European slot reform

April 2012

At IACA’s (International Air Carriers' Association, representing some 30 European leisure-oriented carriers) annual meeting in Madrid in March, one of the main concerns on the agenda was the EC’s proposed changes to the slot allocation rules in a new Airport Regulation Package. This proposal is predicated on the idea that since airport capacity in Europe will be insufficient to cope with growth, a market mechanism should be introduced to encourage more efficient use of resources. According to Eurocontrol, currently five major European airports are at saturation – Heathrow, Gatwick, Düsseldorf, Orly and Frankfurt (even with the new runway?). By 2030, even with a possible 40% planned increase in airport capacity, 19 of the top European airports will be more than full – and under one scenario by then it is estimated that half of all European flights will be subject to serious congestion delays.

Under the current system, slots are allocated to airlines under an administrative system, established under an EC Regulation of 1993. Slots are allocated separately for winter and summer IATA seasons. A minimum of five slots allocated at the same time on the same day of the week during a season forms a series of slots. If an airline uses a series of slots at least 80% of the time it can retain the same slot series for the next comparable season under a grandfather clause; if more than 20% of a series is unused for whatever reason it is returned to a pool for reallocation – the 80:20 “use it or lose it” rule. In an attempt to encourage new entrants, 50% of the available pool is first allocated to new operators at that airport, and then to existing operators on a first come first served basis.

The EC has decided it wants to update the system. The main proposal is to change the “use it or lose it” rule to 85:15 but at the same time extend the concept of a series of slots to 15 weeks in summer and 10 in winter. The EC says that this is designed to impose a stricter discipline on airlines to ensure that capacity is used efficiently: a slot series removed under the “use it or lose it” rule would be longer and therefore more attractive for competing carriers seeking year round operations.

However, doing so may lead to undesirable side effects: carriers may feel forced to operate uneconomical flights merely to ensure that the grandfather right to a slot series is not lost. The increase in the ratio could have a particularly damaging impact on the charter sector – although in the proposal the EC suggests that it will have special rules in force for particularly seasonal traffic patterns.

Also, there is dissatisfaction in the success of the new entrant rules. Under the current regime 50% of pool slots should be made available to new entrant carriers – defined as those operating less than two rotations a day and for intra-European routes less than two rotations on a particular city-pair with up to two incumbents. Further, a new entrant cannot have more than 4% of total slot capacity at the airport.

There has not been a consistent allocation of the rules throughout Europe (with very few slot coordinators interpreting the 50% as absolute) while slots granted under the new entrant rules have unnecessary conditions attached. In many cases those granted under the rules had in any case been relinquished within two years (and therefore returned to the pool for further redistribution). The new proposals are for the new entrant rules to be relaxed, but they will now apply to airline groups not just individual AOCs (so, for example, easyJet would not be able to use easyJet Switzerland to gain new entrant slots at Orly).

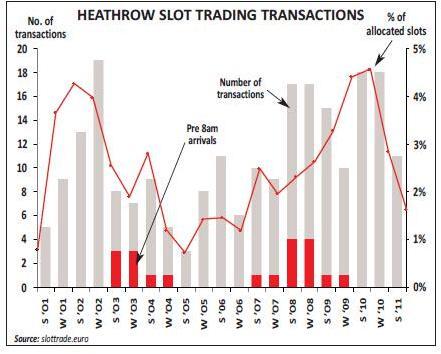

Meanwhile, having for years objected to the idea of slot trading at Heathrow and Gatwick (the only active market in Europe) the EC finally accepted that it could be a reasonable idea after the EU-US Open Skies agreement in 2008. The EC now appears not merely to be trying to ensure a Community-wide legal framework for slot trading between airlines (in some countries in the EU such as Spain, or for that matter at Orly, it is specifically banned) but also actively to encourage it.

It aims to introduce greater transparency. The London slot trading market is still grey, with no requirement to report the type of transaction (sale or lease) nor the monetary consideration or side agreements involved (although the slot coordinator has set up a good slot trade facilitation system in slottrade.aero) By having a transparent market with published indications of transaction values, it believes it may encourage airlines to review the actual value of non-performing slots. Although not specifically stated, the EC is considering direct slot trades (or transfers) between airlines – rather than the rather cumbersome current method of applying for a junk slot and swapping that for the slot you really want plus a financial consideration.

This system could be extended to other airports in Europe – but in many cases airlines will have to wait for changes in local legislation (and in some countries the acceptance of a definition of slot ownership). In the medium term it may re-enliven activities at Paris Orly and Düsseldorf – like Heathrow airport with good real O&D demand but severely constrained by annual movement caps – but may have limited impact elsewhere.

A more disturbing element in the proposals is not necessarily that it will reinforce the independence of slot coordinating committees (not a bad idea) but more that it might encourage mergers across EU boundaries and even suggest the establishment of a single Slot Coordinator responsible for slot allocation at all EU airports – another monopoly supplier being the last thing this industry needs.