Arrivederci to Alitalia?

April 2008

The Italian flag carrier again looks close to collapse given that unions refuse to accept the job cuts demanded by the Franco–Dutch group and the Italian general election has returned Silvio Berlusconi to power — who says he will veto the sale of the Italian flag carrier to Air France/KLM.

In late March Silvio Berlusconi announced that if his right–wing coalition won the election being held on April 13th and 14th then he would veto Air France/KLM’s acquisition of Alitalia, which he regarded as "arrogant and unacceptable". He is in favour of an Italian takeover of Alitalia and said that: "I've appealed to the pride of Italian entrepreneurs who think as I do that we shouldn’t be colonised."

The impending election meant that some of Berlusconi’s statements had to be treated with caution (as they were primarily aimed at attracting votes), and there are analysts who believe that now elected, Berlusconi will back down from blocking Air France/KLM’s takeover. At the time of Aviation Strategy going to press, it was unclear whether the newly–elected Berlusconi would carry out his threat, although on election night Berlusconi did say he wanted to break the current "impasse".

Berlusconi is likely to be emboldened by the fact that his “Popolo della Libertà” party has won a convincing victory at the polls — so large in fact that he now governs without the need to obtain the support of more moderate centre–right parties. But in any case, Berlusconi may never have to formally veto the deal, since Air France/KLM may pull out of the takeover anyway (and may well have done so by the time Aviation Strategy gets to subscribers).

Prior to the election, the immediate problem for Air France/KLM was to get agreement with Alitalia’s nine unions,who have reacted badly to what they say has been a lack of consultation from the Franco–Dutch group, with what they see as a "take it or leave it" ultimatum from Air France/KLM.

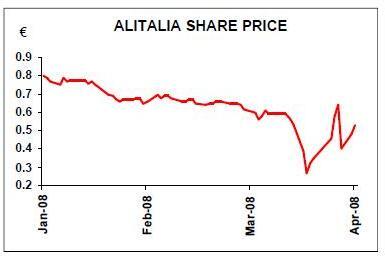

As predicted by Aviation Strategy (see March 2008 issue), Air France/KLM’s indicative offer of €0.35 for each Alitalia share was unrealistically high, although it went a fair way to persuading the government to nominate the Franco–Dutch group as its preferred bidder, ahead of the rival bid by Air One, which indicated a much more realistic price of €0.01 per share.

When in March (following the end of the exclusive period of negotiations) Air France/KLM unsurprisingly lowered its firm bid to an effective €0.10 per Alitalia share (via offering one of its shares for every 160 Alitalia shares, with Air France/KLM shares trading at €16 as at mid–March), this caused uproar in Italy and gave plenty of room for criticism of the Franco–Dutch group by politicians and unions alike.

Air France/KLM argues that it lowered its bid after finding unexpected surprises in Alitalia’s books, such as substantial losses at Alitalia’s cargo operation. Air France/KLM now wants to shut down Alitalia’s specialist cargo flights over the period to 2010, with a gradual elimination of the five–strong MD–11 freighter fleet.

Cargo will then only be carried in the holds of passenger aircraft, but Alitalia’s unions argue that all this move will ensure is that Air France/KLM’s own specialist cargo aircraft (five 777 freighters are on order) will operate very profitably.

Air France/KLM countered that it still planned to invest €1bn into Alitalia via a rights issue, and that if it took over the flag carrier then it could return to operating profit as early as 2009 under its turnaround plan, with capacity growth at Alitalia recommencing in 2011.

Union anger

But these statements count for little with Alitalia’s unions, who have now lost what little trust they had in Air France/KLM and simply do not believe that Air France/KLM will "only" reduce Alitalia’s capacity by around 10% in 2010 compared with 2007, with the fleet being cut from the current 186 to 140 by 2010.

Indeed Berlusconi’s controversial statements came a week after negotiations between unions and Air France/KLM broke down in mid–March, although they restarted a week later as there had been a March 31st deadline imposed unilaterally by Air France/KLM for unions to approve the Franco–Dutch "framework" for Alitalia.

The talks naturally centred on redundancies. Another reason why Air France/KLM was preferred initially was because it appeared to require fewer redundancies than Air One, but that now doesn’t appear to be true. Air France/KLM wants 1,600 job cuts at the current 11,000 workforce and another 500 from the 3,300 employees it says it will transfer across from Servizi, the former Alitalia engineering and ground services division. But although Air France/KLM says the remaining 4,100 at Servizi will be kept for up to four or eight years before Servizi is closed down, unions argue that this effectively means that the true number of job losses will be 6,200.

On/off talks

Predictably, the resumed talks broke down again on the 29th of March, meaning that the 31st deadline imposed by Air France/KLM could not be achieved — although Air France/KLM then extended the deadline to April 2nd. Yet again this was a deadline that was impossible to meet, and later that day Maurizio Prato — Alitalia’s chairman and chief executive — resigned, and the shares were suspended.

That same evening Air France/KLM then withdrew from the deal, only to then say they would give unions (who are willing to restart talks) a second and "final chance" to reach a deal, with talks starting on April 15th.

Air France/KLM is now believed to be offering to take on an extra 891 from Servizi (meaning that 4,191 will transfer from Servizi to Alitalia, of which 500 will then be made redundant), but that still leaves overall job cuts at 5,309 (1,600 at Alitalia, 500 from the transferred Servizi jobs, and the 3,209 left behind at Servizi, whose positions will all go eventually, over a number of years).

It seems unlikely (although not impossible) that unions will agree to this level of job losses, and Jean–Cyril Spinetta — chief executive of Air France/KLM — has warned unions that his airline has little room for compromise on its offer. Since Spinetta wants all nine of Alitalia’s unions to give consent to the takeover — and Air France/KLM maintains it will not go ahead with the deal unless the new government also approves — the prospects for a Franco–Dutch–Italian group look bleak, if not impossible.

A successful Air France/KLM takeover appears even more remote now that Italian airport operator SEA has launched legal action against Alitalia, claiming €1.25bn in damages over the airline’s decision to downgrade its operations at Milan Malpensa. While the current government has asked the airport operator to drop its case, Air France/KLM wants the new government to protect Alitalia from the SEA lawsuit. But if the government provides any kind of monetary promise or guarantee to Alitalia or Air France/KLM over the SEA action, then it could break the EC’s bar on any more state aid to the Italian flag carrier.

A white knight

This situation leaves the door open for Air One. Berlusconi firmly wants an "Italian option" for Alitalia, and indeed a day after Berlusconi’s initial announcement, Carlo Toto, chairman of Air One, said the airline would make a binding offer for Alitalia, to be unveiled in mid–April once (and only if) Air One had a chance to look at Alitalia’s full accounts.

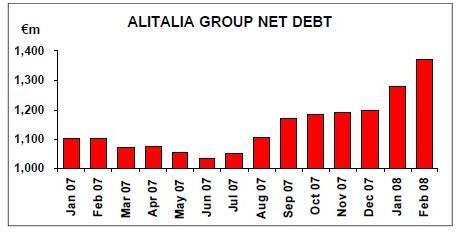

The former Italian government said time was running very short for Alitalia and that any rival offer had to be made within days and not weeks, with Tommaso Padoa–Schioppa — Italy’s former finance minister — adding a warning that the government may appoint a special commissioner to run the airline. The net debt at Alitalia continues to grow (see chart, on first page), and in March Alitalia asked the government for a short–term €300m line of credit, even though Alitalia’s cash position will be boosted shortly by €148m thanks to a €69m tax refund and €79m from the sale of its Air France/KLM shares. Ominously, after a board meeting on April 8th, Alitalia said it had just €170m in short–term funding left.

Assuming Air France/KLM is no longer a realistic option, there is a brief chance for Air One and a variety of Italian investors to step in and prevent Alitalia from going under. Despite the France- Dutch group’s exclusive talks with Alitalia, Air One has continued to work on its bid, and there has been continuing speculation in Italy that Lufthansa may step in and join the Air One bid — although the German flag carrier will not comment.

Of course the most probable outcome is that Air France/KLM pulls out and then an Air One/Italian investor bid fades away, which will effectively mean the end of Alitalia. If that happens, 1,000s will lose their jobs, and accusations and blame will be flung at everyone. But while Italy will be left without a flag carrier, this will give Air One and foreign LCCs and flag carriers alike a huge opportunity to exploit, and the death of Alitalia is likely to ignite a furious scramble to enter the Italian aviation market over the next couple of years.