Network/LCC contrast in Germany

April 2011

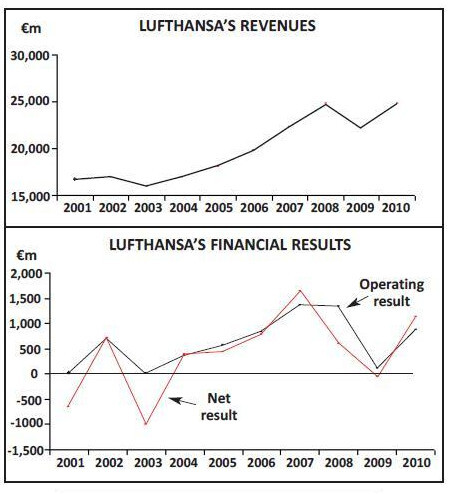

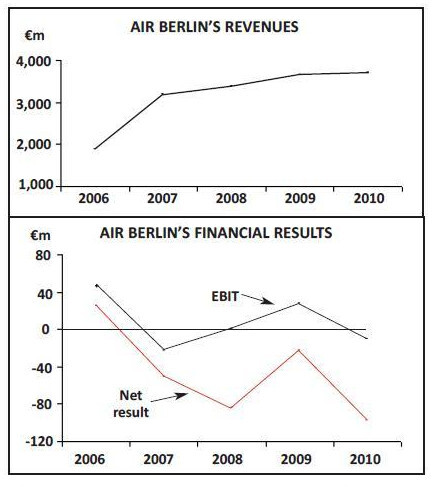

Lufthansa’s results for 2010 showed a strong rebound. Air Berlin’s net losses escalated. So in Germany a network carrier thrives while a leading LCC (or quasi- LCC) suffers.

Lufthansa’s total revenues were up by 23% to €27bn, operating profits increased seven–fold to €1.3bn (despite a 28% increase in fuel costs) and published net profits came in at €1.1bn up from a loss in the prior year of €34m – even though the net profits had been massaged by a useful €400m from restructuring of the Catering division. As normal the group was at pains to outline the impact of 2010’s extraordinary events: the harsh winter at the beginning of the year and the start of an early harsh winter at the end may have reduced profits by €20m and €70m respectively; the closure of European airspace in April €200m; the pilots' strike in February €50m. The group was even able to boast a small cash value added in 2010 of €71m showing that some airlines can create value. These numbers were boosted by the first–time full–year consolidation of bmi and Austrian Airlines; but even without these, underlying group revenues would still have grown by 14% year on year.

Operating cash flow jumped by half again to a record €3.1bn, well covering the year’s €2.3bn capital expenditure, and providing free cash flow of some €700m. As a result the group was able further to strengthen its balance sheet, reducing net debt to €1.6bn from €2.2bn at the end of 2009. The group’s Supervisory Board was so pleased with these numbers that they have proposed a resumed dividend of €60 cents a share.

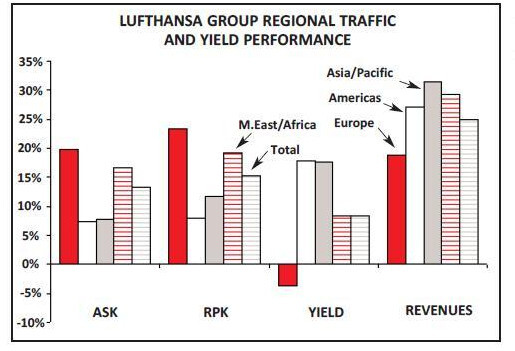

The German flag carrier may appear the closest of all airlines in its corporate structure to a diversified industrial conglomerate, but the passenger division (with two thirds of revenues) is still by far the most important. The two main traffic divisions performed exceedingly well. In the passenger division – which now encompasses Lufthansa, SWISS, bmi, Austrian and germanwings – total capacity grew by 13% year on year, traffic by 15% and, reflecting the strong recovery in long haul premium cabins, average yields by 8.4%; and this is in spite of (or because of?) the group taking a decision to reduce the proportion of premium seats in favour of the economy seats.

On a regional basis the performance was heavily weighted to long–haul: on routes to the Americas and Far East, capacity was up by 7% year on year but traffic revenues jumped by 27% and 31% respectively; on routes to the Middle East and Africa capacity grew by 17% and revenues by 29%. European routes show a slightly different story. Here the group has been introducing higher capacity aircraft and upgrading gauge on regional routes; total capacity increased by 20% (mostly admittedly from the newly consolidated carriers) and traffic increased by 23% but yields fell by nearly 4%.

In the results meeting on March 17th the management repeatedly referred to a current very strong pressure on short–haul yields, emphasising the network carrier’s dilemma. Although the group does not provide a regional profit breakdown the short–haul network – so necessary for feed through the long–haul hubs — may be seriously loss–making overall.

The group has put together a portfolio of European carriers, but has yet seriously to try to integrate them into a single operation.

Lufthansa itself saw revenues up by 13% to €14bn and an operating profit of €382m up from a loss of €107m in the previous year. SWISS generated 25% improvement in revenues and an operating profit of €293m up from €93m in 2009. Austrian, consolidated from September 2009, provided revenues of €2bn and an operating loss of €66m; and bmi, consolidated from July 2009, generated revenues of €896m and an operating loss of €145m (compared with a calculated proforma loss of €225m in 2009). In contrast, germanwings (the group’s attempt at low cost operations) experienced a few disasters in 2010 (including a pilots' strike) and revenues only grew by 9% to €630m and it lost €39m in the year.

Cargo operations were most badly hit by the halt to world trade in 2009 but 2010 provided a very strong rebound. This does not seem all due merely to market conditions, but also to management reaction. The group returned mothballed capacity into service very quickly as world trade started to recover – helped by the swift recovery of the German export market. Traffic increased by over 20% and revenues jumped by 43% to €2.8bn; while, having taken a surgical knife to costs in 2009, profits of €310m reversed losses of €171m in the previous year.

Meanwhile, among the other divisions, maintenance operations at Lufthansa Technik suffered from Euro weakness as well as a “late cycle” nature of its business. Revenues only grew by 1.4% to €4bn after a fall in the first half of the year and operating profits fell by 15% to €286m. IT Services – seemingly the least sensible of the group’s divisions – depends to a large extent on other airlines' willingness to spend on software development and not surprisingly revenues fell slightly and profits by 17%; it has entered its own restructuring programme. In Catering (LSG/Skychefs) there was a pleasing 7% growth in revenues (it does benefit from the gearing of passenger volume growth even if airlines downgrade their on–board catering offerings) and a 45% increase in EBITDA. (The group restructured its holding structure for the division which allowed a capitalisation of tax losses to the tune of €400m.) It managed to reduce its cashflow value added losses; and the Lufthansa Group is likely to want to see a full return to value creation before looking for buyers.

On the cost side of the equation the group boasted success in its latest efficiency programmes. At Lufthansa it stated it achieved €230m in cost savings in 2010, expects to generate a further €350m in 2011 and says it is on target to achieve the full planned cumulative €1bn savings by 2012. At Austrian, it states it achieved €250m cost savings, managed to reduce staff numbers by the planned 20% and has identified an additional €30m potential synergy benefits. At bmi it states that it achieved the planed £60m savings through cutting capacity by 25% and staff by 20%.

On outlook the management was understandably reticent – except for the usual graph showing a possible increase in group profits. SWISS, Austrian and bmi are all due to join the integrated transatlantic joint venture (with United/Continental/Air Canada) in the summer. Lufthansa and SWISS are expected to see improvements in profitability; Austrian to produce profits; and bmi to reduce losses. In the end this year may depend on the development of oil prices: at the announcement of the results the forward curve suggested that the group fuel bill would jump by 30% (after hedging) to €6.8bn in 2011 from €5.2bn in 2010; except perhaps on short–haul operations much of this may be recaptured by fuel surcharges. One additional impact currently under doubt will be the impact on demand of the introduction of a German (and Austrian) passenger departure tax.

Air Berlin: struggling to find its way

Air Berlin by contrast showed a 15% increase in revenues for 2010 to €3.7bn, a 23% jump in EBITDAR to €620m (reflecting a 16.6% margin) but operating profits slumped from €28.5m in 2009 to a loss of €9.3m. Net losses totalled nearly €100m up from net losses in the prior year of €21.9m. As usual the annual figures contain many one–off extraordinary items and are perhaps presented with the intention to confuse.

First, they include a full year of operations of TUIFly’s city routes acquired in 2009 and a half year of the operations of Austrian Niki – the group increased its shareholding to 49% and consolidated the company within the accounts from June 2010 – and on a like–for–like basis total revenues probably only increased by 1%, while if Niki had been included for a full year operating losses would have come in at €17m.

Second, Air Berlin bought back a 9% convertible loan (issued only in August 2009) for €136m, simultaneously issuing a €200m vanilla 8% five–year bond. Apparently this transaction will reduce group financing costs by a total €76m between 2010 and 2014 – but nevertheless led to an after tax write–off of €29m and a reduction in equity of €24m.

As Lufthansa did, Air Berlin complained of the harsh winters at each end of the year and the impact of the volcanic dust cloud — but also mentioned the ATC strikes in August that particularly hit its Spanish business. Excluding Niki (which seems to have added €17m at the operating line in the year), an estimated impact of €40m from the closure of European airspace in April, and an estimated €21m impact of striking controllers, the company claims that it would have produced an operating profit of some €35m for the year. However, as usual the operating line includes what used to be known as extraordinary figures of €54m which could have reduced that “what could have been” to a loss of nigh on €20m. One of the biggest impacts on the year’s results was a substantial increase in both lease rentals (of nearly 50% to €535m) and net interest costs (of 160% to €133m – although €64m of this may be termed “extraordinary”).

Not surprisingly operational cash flow slumped from €184m to €42m. However, gross debt fell slightly while cash increased to €411m (still an uncomfortably low 11% of revenues) and net on balance sheet debt fell by €85m to €489m. Equity as published finished the year at €505m down by €100m on the year. However this does include some €387m in intangibles (including significant amounts for route rights) – and to be a little unfair it might appear that net gearing stood at 440%. Ironically perhaps given the group’s shift away from finance leases to operating leases it will have to put them back on the balance sheet under the new IFRS standards.

In operational terms last year total seat capacity increased by 21% and demand in passenger numbers was up by 20% (5% and 4% respectively on a like–for–like basis) but average revenue per passenger (as well as unit revenues) fell by 2.5%. Charter sales fell by 4% (on a proforma basis) and now make up only 34% of total ticket sales; while in–flight sales (on a per passenger basis) fell by 25% (to €1/pax) and other revenues down by 1.5% to €8.28 per pax.

Air Berlin may be Germany’s second largest carrier (and Europe’s sixth largest by passenger numbers) but seems still to be trying to find its way. Since flotation in 2006 it has doubled it revenues and traffic – but has lost a total of €226m for shareholders; not having made a net profit since then and only achieving an accumulated operating margin of 0.3%.

Meanwhile with a fleet of 144 aircraft (see table) it has orders outstanding for 88 (including 18 787s) and LOIs and options for a further 79 aircraft.

It has managed to increase its penetration of the German corporate market – with some 1,400 company agreements in place up from 330 in 2006 and may now have 2.5m members of its frequent flyer programme up by a compound annual growth of 45% over the period – but the anticipated benefits of tying in the long haul operations of LTU (which still concentrates on leisure routes) to increase the attractions to the domestic corporate market have really yet to come through: this may change as the group finally integrates the LTU operations within the Air Berlin AOC from April this year. Meanwhile it may have built its presence as a viable intra–European alternative to Lufthansa in certain non–Frankfurt markets: having developed intra–European connecting network hubs at Berlin Tegel (no doubt in preparation for a fight with easyJet once the move to Berlin–Brandenburg International Airport takes place), Nuremberg and Dusseldorf – where it is market leader – and it also maintains that its transfer network hub at Palma makes sense. At least this has made it attractive to the oneworld alliance. Having seemingly lost its way as a low cost carrier, it has started code shares with Finnair, AA and BA (with the plan to act as a feed into BA’s Gatwick leisure routes) – and it aims officially to join the alliance in 2012.

On short term outlook the management remains cautious – primarily (as with Lufthansa) because of the impact of the German departure tax. It is however taking on a couple of A330s and boosting long haul operations by some 15% while overall capacity it planned to grow by a modest 4% on a like for like basis – emphasising its network hub operations — surplus aircraft it plans to lease out. While Lufthansa’s comments display worries of severe short haul yield pressure, Air Berlin hopes to be able to improve yields in the current year and pass on all fuel cost increases, with the target of a positive operating profit.

Lufthansa through its acquisitions of Austrian, SWISS (and potential acquisition of SN Brussels) confirms its leading position in German–speaking Europe (while along with its holding in bmi is the only one of the major network players to have a potential pan–European short haul network to compete with the LCC majors). All things considered it must be happy to have Air Berlin as second fiddle in what has been called a “comfortable duopoly”.