Preserve the core value, dump the legacy – the Olympic privatisation

April 2010

Europe’s most recent airline privatisation, mostly unnoticed, was Olympic Airlines, which was 100% sold by the Greek state to a wholly private entity, Marfin Investment Group (MIG), in October 2009. It was an innovative privatisation.

The successful sale was the fifth attempt by a Greek government, either left–leaning Pasok or right–ish New Democracy, to unload the very unprofitable national carrier. Previous efforts failed because unacceptable conditions – maintaining employment, for example – were attached or investors just could not see how to deal with intractable legacy issues: the power of unions and perpetual political interference.

There was also the thorny issue of illegal state aid; Olympic had been investigated on various occasions by the EC and had been ordered to repay €200m of illegal subsidies to the Greek state, which for a company with no net assets and no liquidity would have been the final death blow.

The 2009 privatisation was designed to isolate and monetise the intangible assets of Olympic while getting rid of the liabilities. Potential investors were in effect invited to bid for Olympic’s core assets – the brand and slots. They could also buy the other assets — aircraft, other equipment and the IT systems — but there was no obligation. Critically, the investor was not committed to taking on a single Olympic employee, whether they were a manager, a pilot, an engineer, a flight attendant or an accounts clerk. There was no obligation to operate any Olympic route, though the purchaser would have to bid for the PSO (Public Service Obligation) intra–island routes, which was no hardship as the EC–approved subsidies on these services guaranteed an operating profit.

This clean structure was the end product of a complicated process (in which Aviation Economics was heavily involved).

First, the process had to be approved by the EC, whose prime concern was that this was another example of financial engineering, with liabilities being lumped into one company and assets left in another, but no real change in the airline. Olympic and Alitalia had tried this tactic previously. In short, the EC made two fundamental demands: after the sale the new airline had to be 100% owned by a private entity, with the government exiting totally, and it had to be a smaller company, reduced in size by at least 35%. The all–important consideration was that the process had to be transparent so that the new airline could not be regarded as a “successor company” to Olympic Airlines (and so still possibly be liable for repayment of the illegal state aid.)

Second, various ministries and advisors engaged in protracted negotiations with the various unions at Olympic in order to define the terms of the “social package” required to soften the blow of a massive lay–off of airline employees. Redundancy settlements were agreed, which would be regarded as generous in the UK or the US, and fall–back jobs were offered to ex–Olympic employees in the Greek civil service. Here, the key consideration was to minimise the TUPE problems. Under EC regulations known as Transfer of Undertakings (Protection of Employment) or TUPE, employees’ rights in a company sale, particularly a privatisation, may be protected to the extent that they can claim exactly the same terms and conditions and continuity of employment as they enjoyed under the previous employer. If the owners of the new airline were liable to inherit the old Olympic labour contracts, the sale simply would not have happened. Eliminating TUPE risk was a vital part of the social package deal with the unions.

(However, it appears that the relatively new Pasok government, which replaced New Democracy last October, has not been able or willing to fulfil these redundancy terms in full, which is not surprising given the depth of the current Greek economic crisis; ex–Olympic staff have been prominent in the demonstrations that have taken place in Athens.)

Third, a transition vehicle was established – Pantheon Airways – to which the core assets that the investor wanted from the old Olympic were transferred. The investor actually bought Pantheon — which was then renamed Olympic Air — and old Olympic Airlines, with all the unwanted assets, was put into liquidation. Pantheon was set up as a 100% Greek state–owned company and a 51% subsidiary of the flag carrier, with its own AOC and set of operating manuals. As well as managing the business- planning and transition–planning between the old and new Olympics, Pantheon was also designed so as to be capable of taking over the temporary operation of important Olympic routes to ensure the transfer of slots to the new Olympic Air.

The transaction, which required some careful and patient explanation (and was monitored by EC–appointed lawyers), attracted interest from a dozen potential investors, but in the end Marfin Investment Group (MIG, also known as Made in Greece), possibly nudged by the Greek government, was the successful bidder. MIG is a private investment holding company listed on the Athens stock exchange with €7.8bn of assets invested in a range of sectors including shipping, health–care, banks, IT and food.

The liquidation option

To recap, what MIG actually bought was the Olympic name, its logo (the five interlocked Olympic Games circles plus an extra one) and slots at destination airports (of which two pairs of Heathrow slots accounted for almost all the value). The total price paid by MIG was about €55m, roughly half for the brand, half for the slots. In addition, MIG bought the profitable ground handling company, OA Handling, and OA Engineering, the maintenance base at Athens airport, an unprofitable but excellently equipped facility. This brought the book value of its investment up to €210m. Why go through his complex process? Why not simply put Olympic Airlines into liquidation, cease trading and rely on market forces to fill the gap in aviation services? The answer is that almost all European governments find the political cost of killing off their flag carriers to be unacceptable. In Greece’s case, Olympic was still strongly associated with the heritage of Aristotle Onassis, who sold his airline to the state in 1974, there was genuine concern about maintaining services to the remoter islands, and then there was intense pressure from the unions and other vested interests. The process enabled the government to realise the core value, which would otherwise have disappeared in a bankruptcy (for example, the Olympic brand realised a substantial sum whereas the Pan Am brand, once the most recognised in the world after Coca Cola, was traded for only a couple of hundred thousand dollars after Pan Am ceased operations). The Greek transition model might well serve as a template for other small European states grappling with flag carrier privatisation issues.

Although MIG retained the Olympic name, it moved quickly to create a new airline. Adonis Symigdalas, a former and highly- regarded COO of Aegean Airlines, was appointed as CEO. A new fleet was leased and bought in – A320s and Q400s completely replacing the 737–400s and ATR42/72s that MIG was not interested in and which were parked at Athens El. Venizelos airport, still awaiting disposal by the Greek authorities. The old Olympic Airlines network was cut back, with the loss–making (but previously inviolable) long–haul operation to New York, Toronto/Montreal and Johannesburg dropped completely — this enabled Olympic Air to comply with the EC requirement for a 35% reduction in size (as measured by ASKs) — partly replaced by a code–share with Delta. Olympic’s four A340s were also parked at the airport and are also awaiting disposal by the Greek authorities.

Bad timing

Only a minority of Olympic Air’s cockpit, cabin and ground staff were taken on from the old flag carrier, and these were generally junior employees, so there was much less to unlearn. In–flight service standards, on the London–Athens flight at least, improved immensely. Unfortunately, Olympic Air was launched into a global economic crisis. The Greek economy has been particularly hard hit, and the decision to join the Eurozone, justified by what turned out to be wildly optimistic national accounts, rebounded badly. Locked into the Euro rather than the traditionally weak Drachma, Greece has become a very expensive destination for British visitors, who have comprised the majority of tourists to the country. Tourist arrivals in 2009 fell by 20% compared with the previous year, with Turkey and Egypt benefiting at Greece’s expense.

Also, the response of the other privately owned and relatively profitable Greek airline – Aegean Airlines – to Olympic Air was brutal. Aegean did not participate in the privatisation process (until it made a last minute bid that was deemed to be too late). Aegean’s thinking might have been that the privatisation was bound to fail again – a not unreasonable assumption given the history – and that it made more sense just to wait and pick up Olympic’s business. Aegean launched a fare war against Olympic Air in the very important domestic market – after taxes fares from Athens to the islands were in effect cut back to one or two Euros.

In March MIG announced that Olympic Air had lost €79.3m in the first six months of operation and the six month start–up cost period. The logical solution, already announced in February, was a merger of Olympic Air and Aegean, with the new entity, which will appear in the first quarter of 2011, carrying the name and logo of Olympic – so another brand reincarnation. The 2011 Olympic Air will be 27% owned by MIG, 27% by the Vassilakis Group, a major conglomerate in Greece and the largest shareholder in Aegean, with the remaining 46% split among minority Aegean shareholders.

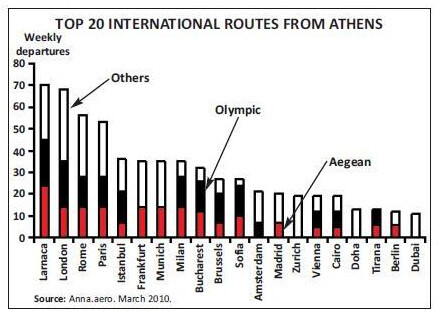

Consolidation won’t solve the fundamental problems caused by the deteriorating state of the Greek economy but it will moderate competition on international routes. Also, neither Olympic nor Aegean has low costs – they are essentially full service airlines – and there is the possibility that a leading LCC will expand into the Greek market. The prime candidate is easyJet, which flies to Athens from other European bases but has not established a base in Greece, partly because airport charges are so high at El. Venizelos.

The degree of consolidation in the domestic market is going to cause some concern at the EC Competition Directorate. Olympic and Aegean together have more than 95% of the domestic market, the rest split between Athens Airways, a start–up, and Sky Express, a Crete–based regional. The merger restores Olympic’s domestic near–monopoly that was the regulatory regime up to 1997, Greece having been allowed a five–year domestic market exemption from the 1992 air transport liberalisation package, in order to adjust gradually to free competition.

| Olympic Air | Aegean Airlines | |

|---|---|---|

| A319/320/321 | 17 | 22 (5) |

| Q400 | 9 (5) | |

| Q100 | 5 | |

| ATR 42/72 | 2 | 2 |

| Avro 100 | 6 | |

| Total | 33 (5) | 30 (5) |