A potential US Airways-AMR merger: The best option for American?

April 2012

US Airways’ unprecedented labour deals with American’s key unions have added drama and potential complications to AMR’s Chapter 11 proceedings. What will happen next? Would an eventual merger with US Airways be a good option for AMR?

US Airways, the nation’s fifth largest carrier, and American’s three major unions (TWU, APFA and APA) announced on April 20 that they had agreed on terms that would govern the unions’ collective bargaining agreements in the event that there is a merger between the two airlines. This was an unexpected and stunning development, given that AMR’s management is working on a standalone business plan and has made it clear that it would consider consolidation only after Chapter 11. Airline unions do not usually support mergers. The deal was announced just as AMR’s management was due to begin arguing its case in court for abrogating existing labour contracts under Section 1113 of the US Bankruptcy Code.

There is no merger deal on the table. AMR currently has exclusive rights until late September to propose a reorganisation plan. But US Airways confirmed in its 1Q earnings call on April 25 that it is proceeding on a possible combination. Having won the support of employees, US Airways is now focusing on persuading AMR’s creditors of the merits of such a deal.

Many people now see an eventual AMR-US Airways merger as a highly likely outcome. In an April 20 research note, JP Morgan analyst Jamie Baker ascribed it a 75% probability. A potential AMR-US Airways combination now looks much more promising than it did in the past. And AMR’s management could surely not implement a standalone business plan without the cooperation of labour.

Why this is happening

The deal between US Airways and AMR’s unions reflects, first of all, AMR’s bad labour

Second, the deal reflects US Airways’ ambitions and aggressive style. CEO Doug Parker, who took over at the helm when America West Airlines (AWA) and the old US Airways merged in 2005, is a vocal proponent of consolidation and has aggressively tried to involve US Airways in further mergers. A hostile bid to acquire Delta out of bankruptcy failed in early 2007 and Delta later combined with Northwest. Multiple merger explorations with United also came to nothing and United picked Continental instead.

As the smallest of the major hub-and-spoke carriers in the US, with a primarily domestic network that is more heavily exposed to Southwest than any other carrier’s, US Airways probably needs a merger for its long-term survival.

Third, the April 20 developments were possible because on February 1 AMR’s management put forward a standalone business plan that has been widely criticised as weak and uninspiring. Many people fear that the plan would not enable AMR to stay competitive. Some of AMR’s unsecured creditors immediately began calling for the company to explore alternative options, such as a merger with US Airways or another carrier, that they felt might lead to a better recovery of their claims.

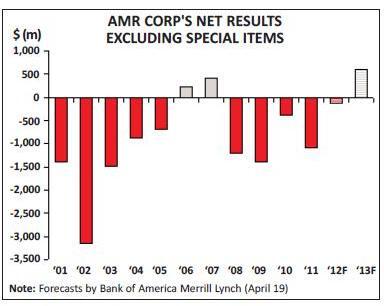

The standalone plan calls for $3bn in financial improvements by 2017, including $2bn in cost savings (of which $1.25bn would come from labour) and $1bn in revenue enhancements. The key elements are to renew and optimise the fleet, build network scale and alliances, and modernise brand, products and services. AMR wants to invest an average of $2bn annually in new aircraft. The “corner

The verdict on the proposed cost reductions has been broadly favourable: perhaps exactly what AMR needs to make its costs broadly comparative with those of Delta and United. The $1.25bn labour cost cuts, when added to the $1.8bn of labour concessions American secured in 2003, are roughly in line with the cuts implemented by competitors in Chapter 11.

But the revenue side of the plan has been widely criticised for doing little to solve the basic problem, arising from a network that is smaller and less attractive than United’s and Delta’s. American has been losing corporate market share to the two larger merged carriers; it needs to reverse that trend.

In recent years AMR’s management has been presenting the “cornerstone” strategy and the transatlantic and transpacific joint ventures (with IAG and JAL) as the remedies to its lagging revenue performance. But those benefits have been slow to materialise – something that AMR already took a lot of stick for last summer (see Aviation Strategy, July 2011). To see those same items as the centrepiece in the post-Chapter 11 business plan, with no substantial extras (other than a fleet overhaul), was frustrating to AMR’s creditors, leading to accusations that the new plan was just “more of the same”.

Furthermore, AMR has had to back off from terminating its defined benefit pension plans (which will be frozen instead) in response to pressure from PBGC, the US agency that protects corporate pensions. This was a major setback in the carrier’s quest to shed obligations; it will mean having to raise new capital to cover the incremental pension costs.

The dissatisfaction with the standalone plan opened the door for US Airways to make its aggressive early move. If the merger becomes a reality, AMR’s management has only itself to blame.

What is US Airways offering?

While there is no merger offer on the table, CEO Doug Parker’s April 20 letter to US Airways employees and the statements and comments made by AMR’s unions give a broad picture of what US Airways has in mind.

Parker wrote about creating a “preeminent airline with the enhanced scale and breadth required to compete more effectively and profitably”. The intention would be to “put our two complementary networks together” and “maintain both airlines’ existing hubs”.

AMR’s three unions, which represent about 55,000 frontline employees, said in a joint statement that they confirmed their support of a possible merger, which they said would be the “best strategy and fastest option to complete AMR’s restructuring”. It would “avoid a lengthy and contentious 1113 process”.

AMR’s unions have reportedly also said that the combined carrier would be branded American Airlines, would be based in Fort Worth, Texas (AMR’s headquarters) and would remain in oneworld. But the obvious implication is that the unions want US Airways’ management to take over and run AMR.

Obviously a key aspect of the deal is that AMR’s unions would be treated better than under the standalone plan. The merger would preserve at least 6,200 of the 13,000 union positions that American proposes eliminating under the standalone plan. The merged entity would provide “competitive, industry-standard compensation and benefits” and “improved job security and advancement opportunities” for all employees. Parker said that US Airways employees could expect “enhancements to the compensation and benefits currently in place”.

The Wall Street Journal reported (citing APA as the source) that AMR pilots have been promised an immediate 5.5% raise, followed by 3% hikes annually for five years, after which the contract would revert to an average of the compensation at United and Delta. Even though the US Airways plan includes higher productivity measures, because of merger growth and new aircraft, there would be no AMR pilot furloughs. This compares with AMR’s latest offer to the pilots of a 1.5% annual raise for five years, 400 furloughs and $370m in annual concessions (more flying hours, elimination of premium pay, reduction in medical benefits and removal of restrictions on codesharing and regional flying).

AMR’s flight attendants would get an immediate 2.5% raise, followed by 1.5% annually for five years, and they would maintain their current vacation and sick-leave policies. Instead of furloughs, there would be voluntary buyouts – an option that AMR, which wants to eliminate 2,300 jobs, has refused. AMR’s mechanics and ground workers (TWU) might see only half of the 8,500 job cuts AMR is proposing.

The rationale is that the revenue and cost synergies generated by the merger would allow US Airways to pass some of those benefits to AMR’s employees. US Airways executives said on April 25 that the merger could yield at least $1.2bn in annual cost savings and revenue benefits, even with less labour cost savings than AMR is proposing and including improved pay and benefits for US Airways workers.

According to AMR’s unions, the merger would be “based on growth” and AMR’s orders for narrowbody aircraft would proceed. AMR confirmed in bankruptcy court last month that it wanted to keep the firm orders for 460 Boeing and Airbus narrowbodies placed in July 2011 (which secured $13bn of lease financing on attractive terms) and earlier orders for 787s and 777s.

In addition to eliminating 13,000 union jobs (15% of the workforce), AMR plans to cut another 1,200 non-union positions. But the original labour proposals have been sweetened in two important respects. First, there was the decision to freeze rather than terminate the traditional pension plans. Second, when filing the Section 1113 motions at the end of March, AMR outlined an attractive employee profit-sharing plan, which would begin paying out immediately as new labour deals are signed and would pay from the first dollar of profit (as opposed to only when profits reach $500m, as with the current plan).

Many positives, much risk

The idea of a possible US Airways-AMR merger has been mostly well-received in the financial community and in the airline industry, though many observers have cautioned about the risks involved and the potential negative repercussions if US Airways tries to interfere this early in AMR’s Chapter 11 process.

In the past it was often argued that AMR would not gain very much from a merger with US Airways. S&P made the point last year that US Airways’ route network, which focuses on leisure destinations or second-tier business markets, would not fit into American’s business strategy, which focuses on major business markets in the US and building closer ties with airline partners overseas.

The network synergies are not as compelling, at least from American’s perspective, as in the Delta-Northwest and United-Continental mergers. S&P wrote in an April 20 report: “Those combinations created broad route networks with a strong presence on transatlantic and transpacific routes, which we believe enabled these two merged airlines to win business travellers from American in recent years”.

But US Airways does have a robust domestic network and hubs (especially in the East) that could provide valuable feed to AMR and its global partners. Its major connecting hubs in Philadelphia and Charlotte and its strong position at Washington DCA would all help AMR.

JP Morgan analysts argued in an early-March research note that AMR’s standalone plan “fails to adequately address the decade-long marginalisation of its domestic network” and suggested that US Airways might be just the right partner. Based on their analysis, AMR has fallen to fourth place in the largest non-hub Eastern and Western markets, though it maintains number two rank in the Midwest. A US Airways-AMR combination would likely rank second in the East and number one in the Midwest. The analysis found that US Airways and AMR overlap in just 13 domestic markets.

US Airways has made some smart strategic moves to enhance its network in the past year or two. First, it has invested more aggressively in European growth – a highly successful strategy that has led to strong RASM improvement. Second, in what almost mirrors AMR’s cornerstone strategy, US Airways has sought to focus its flying in places where it has a competitive advantage. This summer 99% of its capacity will touch its four hubs (Charlotte, Philadelphia, Phoenix and Washington DCA) or the Shuttle. Full implementation of the “Focus on Four” strategy is possible because this year US Airways is finally able to implement the unique LGA/DCA slot swap that it agreed with Delta in 2009.

Notably, unlike American, US Airways has not lost corporate market share to Delta and United. This reflects its number one position in all of its key markets and its strong presence on the Eastern seaboard.

So, US Airways could conceivably give AMR that little bit of extra scale that AMR needs to compete on an equal basis with Delta and United for corporate contracts and business traffic.

A US Airways-AMR union would probably be palatable to regulators, certainly more so than a Delta-AMR combination. The merged entity would have a 22% domestic market share, on par with UAL’s and Delta’s.

Many equity analysts would enthusiastically welcome a US Airways-AMR merger, because they see it as the best outcome also for the US airline industry. AMR’s standalone plan is very unpopular because it is based on growth and from the stockmarket’s perspective, could jeopardise industry capacity discipline.

The result would be three top US carriers of roughly equal size. JP Morgan’s Jamie Baker commented that almost 90% of US domestic capacity would then be controlled by the Big Three and Southwest, up from roughly 50% in 2005. Baker wrote: “Four airlines with 90% market share represent the optimal industry structure and should allow for consistent return generation going forward”.

From the point of view of the rest of the world, if there needs to be one final merger in the US involving the large carriers, US Airways-AMR would probably be the most favoured combination. It would avoid an upheaval of global alliances. It would make it unnecessary for IAG to invest in AMR – something that IAG probably would prefer not to do given that it has just purchased bmi, is hoping to bid for TAP (for very good strategic reasons) and may soon come under pressure to invest in JAL. IAG CEO Willie Walsh reportedly said on April 21 that BA and IAG intended to remain on the sidelines in respect to AMR’s reorganisation .

In the early-March research note, JP Morgan estimated that adding US Airways’ Philadelphia hub and potentially Charlotte to oneworld would net BA/IAG 33 new Eastern US cities that AMR does not presently serve.

There is also the intriguing possibility that a US Airways-AMR deal on the table might help break the deadlock in US Airways’ own union negotiations. Seven years after the 2005 merger with America West (AWA), US Airways still has not integrated the two pilot and flight attendant groups (the pilots cannot agree on seniority list integration). In the past many people felt that combining that with AMR’s very difficult labour relations could be a recipe for disaster. But the higher salaries at AMR and the better job security and opportunities at a merged entity might break the seven-year deadlock.

One analyst suggested that it might actually be easier to plan for integrated operations for US Airways-AMR while the “East” and “West” pilot groups were still separate at US Airways.

On the negative side, there is the question of how much a merger deal with US Airways – or just US Airways’ early meddling – would reduce AMR’s potential Chapter 11 cost savings. It seems that a merger could help address AMR’s revenue problem, but a standalone Chapter 11 restructuring without interference from third parties (which Delta, Northwest and United all enjoyed) would be the best way to solve AMR’s cost problem. The main reason AMR is in bankruptcy is to close the cost gap with the larger competitors and to restructure its debt and other obligations. AMR has already had to back off from terminating its defined-benefit pension plans.

In its report S&P expressed concern that a reorganised AMR or a US Airways-AMR combine “could be at a continuing competitive disadvantage to United and Delta”. Because of that and other uncertainties related to a potential merger, the agency said that it was not sure if it would rate a merged entity any higher than US Airways’ current B- corporate rating (which is one notch lower than UAL’s and Delta’s B ratings).

S&P mentioned another potential danger: “Even if a merger does not occur, a bidding war for the support of American’s unions could force AMR to accept less labour and retiree obligations savings, thus reducing AMR’s earnings and cash flow generation”.

Then again, US Airways and AWA executed a successful merger while the old US Airways was in bankruptcy. Fitch Ratings suggested in an April 20 report that “a potential combination while AMR is still in bankruptcy would enable US Airways management to use the Chapter 11 process to maximise the potential of the merged entity”.

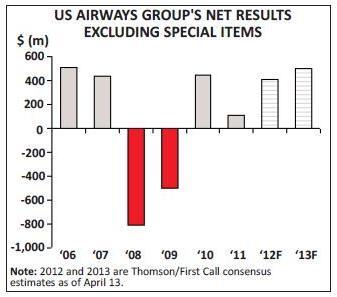

US Airways’

financial turnaround

Some of AMR’s creditors and constituents may have held somewhat negative preconceptions about US Airways. There is a perception that the carrier is desperate for a merger. There is the track record of failed merger attempts. There are the labour issues. Just three years ago US Airways was close to a liquidity crisis, keeping AMR company at the top of the “endangered carriers” list.

However, US Airways has staged an impressive financial recovery in the past two years. It has kept its non-fuel costs in check, restored operational performance, raised significant funding and improved its balance sheet. Its pretax margins are now on par with the top carriers, if adjusted for fuel hedging (which US Airways does not do).

In addition to the smart network actions, US Airways has benefited enormously from the past few years’ industry restructuring, domestic capacity cuts and the move to develop lucrative new ancillary revenue streams. With domestic capacity discipline set to continue in 2012 and beyond, US Airways’ earnings prospects are promising.

As a result, US Airways’ top executives have repeatedly stressed in recent months that US Airways does not need to participate in consolidation. They feel that the airline is now well positioned on a standalone basis, though they are of course “always interested in studying potential value-enhancing opportunities”.

The main negatives with US Airways concern its balance sheet: high debt levels, weaker liquidity than its peers (unrestricted cash 15% of annual revenues at year-end 2011) and substantial looming debt maturities in 2014 (which the company expects to refinance). US Airways would not find it as easy as some of its peers to raise capital to fund a merger, though it expects to be able to do it.

What happens next?

AMR’s CEO Tom Horton dismissed the April 20 developments in a letter to employees on April 23 with references to “nonbinding arrangements with our unions” and to parties who are “working their own agendas at our expense”. AMR’s management remains focused on a standalone plan and will consider consolidation only after Chapter 11, which it currently hopes to exit by year-end 2012.

On April 23 AMR also began making its case to the bankruptcy court on why it should be allowed to terminate existing labour contracts and impose new terms. The unions are scheduled to present their case in May. The judge’s final decision is expected in early June, though throughout this period AMR and the unions are expected to continue trying to reach consensual agreement. As an interesting development on April 23, TWU agreed to send AMR’s latest contract proposal to members for a vote. However, the union continues to support the US Airways deal as an alternative.

AMR has exclusive rights to present a reorganisation plan until September 28, and that period could be extended until the end of May 2013 (maximum 18 months from the Chapter 11 filing). However, creditors could petition the court at any time to terminate the exclusive right if they feel that better alternative deals are in the pipeline.

So the judge and the unsecured creditors’ committee (UCC) are now effectively in control over which plans will be considered, though any merger would also need the support of AMR’s management and board of directors.

Having secured the support of three of the nine UCC members (the unions), US Airways is expected to try to win the support of the other six UCC members, while working on the details of the merger plan. The other members are Boeing, Hewlett-Packard, PBGC and three financial institutions that represent financial creditors.

It is impossible to predict how the other UCC members might respond. All are looking for the best possible deal on debt repayment. Some have wanted AMR to explore possible merger opportunities. Some may feel that they will get the best deal from the standalone plan. Some may prefer to wait before exploring alternative plans. JP Morgan analysts said that they were almost certain the other UCC members would have preferred US Airways to wait and make a bid later in the Chapter 11 process.

So it is not clear when and how US Airways might present a merger proposal. One thing is certain though: it will not be a hostile bid. US Airways executives said recently that one thing they had learned from the Delta experience was that they could not do it alone. “An outright hostile transaction won’t work. Just having the most value creation isn’t enough.”

Of course, there could also be surprises in store, such as a Delta bid for US Airways – something that in principle would be acceptable to US Airways. Or AMR’s management, known for wanting to do deals on its own terms, could make a run for JetBlue or Alaska (two airlines it has mentioned). Or there could be no more major mergers. As US Airways executives pointed out recently, because the US airline industry is already much more stable, the final round of consolidation that many are clamouring for “does not have to occur”.

| By revenue | By RPMs | |

| $ (m) | (bn) | |

| United Continental | 37,110 | 207.5 |

| Combined AMR+US Airways | 37,034 | 207.7 |

| Delta | 35,115 | 192.8 |

| AMR | 23,979 | 136.4 |

| Southwest | 16,596 | 97.6 |

| US Airways Group | 13,055 | 71.3 |

| JetBlue | 4,504 | 30.7 |

| Alaska Air Group | 4,318 | 25.0 |

| Hawaiian | 1,651 | 10.1 |

| Spirit | 1,071 | 8.0 |

| Allegiant | 779 | 5.6 |