Delta: From bankruptcy to industry-leading financials?

April 2007

Having fended off a hostile takeover bid from US Airways back in January, Delta Air Lines is now on course to emerge from Chapter 11 as a standalone entity at the end of April. The Atlanta–based carrier, which has been in bankruptcy since September 2005, has made a comprehensive effort to reshape itself. It looks to be a perfect example of Chapter 11 transformation, but are its business plan forecasts realistic?

Delta still needs final creditor and bankruptcy court approvals for its Plan of Reorganization (POR), which was originally filed on December 19 and amended in late January. The plan must be approved by at least 51% of the creditors and two–thirds of the dollar amount of claims. The voting deadline is April 9, and the bankruptcy court has scheduled a confirmation hearing for April 25. If all goes well, Delta hopes to emerge from Chapter 11 on April 30 or shortly thereafter and re–list its stock on the NYSE (under its historic ticker symbol "DAL") in the first week of May.

Creditor approval is virtually certain. The official committee of unsecured creditors and the two official retiree committees all support the plan; after all, they have worked very closely with Delta’s management in the past two months in finalising key aspects of the POR. No major new objections have been raised. And, as of the end of March, there appeared to be no competing plans in the works.

Back in January, Delta made some important concessions and ceded authority in return for the creditors' committee not supporting US Airways' hostile bid, which was withdrawn on January 31. Most importantly, the creditors' committee gained the right to appoint 10 of the 11 post–bankruptcy board directors (of which three had to be current directors). Delta also agreed to exclude from its new charter and bylaws any poison–pill provisions that could be used to block future merger deals.

The unsecured creditors, which will be major shareholders in the reorganised company, merely wanted to make sure that Delta’s board and leadership would be open to potential future mergers and acquisitions, should such opportunities arise. But those moves certainly added an unusual twist to the final months of Delta’s Chapter 11 reorganisation.

In recent weeks, Delta and the creditors have finalised the company’s post–bankruptcy compensation plans, corporate bylaws and the board of directors. The new board, announced on March 30, includes seven new appointees — all current or former executives of large US companies. Ex- Continental chief Gordon Bethune, who acted as advisor to the creditors' committee on the US Airways bid, is not included, but ex–Northwest CEO Richard Anderson is. Ex- Eastman Kodak CEO Daniel Carp will be chairman. The one director guaranteed a board seat is Delta’s CEO — currently Gerald Grinstein, 74, who will retire after the post bankruptcy board has named a successor.

Delta has had Chapter 11 exit financing commitments in place since late January. Unlike US Airways, but like UAL, it has raised no new equity. It has lined up $2.5bn in secured debt financing from a group of prestigious financial institutions, including JP Morgan, Goldman Sachs, Merrill Lynch, Lehman Brothers, UBS and Barclays Capital. The financing, which has competitive terms and comprises a $1bn first–lien revolving credit facility and $1.5bn in secured term loans, will replace Delta’s $2.1bn DIP financing and boost its cash position. Since it is all secured financing backed by attractive collateral, risks to the lenders are obviously minimal.

Finally, Delta has accomplished something that bankrupt companies usually avoid until well after their emergence from Chapter 11: it held a "2007 Investor Day" at its Atlanta headquarters on March 27. This was despite the fact that many shareholders got burned in the lead–up to the Chapter 11 filing and those still hanging on will receive nothing when the current stock is cancelled upon Chapter 11 exit. But, based on what happened with US Airways and United, many analysts will be keen to quickly reintroduce coverage of Delta. The many hours of management presentations (also via the Internet) were extremely helpful.

Financial turnaround

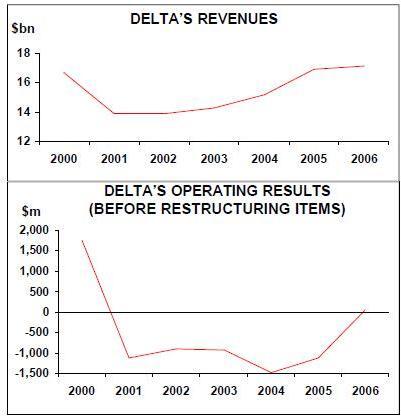

Delta’s ability to hold an investor day at this stage may be another example of the reduced stigma associated with bankruptcy. But another reason is that Delta has a great story to sell. First, the airline has achieved an impressive financial turnaround in the past 18 months. Second, like United a year ago, Delta emerges from bankruptcy with a formidable global network.Ironically, Delta entered the post- September 2001 industry crisis in great financial shape. It had earned double–digit operating margins and net profits in the region of $1bn for five consecutive years up to and including 2000. The famous (and much–maligned) 1994–96 "Leadership 7.5" project had made it the lowest–cost major network carrier in the US. Delta retained that cost structure in the boom years of the late 1990s, thanks to a favourable four–year pilot contract in April 2006, low–fare subsidiary Delta Express (October 2006) and tight cost controls. As a result of a mid–1990s restructuring, Delta also had a strong balance sheet and investment–grade credit ratings.

But the strong balance sheet turned out to be a mixed blessing: it enabled Delta to continue to tap the capital markets for funds to a much greater extent than the other legacies, despite losing just as heavily post- 2000. Also, Delta was unlucky with the timing of its labour negotiations: it happened to be the last major carrier to sign an expensive pilot deal before September 2001, making its pilots the highest–paid in the industry. Between 1999 and 2003, as its unit costs surged from 8.80 to 10.58 cents per ASM, Delta not only lost its CASM advantage but became one of the highest–cost large network carriers.

But, because Delta’s balance sheet was still relatively strong in 2002 and 2003, it could do nothing but watch helplessly as United and American, in their Chapter 11 and near–Chapter 11 situations respectively, extracted significant cost concessions from their pilots in 2003. In other words, Delta happened to be financially strong at precisely the wrong point in the industry (pilot contract) cycle.

In the five years up to and including 2005, Delta’s net losses before special and restructuring items totalled $7.5bn, including losses of $2.3bn and $2.2bn in 2004 and 2005, respectively. Total lease–adjusted debt surged by a similar amount, from $11.2bn in 2000 to $18.9bn at the end of 2004.

Delta did manage to garner up $5bn of annual cost reductions and revenue enhancements before its bankruptcy, including $1.1bn of pilot concessions and $1.8bn savings from other employee groups. But it was not enough and the company filed for Chapter 11 on September 14, 2005 (coincidentally on the same day as Northwest).

Delta’s financial turnaround in Chapter 11 has been swift and strong. The leadership noted at the late–March investor event that the company’s economic performance had improved by $2.1bn in the past 16–17 months, despite a $1bn higher fuel bill.

The airline attributed the past year’s improvements to revenue and cost measures implemented in Chapter 11, revenue and network productivity improvements, in court restructuring initiatives and labour cost reductions. However, 2006 was a good year for all legacy carriers — Delta’s own comparisons show that while the two Chapter 11 carriers (Delta and Northwest) saw their pretax income surge by about $1.6bn, Continental’s also rose by $1bn and AMR’s by $908m.

Delta earned its first operating profit in six years in 2006 — a marginal $58m on revenues of $17.2bn. Significantly, the airline generated $1.2bn of free cash flow last year — its first positive free cash flow since 1998. The net loss before special and restructuring items was $406m, representing a $1.8bn improvement over 2005. The reported 2006 net loss was $6.2bn, which included the same amount ($6.2bn) of reorganisation charges, a $310m accounting–related charge and a $765m income tax benefit.

The Chapter 11 reorganisation

The full–year, second–half and fourthquarter 2006 operating margins were still measurably below those achieved by other legacy carriers. However, Delta argued that if the second–half results were adjusted for a common fuel price of $2 per gallon and for the now–terminated pilot pension plan, it was already "in the middle of the pack" with a 5.5% operating margin. Delta’s reorganisation plan estimates an initial equity value of about $10bn and a recovery to unsecured creditors of 62–78 cents on the dollar (76–100 cents in the case of regional subsidiary Comair). The unsecured creditors will receive primarily new Delta common stock to settle their claims. Contrary to earlier expectations, Delta no longer plans an equity rights offering, which would have allowed creditors to buy additional shares.

The bulk of the new stock will go to the unsecured creditors, which hold $15bn in claims ($14.2bn for Delta and $800m for Comair). Most of the claims are from groups that are not traditional holders of equity (US Bancorp, Bank of New York, etc.), so there is likely to be a large initial turnover. Delta’s pilots (current and retired) and the Pension Benefit Guaranty Corporation (PBGC) will also be major initial shareholders, due to their $3.3bn and $2.2bn respective claims. Delta’s non–union employees will be allocated a 3.5% ownership stake, while management employees will get about 2.4%.

After the Chapter 11 filing, Delta set a goal of achieving $3bn in annual financial improvements by the end of 2007. That tar–get was reached a year ahead of schedule, so additional cost cuts and revenue enhancements are now expected in 2007.

Much of the financial improvement has obviously been achieved through the usual in–court restructuring facilitated by Chapter 11: debt, lease and facility restructurings, aircraft lease re–negotiations and rejections, vendor contract re–negotiations and labour cost reductions.

However, Delta’s reorganisation has been notable for the wide–ranging efforts made to re–engineer the company, rather than just cut costs, reduce debt and shore up the balance sheet. Some of the $3bn financial improvement has come from higher revenue generation and network productivity improvements. The key accomplishments have included simplifying the fleet by retiring four aircraft types, right–sizing domestic operations, undertaking significant international expansion, increasing point–to–point flying and right–sizing and simplifying domestic hubs.

Delta has used the Chapter 11 process to reject, return or sell a significant number of aircraft — the tally at year–end was 188. It had reviewed facility agreements at 55 locations and rejected or restructured leases at airports such as Dallas, Orlando and Tampa. At the end of March, negotiations still continued in respect of various aircraft and facility agreements.

Recently amended contracts with several regional partners will facilitate cost savings this year. Two deals announced in March incorporate lower fees and some reduction in 50–seat RJ flying; partners Mesa and Republic are receiving unsecured claims of $35m and $91m, respectively. Delta also anticipates significant savings through Comair’s Chapter 11 restructuring. However, Delta has assumed its contract obligations with ASA and SkyWest. It has also granted Mesa a new contract to operate 14 CRJ- 900s and signed up ExpressJet and Mesaba’s Big Sky unit as new regional partners.

The key labour milestone was a comprehensive agreement with ALPA, effective June 2006 and amendable at the end of 2009. The pilots agreed to reduced pay rates and benefits, changes in work rules and the termination of their defined benefit pension plan. In return, ALPA is receiving a $2.1bn unsecured claim and $650m in unsecured 15–year notes. A similar deal was clinched with the flight dispatchers (the only other union at Delta), which are also receiving an unsecured pre–petition claim.

The pilot wage and work rule concessions are expected to result in $280m annual cost savings in the contract period. Other employee groups have contributed an aggregate $600m–plus in annual savings in the form of pay and benefit reductions and staff cuts, and retiree health–care benefit changes will result in a further $50m saving.

The termination of the pilot defined benefit pension plan, effective September 2006, reduced Delta’s pension obligations by $5.2bn to $7.6bn at the end of 2006. Other retiree benefit obligations were reduced by $859m to $1.2bn. The PBGC, which took over the pilot pension plan at year–end, will be issued $225m in senior unsecured 15- year notes in addition to the $2.2bn unsecured claim.

Thanks to the Pension Protection Act of August 2006, which allows US airlines to significantly reduce their near–term pension funding obligations, Delta has been able to preserve its defined benefit pension plan covering ground employees and flight attendants. Funding requirements under that plan are expected to be only around $100m annually in the next few years.

One of Delta’s most impressive moves — which just may help ensure continuation of the surprisingly strong staff morale seen in recent months (partly because employees united to oppose the US Airways bid) — is an unusually generous post–bankruptcy compensation programme. The company announced in late March, first of all, that its 39,000 non–union employees (excluding officers and directors) will receive $350m worth of stock and $130m in cash lump sum payments upon the Chapter 11 exit. This is separate from the benefits secured by the two unions as part of their concessionary new contracts. Such a broad–based stock award involving non–union workers is probably unprecedented for a company emerging from Chapter 11. Second, the non–contract employees will begin receiving pay increases this summer. Delta has made a commitment to move towards an industry–standard pay structure over time.

Delta is also introducing a generous profit- sharing plan that will pay out at least 15% of the company’s annual pre–tax profit, with no thresholds. There will be new incentive performance awards and a new defined contribution retirement benefit, offered to enhance existing pension plans. All the employees (including the pilots and the flight dispatchers) will participate in those programmes.

These measures were reportedly explicitly designed to surpass what other airlines have offered when emerging from Chapter 11, to prevent unionisation (currently only 17% of employees), to ensure that people remain flexible to route and schedule changes and to maintain a happy front–line workforce as Delta strives to raise unit revenues.

Delta's business plan

Equally importantly, management and leadership pay and stock awards have been kept modest to avoid the sort of anger and criticism that UAL and other companies have provoked with their big top executive payouts upon Chapter 11 exit. While around 1,200 Delta management employees will receive restricted stock, stock options and performance stock representing about 2.4% of Delta’s value (vesting over periods of up to three years), officers and directors will not receive pay increases until front–line employees have reached industry standard pay. CEO Grinstein has refused an exit bonus; instead, at his request, the company is setting up two charitable foundations to provide scholarship and hardship assistance for Delta employees. Delta’s business plan has three goals: closing the unit revenue gap with its peers, maintaining the lowest unit costs among the large network carriers and achieving top–tier financial and operational results. A further goal is to achieve an industry–leading balance sheet that will allow reinvestment.

Closing the RASM gap: The focus of the business plan is very much on revenues, because Delta’s former strong revenue position (a decade or so ago) had by 2005 deteriorated to such an extent that its RASM was only 86% of the industry (ATA) average. The airline estimated that the 14–point RASM gap represented $2.5bn of lost revenues.

The airline believes that the RASM gap was driven by three roughly equally important factors. First, Delta carried the highest percentage of (lower–yielding) connecting traffic among the network carriers — partly because it had a 22% larger average gauge in domestic operations and because it had significant capacity at relatively small hubs such as Cincinnati. Second, in 2005 Delta had a much lower percentage of international traffic than its peers (low 20s, compared to an average of 35% for competitors). Third, and most challengingly, Delta’s non–stop domestic yields are lower than the other networks' — reflecting factors such as a heavy East Coast presence, competition with AirTran at Atlanta and a tertiary position at New York (resulting in lower transcontinental yields than American’s and United's).

Consequently, while in Chapter 11 Delta has focused on fixing those problems. First, it has right–sized domestic operations, among other things, by utilising smaller aircraft; this led to a 16% reduction in domestic capacity in 2006. Second, Delta has grown internationally by shifting widebody aircraft from domestic to international routes; international capacity rose by 21% in 2006. Third, the airline has increased point–to–point flying and right–sized and simplified domestic hubs to achieve a greater local traffic mix.

As a result, Delta’s length–of–haul adjusted PRASM surged by 17.8% in 2006, compared to an industry average increase of 10.7% (in a relatively healthy overall revenue environment). The airline reduced the RASM gap by seven points, to 93% in 2006. The aim is to achieve industry parity by the end of 2008.

Having restructured its network and operations, Delta is now focusing on improving the basic product in order to establish itself as "the airline of choice". In the first place,this has meant improving on–time performance and customer service, increasing the frequency of aircraft cleaning and upgrading in–flight entertainment. Delta has also invested in new technology, products, equipment and facilities in Atlanta to improve all aspects of the customer experience.

Unlike United, Delta has not introduced any type of "premium economy" service, and it does not really have a brand — things that would help attract business traffic and make a mark in markets such as New York and Los Angeles. In other words, Delta is not doing anything exciting or extraordinary — just positioning itself as a good network carrier. But Delta’s top executives indicated at the investor event that "revitalising" the brand would follow after Chapter 11. The priority is to "absolutely nail down and execute our two–product strategy" before considering premium economy maybe in a couple of years.

Best-in-class CASM? Following the $5bn pre–bankruptcy cost cuts, Delta eliminated $2bn from its cost structure while in Chapter 11 — through improved productivity, fleet simplification and renegotiated contracts. As a result, the airline has reduced its mainline non–fuel CASM by 20% in the past three years, from 8.99 cents in 2003 to 7.20 cents in 2006, despite a 6.6% capacity reduction in that period. Significantly, Delta projects a further non–fuel CASM decline in 2007, to 6.60 cents. That would mean a 27% unit cost reduction in four years.

Delta is claiming that it is emerging from Chapter 11 with the lowest unit costs of any network carrier and that it is closing the gap with LCCs. According to Delta, its mainline stage–length adjusted non–fuel CASM of 6.93 cents in the second half of 2006 was 12–13% below American’s and Continental’s and 15% below United’s though still above Northwest’s 6.78 cents. However, when adjusted for the elimination of the pilot pension plan, Delta’s 2H06 CASM of 6.71 was below Northwest’s. The full–year projected CASM of 6.60 cents would even bring Delta close to US Airways' LCC–type CASM of 6.54 cents.

These comparisons have to be taken with a pinch of salt, because each airline comes up with a different set of figures. Furthermore, what matters the most is what your main competitors' cost levels are. AirTran has claimed that it has actually increased its cost advantage over Delta despite the latter’s bankruptcy.

Delta’s aim is to sustain a low average unit cost and it recognises that the process is a "never–ending battle". The airline enjoys some inherent cost advantages: a flexible workforce (due to its minimal unionisation) and a main hub (Atlanta) at a low–cost location.

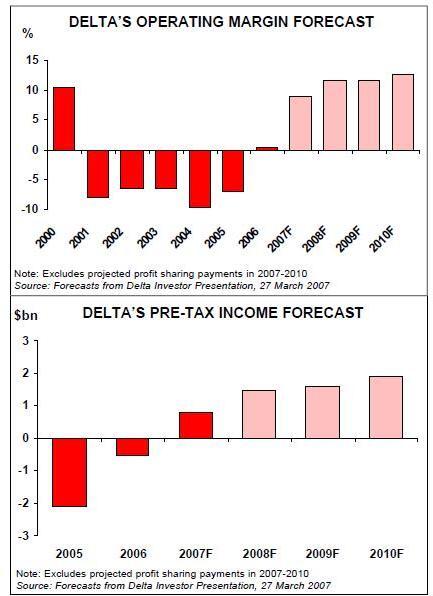

Industry-leading profits? Delta’s business plan projects an amazingly swift financial recovery this year and continuation of strong results in 2008–2010. After only breaking even operationally in 2006, the airline is forecasting a 9% operating margin in 2007, subsequently increasing to the 11- 13% range. On a pre–tax basis, Delta anticipates a turnaround from a $452m loss in 2006 to an $816m profit in 2007, to be followed by profits of $1.5bn, $1.6bn and $1.9bn in 2008, 2009 and 2010.

Those forecasts assume 2–4% capacity growth in 2007 (domestic down 1–3% and international up 14–16%), to be followed by 3% annual growth from 2008 onwards. RASM growth is expected to be 4% this year (compared to 1.5% growth for the industry) and 2% in later years. Fuel is assumed to be $2.06 per gallon in 2007 (including taxes), subsequently increasing by 5% annually. Mainline CASM is expected to decline by 7% in 2007, with further reductions in later years.

Many Wall St. analysts have considered Delta’s projections "aggressive" or overly optimistic and have questioned them basically on three grounds. First, as one analyst asked, "how can Delta catapult itself from industry laggard to leader profitability–wise in 6–12 months?" Second, can Delta realistically expect to fully close the RASM gap given its heavy exposure to the East Coast and LCCs and in light of the continuing RASM improvements at competitors? Third, would it not be unprecedented to have such strong profits for four consecutive years? What are the GDP growth assumptions?

The 2007 profits are probably achievable because they are largely based on the cost cuts accomplished in Chapter 11 but that came too late to help the 2006 results. Those cost cuts (the pilot pension plan termination and other Chapter 11 deals) will contribute $739m and lower fuel prices could add $107m to this year’s bottom line, while a $171m profit sharing will represent a new expense. The $593m revenue contribution (from improved RASM and capacity growth) needed to achieve the projected $816m pretax profit is also likely to materialise, given that recent domestic fare increases have stuck and international routes are apparently performing better than expected.

But the longer–term revenue trends are less encouraging. AirTran will continue to be an aggressive competitor at Atlanta. Delta’s new focus on New York will bring it into closer contact with Continental and JetBlue, which are currently really fighting it out in the New York area, and potential new transcontinental entrants such as Virgin America. The North Atlantic market, which is a primary focus for Delta, is likely to see increased price competition as a result of the new EU/US agreement. Delta’s argument that it can return, on a sustainable basis, to the 12% operating margins seen in the late 1990s seems a little idealistic.

Industry-leading balance sheet: Delta will emerge from Chapter 11 with one of the strongest balance sheets in the industry. Its total lease–adjusted debt has been reduced from $18.6bn in June 2005 to $10.9bn in 2007. Lease–adjusted net debt (after the deduction of cash reserves) has fallen by 55% in the same period, from $16.9bn to $7.6bn, with a further reduction to $6.2bn expected in 2008. Cash reserves at the end of 2006 amounted to $3.5bn, of which $2.6bn was unrestricted — an adequate 20% and 15% of last year’s revenues.

According to Delta’s annual report, debt maturities (excluding amounts subject to compromise) amount to $1.5bn in 2007, $2.2bn in 2008, $392m in 2009, $1.3bn in 2010 and $2.4bn thereafter. Operating lease payments amount to $1.3bn in 2007, $1.2bn in 2008, $977m in 2009 and $915m in 2010. Capital lease obligations are running at about $100m annually. Delta has $3bn of aircraft order commitments, of which $523m are for 2007, $823m for 2008, $960m for 2009 and $712m for 2010.

Delta anticipates free cash flow in excess of $1.5bn per year in the four–year plan period, which will allow reinvestment in the business as well as continued debt reduction and hopefully credit rating improvement. Investing in baggage handling and ground facilities at various locations will be early priorities.

The airline calls its Net Operating Losses (NOLs) a "significant asset"; they amount to $7.8bn and can be used to offset regular taxable income in full until depleted.

Network strategy and plans

Delta has said that it will continue to seek opportunities to unlock shareholder value, including further monetisation of assets. This may include spinning off wholly–owned subsidiary Comair. Delta sold its other former regional unit, ASA, to regional carrier SkyWest for $425m in August 2005. Delta’s network restructuring has featured a sharp domestic to international shift. In the fourth quarter of 2006, the airline’s North American ASMs were down by 11.8% year–over–year, while North Atlantic capacity was up by 27.6% and Latin American capacity by 18.5% (Pacific ASMs were unchanged). The strategy was possible because Delta had a large inventory of widebody aircraft suitable for international operations that were causing revenue dilution in the domestic market.

Since filing for Chapter 11, Delta has added 60–plus new international routes, with many more planned for 2007 and 2008. The airline is moving from a domestic/international capacity split of 80/20 in 2004 to a 60/40 split over the next couple of years; the long–term goal is 50/50.

In addition to becoming more international, Delta is looking to get a more globally balanced network. This means focusing near term growth on Asia — one of the few large gaps in its network — at the expense of Europe, which saw significant expansion in 2006. Delta’s business plan calls for increasing the Asia/Middle East/Africa regions’ share of international capacity to 22% by 2009 (from just 3% in 2005), while Europe’s share would fall from 70% to 50% and Latin America/Caribbean’s share would remain unchanged at 27–28%. That would be similar to Continental’s nicely balanced international network.

The new strategies have strengthened Delta’s two principal international gateways, Atlanta and New York, while the smaller hubs have contracted. In October 2006, Delta’s capacity was 30%, 16% and 5% down year–over–year at Cincinnati, Salt Lake City and Los Angeles, respectively. However, RASM was up at all of the hubs — either due to profitable international growth or reduced capacity — and Delta will resume growing also at Los Angeles and Salt Lake City. The airline is looking to develop Los Angeles as a gateway to Latin America.

Domestic plans: Delta’s top priorities in the next two years will be to boost its presence in New York and improve Delta Connection’s seriously lagging operational performance.

Delta is the largest carrier in terms of departures at JFK and LaGuardia combined but is not getting its share of premium traffic. The airline is determined to rectify that and attain sustained profitability in New York through measures such as increasing domestic connectivity, upgrading the transcontinental product, implementing an international flight bank split at JFK (this spring) and improving facilities at JFK.

However, JFK poses a tough challenge, because key competitors there have spent years strengthening their positions and building new facilities. Delta will not be able to match American’s $1.1bn spending on a new terminal — its current JFK plans feature only $50m spending. Although Delta apparently has got its long–term strategy at JFK sorted out, its facility plans are still up in the air. According to CFO Ed Bastian, the airline "needs to be looking at alternatives" to its current facilities, as competition heats up.

Asia: This year’s growth will focus mainly on Asia, spearheaded by new JFKMumbai and Atlanta–Seoul flights. The 777- 200LR opens many new markets — for example, Delta would like to operate Atlanta–India — and there will also be expansion through code–shares. Delta is seeking Atlanta- Shanghai route authority from March 2008; it is the only large US international carrier without service to China. The airline is proposing daily non–stop 777 flights, with code–shares beyond Shanghai with its partner and future SkyTeam member China Southern.

Europe: Since September 2005 Delta has added nine new European destinations, many of them in Eastern Europe: Budapest, Bucharest, Copenhagen, Dusseldorf, Edinburgh, Kiev, Pisa/Florence, Prague and Vienna. The profitable expansion has been facilitated by the domestic widebodies. Delta is the largest US carrier on the transatlantic, serving 31 destinations.

Delta has supported a liberalised US/EU agreement from its inception, believing that a good cost structure and strong balance sheet will enable it to compete. The top priority is to gain access to London Heathrow, in the first place from Atlanta but also from JFK — routes that the carrier describes as "huge opportunities". In October 2006 Delta bought United’s New York–London route authority for $21m; however, under the current ASA it cannot serve Heathrow and has to operate to Gatwick. Having paid United $13m when the deal closed, Delta will not have to make the four subsequent annual payments of $2m due in 2007–2010 if the liberalised US/EU agreement becomes effective.

Delta executives indicated on March 27 that the airline would immediately start investigating how to secure Heathrow slots. One obvious source is SkyTeam partner Air France, which is unlikely to want to operate London–New York but would probably be happy to include its code on Delta–operated flights on that route. Delta, Air France, Alitalia, CSA and Korean have benefited from antitrust immunity in the US since 2002.

Fleet plans

Latin America & Caribbean: Delta had added or announced more than 40 new routes to Latin America and the Caribbean since the autumn of 2005. There was a major growth spurt in November/December 2006, when 16 new routes were added in 22 days. Currently 58 destinations are served in the region, mainly from Atlanta and to a lesser extent from New York. This year will see some further growth to Latin America, also from new gateways; most recently, Delta has announced plans to add Los Angeles–Belize City and Fort Lauderdale–Santo Domingo flights in June.Delta had a mainline fleet of 440 aircraft at the end of 2006, down from 480 a year earlier. The mainline fleet consisted of eight 777–200ERs, 21 767–400ERs, 59 767- 300ERs, 24 767–300s, 121 757–200s, 71 737–800s, 16 MD–90s and 120 MD–88s. Firm orders included five 777–200LRs (plus six options) and ten 737–700s, all for delivery in 2008–2009. Delta has also signed a letter of intent with a third party to lease ten 757- 200ERs from July–November for seven years and three 757–200ERs from early 2008 for five years.

Delta also has 50 737–800s on firm order, but it has agreed to sell 48 of those aircraft to third parties immediately after they are delivered in 2007–2010. These sales will reduce the aggregate mainline aircraft order commitments from $3bn to $1bn over the next four years. However, in January the bankruptcy court allowed Delta to place a $1.1bn order for 30 76–seat CRJ–900s (plus 30 options), which will be operated by regional partners.

The domestic down–gauging is achieved by transferring 767–400ERs to international markets and adding 737–700s — and in the future 100–seaters — domestically. The goal is to reduce the 22% domestic gauge gap with the industry to 6%.

Delta is in much less of a hurry than American to retire its MD–80s, because its aircraft are 5–10 years younger, have full electronic cockpits (keeping training costs lower) and have market–rate financings. When ownership costs are taken into account, the MD–88’s unit costs are lower than the 737–800’s. But Delta has quite a gap between the 144–seat MD–88s and the 70–seat RJs — in the future it will be addressing the issue of whether to get a smaller gauge aircraft into mainline.

Delta has about 30 internationally capable mainline aircraft coming in the next three years. The 777–200LRs open up a whole series of markets that the airline was not previously able to serve. However, Delta still regards the 767–300s, especially with winglets, as competitive aircraft and well–suited to the North Atlantic.

Nevertheless, re–fleeting is going to be one of Delta’s top priorities after it emerges from Chapter 11. The key question will be where the airline stands regarding the 787. Would the 787 be mainly for growth in longer–haul markets or would it replace the 767s?

But the Delta board’s first task will be to select a new CEO. Grinstein, who is (unfortunately) retiring, has made it clear that he would like an internal candidate to succeed him because "Delta is an unusual entity and understanding the social network is critical". The two internal front–runners are CFO Ed Bastian and COO Jim Whitehurst — both very impressive candidates, except that they both sounded just a little too bullish on industry mergers when grilled about that subject at the March investor event.