m).

The Thai subsidiary has launched a raft of new domestic and international routes so far this year, including services to Chongqing in China and Chennai in India, but Thai AirAsia needs capital to underpin growth and finance fleet expansion to 48 aircraft by 2016 (with five more A320s being delivered this year). An IPO for Thai AirAsia was supposed to happen by the end of 2011, but this was postponed until the first quarter of 2012, and now the plan is to carry it out in the third quarter of this year, with up to US$200m of fresh capital being raised. At some point Thai AirAsia will face competition from an LCC from Thai Airways International, which was going to be a joint venture with Tiger Airways but which Thai Airways says it will now launch on its own.

Malaysia AirAsia owns 49% of Jakarta-based Indonesia AirAsia, which was launched in late 2004 with local entrepreneurs. It operates to 14 domestic and international destinations (in Malaysia, Singapore, Australia and Thailand) from Jakarta and two other main bases, at Bali and Bandung, with a fleet of 17 A320-200s, having disposed of its last few 737-300s.

Indonesia AirAsia’s revenue increased by 34% in 2011 to IDR3,705bn (US$426m), with passengers carried up 28% to 5 million. Load factor fell by just 0.1% year-on-year to 76.9%. However, operating profit fell 52% to IDR 150bn (US$17m), and net profit plunged 87% to IDR62bn (US$7m) – again thanks primarily to rising fuel costs.

Indonesia AirAsia is currently adjusting its strategy by reducing its dependence on international routes, which accounted for 70% of all services last year. They will be eased back to around 60% by 2015 as the airline refocuses slightly on a strategy to “re-enter the Indonesian domestic market, which has high growth potential given the rapidly rising incomes of the Indonesian middle classes”. However, as elsewhere, AirAsia’s airline in Indonesia is facing greater challenges from competitors – primarily from Jakarta-based Lion Air (which has 74 aircraft) and Citilink, the nine aircraft strong LCC of Garuda Indonesia.

Indonesia AirAsia plans to raise US$200m with its IPO, which will now occur in the second quarter following the postponement from last year. And similar to the Thai carrier, the money raised in the Indonesian IPO will be used to bankroll an increase in the fleet to 21 by the end of 2012 and 34 by the end of 2015.

While there is still room for growth in its three core markets (and most particularly Indonesia and Thailand), it’s clear that the rate of growth in those markets is maturing, and so the AirAsia group is looking for new markets to enter.

New subsidiaries

Despite being founded back in 2010, a series of delays (most critically in gaining an AOC) postponed the launch of AirAsia Philippines until the end of March this year, when two A320s started operating on two domestic routes (to Kalibo and Davao) out of a base at Clark airport, just outside Manila. AirAsia has a 40% stake in the airline, which is a partnership with three Philippine entrepreneurs — Marianne Hontiveros, Antonio Cojuangco and Michael Romero — and which plans eventually to operate international services to Thailand, South Korea, Indonesia, Singapore, Macau, Hong Kong and mainland China. Two more A320s will join the fleet later this year, and the airline has targeted a fleet of 14 aircraft by 2015, all of which will be leased.

A similar business model will be followed when AirAsia Japan launches later this year – probably in August. It’s a joint venture between AirAsia (49%) and All Nippon Airways (51%) that will operate out of Tokyo Narita and which will initially serve domestic routes only before expanding onto international services in the fourth quarter, most probably to South Korea, China or Taiwan. If these go well then there are ambitions to start long-haul services to destinations such as Thailand, Indonesia and Australia in 2013, using a fleet of up to 10 A330s.

Until this year Japan has never had a significant LCC, and AirAsia believes that a high propensity to travel in Japan combined with high disposable income will make AirAsia Japan an instant success. However, although ANA will not compete against AirAsia Japan, the new airline will indirectly face competition from Peach Aviation, ANA’s LCC that started operations in March this year out of Kansai airport in Osaka.

And to make matters more complicated for AirAsia, Qantas is now accelerating the launch of its Japanese LCC, to be called Jetstar Japan. The airline is a joint venture between Qantas, JAL and Mitsubishi, and it had been going to launch in the fourth quarter of 2012 — but this is now being brought forward to July. It will initially operate domestic routes between Tokyo, Osaka, Sapporo, Fukuoka and Okinawa with three A320s, eventually building a fleet of 24 aircraft within a few years. Jetstar is already AirAsia’s closest LCC rival, having launched joint venture airlines in Singapore, New Zealand and Vietnam.

As yet there are no plans for AirAsia to formally establish a subsidiary in Singapore, although this is a “virtual hub” for the group already, with 12 routes out of Changi and with AirAsia planning to launch more routes out of Singapore.

Other moves

For the moment the Philippines and Japan will be the focus of new subsidiary growth in Asia, as potential forays elsewhere have come to nothing. Last October an agreement by AirAsia to purchase 30% of VietJet (made back in February 2010) lapsed, and AirAsia states it had no intention of renewing the deal. The plans for a LCC in Vietnam had run into substantial regulatory problems, including a lack of permission from the Vietnamese government for using the AirAsia brand in the country, which are believed to originate from political opposition to a foreign airline investing in the domestic aviation business.

AirAsia has also been monitoring the possibility of launching a subsidiary in Australia, where domestic airlines are allowed to be majority-owned by foreign companies. However, AirAsia executives say this is not a priority in the short- or even medium-term.

AirAsia is also looking at opportunities in the Indian market, though for the time being this is in terms of new routes rather than launching a local start-up. It’s the south of India that AirAsia is particularly interested in – a five times a week service between Bangkok and Chennai started in March this year, and further AirAsia routes to Kochi, Hyderabad and Bangalore are under consideration to add to the 50-plus flights a week already operating to Kuala Lumpur, Bangkok and elsewhere.

Also on AirAsia’s radar for a subsidiary is – somewhat surprisingly – the Middle East. In February Tony Fernandes, AirAsia group CEO, said that the Gulf region would be an ideal location for a subsidiary as the area is dominated by full service airlines and has few LCCs, and has the added advantage of being a destination for Islamic pilgrim visitors and tourists, plus many thousands of low paid foreign workers employed in the Gulf states.

However, while the current penetration of LCCs into the Gulf region is low (around a 12% market share compared to 25% globally and 20% in the Asia/Pacific region), it is growing, with Air Arabia (with 27 aircraft) – the first LCC in the region, launched in 2003 – now joined by flydubai (23 aircraft). Added to this, full-service airlines in the regions are looking to launch their own LCCs, or have tentative plans for one; for example, Qatar Airways talks about launching a LCC out of Doha (see Aviation Strategy, December 2011).

This means a key challenge for AirAsia will be finding a suitable Gulf hub airport, though of course a joint venture with a full-service airline might be the ideal solution here for AirAsia. Apparently AirAsia is already in talks with potential partners in the Middle East region, and the path for AirAsia will no doubt be made easier by the launch of a Middle Eastern subsidiary of The Tune Group, co-founded by Tony Fernandes and the parent of Tune Air. It launched a subsidiary out of Doha, Qatar, in February this year, with a local partner, and although its focus will be Tune Hotels and Tune Money financial services, the Tune Group’s foray into the region will help open doors for AirAsia.

The establishment of a subsidiary and a hub in the Gulf region might also have the added benefit of giving AirAsia X a better and more sustainable chance of serving the European market it has just withdrawn from — although Fernandes says that’s a minor consideration when looking at an AirAsia subsidiary in the Middle East region.

AirAsia X retreats

Although formally not part of the AirAsia group, Malaysia AirAsia owns 16% of AirAsia X (with another 48% owned by Aero Ventures, controlled by Tony Fernandes and others), the Kuala Lumpur-based LCC that operates nine A330s and two A340s on long-haul routes on a point to point basis. In 2011 AirAsia X saw a 31.5% rise in passengers carried, to 2.5 million, RPK growth of 36.2% outpaced ASK growth of 30%, resulting in a 3.6 percentage rise in load factor, to 80.1%.

However, AirAsia X has found that truly long-haul flights are problematical – costs per ASK rise not just because of fuel but because it has proved difficult to attract premium passengers, who are needed to push up average yield. This is partly due to customer perception and partly due to business travellers being unhappy with low frequencies.

That’s why earlier this year AirAsia X suspended its routes into its European network (London Stansted and Paris) as well as to Mumbai and Delhi in India (though it also cited poor demand). Azran Osman Rani, the CEO of AirAsia X, says that the London route was “bleeding millions a month”. It is now concentrating on the Asia/Pacific region, where it currently serves 13 destinations. AirAsia X’s network will now refocus on destinations up to a maximum of seven or eight hours’ flying time from its Kuala Lumpur base, although the airline is carrying a review of all its existing routes, and a Kuala Lumpur-Christchurch route was closed in March.

AirAsia X operates a fleet of 11 A330s and A340s. The two A340-300s that AirAsia X used on the European sectors are on lease until 2015, but they will not be operated on other AirAsia X scheduled services and so the airline is looking to find a sub-lessor. In addition two A330-200s that were due to be delivered this year were also earmarked for European routes, and AirAsia X is now trying to swap these order slots for A330-300s, of which the carrier already has 17 on outstanding firm order, for delivery over the next four years. In addition AirAsia X has 10 A350s on order, although they will not arrive until 2017 at the earliest, and AirAsia X says their future is not affected by the decision to pull out of Europe.

That’s a lot of capacity coming into AirAsia X, although the airline appears confident those aircraft can be deployed successfully on new services in the Asia/Pacific region, plus extra frequencies on existing routes. For example, AirAsia X is adding a fourth Australian destination this April with the launch of a daily route between Kuala Lumpur and Sydney’s Kingsford Smith airport. However the airline is facing increasing competition from medium-haul LCC rivals such as Qantas’s Jetstar, the Philippine-based Cebu Pacific Air, Indonesia’s Lion Air and Singapore Airlines’ Scoot – although Fernandes contemptuously dismisses Scoot as having “a really dumb name” and says it will not offer any serious competition to AirAsia.

AirAsia X is also looking for an IPO in the second half of this year, but only after the (hopefully successful) listings of AirAsia airlines in Thailand and Indonesia, which would give a good pointer to AirAsia X over the timing and pricing of its own IPO. The intent to float AirAsia X has been around since 2010, but the decision to refocus on Asian routes will need to be explained to investors.

AirAsia X says it recorded a net loss in 2011 (it reported a RM132.6m net profit in 2010), although financials have not yet been released other than a 47% rise in revenue in 2011, to RM1.9bn (US$0.6bn) and without significant progress towards profitability it’s difficult to see how an AirAsia X IPO could be carried out successfully this year. Maybe a pointer comes from AirAsia X’s decision in March to postpone a planned US$200m Islamic bond issue, which is now on hold until new aircraft start arriving in 2013. Given the pull back from Europe and the need for fewer aircraft, this may free up enough financial “wriggle room” for AirAsia X to postpone its IPO to 2013, particularly if the AirAsia IPOs in Thailand and Indonesia prove troublesome.

The IPO test

The AirAsia group focus in 2012 is on getting those IPOs in Thailand and Indonesia away successfully, as further postponements would prove embarrassing. Those IPOs are needed to fund fleet expansion — the group has a staggering 277 aircraft on order (nominally assigned to Malaysia AirAsia), with 77 A320-200s already on backlog being joined by an order for 200 A320neos placed last year (and apparently AirAsia is considering converting some of those classic A320 orders into neo models as well). The group is receiving 20 new A320s in 2012, of which 17 are coming direct from Airbus and three from lessors. New aircraft being delivered will drop to 13 in 2013 before gradually ramping up to 19 in 2015 and then remain at or around the 20 aircraft a year level all the way to 2025, before falling to nine in 2026 .

The volume of aircraft that will arrive over the next 15 years will generate both operational questions (in terms of finding enough profitable routes and markets to put them onto) and financial challenges. AirAsia’s total debt at the end of 2011 was RM7.7bn (or some US$2.6bn), and after offsetting cash balances the net debt was RM5.7bn (US$1.9bn), which gives net gearing of 1.43x. That’s actually fallen from 3.5x as at the second quarter of 2009, and the other good news is that cash and cash equivalents totalled RM2bn (US$0.7bn) at the end of 2011, compared with RM1.5bn a year earlier. But though strong at present, AirAsia’s finances will be stretched in meeting new capex commitments, and successful IPOs at the subsidiaries will go a long way towards opening up new funding avenues.

Successful IPOs should also boost the recent rise in AirAsia’s share price. As can be seen in the chart, on left, after listing on the Kuala Lumpur stock exchange in November 2004, Malaysia AirAsia’s shares had performed poorly for many years, but the price broke out in mid-2010 and has been rising ever since (and is well above the RM3 mark as at April).

Despite the reduction in net profits for 2011 at the core Malaysian subsidiary, AirAsia remains by far the leading LCC in the Asian region, and with the exception perhaps of AirAsia X, which needs to prove that a new Asia-focussed strategy can be implemented successfully, the AirAsia group is well placed to continue steady expansion through the decade. The key operational challenge will be to keep load factors up as the new capacity comes on board — at a group level AirAsia almost broke through the 80% load factor mark in 2011 (see chart, page 14).

A problem AirAsia may face is the “Branson question”. On the 10th anniversary of the airline, in December last year, there was speculation that CEO Tony Fernandes may leave the airline, directly fuelled by his statement that "there will be a new CEO, my time is coming to an end soon", although the airline was quick to say that Fernandes has no plans to retire any time soon.

| Cost/ASK | Malaysia | % | Thailand | % | Indonesia | % | |||

| US Cents | 2010 | 2011 | change | 2010 | 2011 | change | 2010 | 2011 | change |

| Employees | 0.48 | 0.60 | 25% | 0.49 | 0.52 | 6% | 0.49 | 0.51 | 4% |

| Fuel | 1.62 | 2.15 | 33% | 1.71 | 2.27 | 33% | 1.73 | 2.25 | 30% |

| User charges | 0.51 | 0.46 | -10% | 0.73 | 0.71 | -3% | 0.51 | 0.47 | -8% |

| Maintenance | 0.12 | 0.11 | -8% | 0.37 | 0.39 | 5% | 0.46 | 0.43 | -7% |

| Aircraft lease costs | 0.09 | 0.10 | 11% | 0.95 | 0.97 | 2% | 0.83 | 0.83 | 0% |

| Depreciation | 0.70 | 0.72 | 3% | 0.05 | 0.03 | -40% | 0.03 | 0.05 | 67% |

| Other | 0.38 | 0.35 | -8% | 0.20 | 0.20 | 0% | 0.11 | 0.21 | 91% |

| Total cost/ASK | 3.90 | 4.49 | 15% | 4.50 | 5.09 | 13% | 4.16 | 4.75 | 14% |