Emirates: Radicalising the long-haul network model

April 2006

Some 20 years after it was launched, Emirates has become the world’s most profitable network airline, by a wide margin.

Can it maintain its seemingly relentless growth?

The Group

The Emirates group is owned 100% by the government of Dubai and comprises the airline and Dnata, an aviation services company. The group employs approximately 20,000 staff, with the airline accounting for 16,400 (of which 1,000 are pilots and 5,600 are cabin crew).

Over the past two decades, Emirates has grown into a highly successful profit generator (see Aviation Strategy, February 2003).

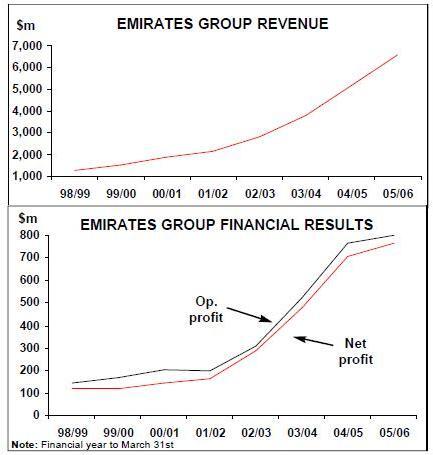

In the financial year to the end of March 2006, the Emirates group posted a net profit of US$763 (AED 2.8bn), 4.9% up on 2004/05, its 18th consecutive year of profit, though the increase was modest in comparison to previous years — net profit in 2004/05, for example, was 49% up on the previous year. Operating profit was $802m, 2.9% up on 2004/05, while there was a 27% rise in turnover, to $6.6bn.

This increase in operating profit was achieved despite rising fuel costs that accounted for 27% of operating costs, compared with 21% in 2004/05 and 14% in 2003/04, even though hedging saved the group $189m in the financial year (fuel surcharges were raised again in February 2006). Results were good enough for the Emirates group to pay a $105m dividend to the Dubai government.

Airline operations accounted for $674m of group net profit in 2005/06 (88% of the total), 2.8% up on the previous year, with airline revenue up 27% to $6.3bn (representing 95% of group revenue). Airline operating profit was $722m, 1.3% up on 2004/05, and accounting for 90% of group operating profit, with the remaining revenue and profit coming from Dnata (although in March 2006 the Emirates group launched a hotels division). Load factor rose by 1.3% to 75.9% in 2005/065, with passengers carried up 16% to 14.5m, thanks to new routes and extra capacity on existing services.

Dubai's strength

These impressive figures have arisen from Sixth Freedom traffic growth based on a dominant position at Dubai International airport, which acts as a hub for regional flights that connect with Emirates' international services. Today the UAE airline operates passenger services to 83 destinations in 55 countries, but more than 60% of Emirates' passengers make a connection at Dubai airport, based on a system of two waves of flights each day. There is a west–east wave in the late evening and early morning (where passengers on flights from Europe, the Middle East and Africa connect with short haul services to the Indian sub–continent and long–haul to the Asia/Pacific region), and a east–west wave in the 6.00am to 9.00am period, where the opposite traffic flows occur.

The system originated back in the late 1980s and early 1990s, when Emirates negotiated long term landing rights deals with foreign governments at a time when it was regarded as nothing more than a niche carrier. With these agreements in place, Emirates built up a network of feeder flights, and the two parts of the route strategy now reinforce each other so much that Emirates can open regional routes almost anywhere on the basis that there will be substantial connecting traffic with its international routes.

Although Dubai has a population of just 1.3m (according to the UAE government), some 3.5bn people live within a 4,000 miles radius of Dubai — or a maximum eight–hour flight.

Despite the 100 other airlines that compete at Dubai, Emirates accounted for about 54% of the 22m passengers at the airport in 2005 (Gulf Air was in second place) and 50% of cargo traffic. Crucially for Emirates, Dubai airport is carrying out a $4.5bn terminal expansion over the next few years that will enable the airport to handle 70m passengers a year by 2012 (the same size as Atlanta today), of which approximately half are expected to be Emirates' customers.

Two new concourses are being built, which together will have capacity to receive 23 A380s. Emirates will have exclusive use of these facilities, while all other airlines will have to make do with just two other A380 stands, being built at the existing concourse.

It’s advantages like these that have increasingly made Emirates the target of criticism from rivals such as Qantas and Air France.

For example, in November 2005 Qantas chairman Margaret Jackson said that: "Life must be wonderfully simple when the airline, government and airport interests are all controlled and run by the same people." She added that Emirates benefited from corporate tax exemptions and, since it was owned by the government, the airline had a risk rating that allowed higher levels of debt than commercially owned airlines could enjoy.

Qantas’s attack followed an attempt by Emirates to double the number of weekly flights it operates to Australia, to almost 100.

Emirates' load factors to Australia are apparently in the 80s, and Qantas is particularly worried that Emirates' 90 flights a week between Dubai and the UK will allow the airline to win a large chunk of the lucrative UK–Australia market, connecting via the Dubai hub.

The dispute between the two airlines was stoked further after Maurice Flanagan, Emirates vice chairman and group president (and who built the airline up since launch), responded by saying that Qantas’s statements proved they were "fundamentally against competition ... lately Qantas has tried to stop, at all costs, competition on one of the world’s most protected routes — Australia to the US — and now they want to stop further competition on arguably Australia’s most important routes to greater Europe, the Middle East and Africa".

But while it’s true that Emirates has had no direct financial aid from the Dubai government since $10m of launch funding, some of Qantas’s claims are based on fact, in that Emirates enjoys privileges at Dubai that most of its rivals would love to have at their hub airports.

Landing fees have not been raised at Dubai airport for at least 10 years, and unlike almost all its rivals, Dubai airport does not have any noise restrictions, which allows Emirates' aircraft to operate 14 hours each day.

Importantly, Sheik Ahmed bin Saeed al–Maktoum, the chairman and CEO of Emirates Group, is also head of aviation for Dubai and his nephew, Sheikh Mohammed, the founder of Emirates (and since the start of the year the new Emir of Dubai), led the development of what will become the world’s largest airport when it is completed in 2020 — World Central Jebel Ali Airport City. And then there is the favourable tax regime that Emirates enjoys in Dubai, which saves the airline an estimated $250m a year, according to one analyst.

Emirates' fleet has grown steadily over the last few years, from 38 in early 2002, 69 as at March 2005 and 90 as at the end of March 2006. During last year Emirates received the last of its $2bn worth of 10 A340–500 aircraft, and the overall fleet now has an average age of less than five years (surprisingly the average has been rising steadily for the last two years, although it is younger than most of its rivals).

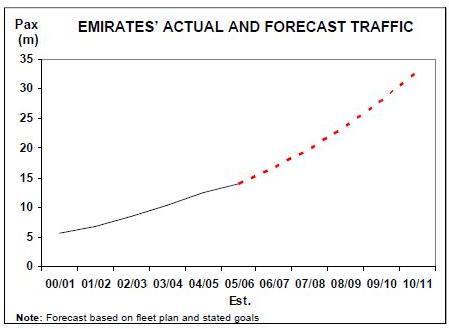

Yet that fleet growth is just the start, for Emirates is targeting a fleet of 150 aircraft by 2010, which will carry 33m passengers in that year. There are now no fewer than 121 aircraft on firm order, and more orders are expected shortly. Among the major fleet developments are:

- In November 2005 Emirates announced the largest ever order for 777s — 42 aircraft (24 777–300ERs, 10 777–200LRs and eight 777Fs) worth $9.7bn at list prices, as well as options for another 20 aircraft. The first aircraft will be delivered in 2007 and enable a whole raft of new routes to be launched, including non–stop services to the west coast of the US.

Emirates already had 28 777–300ERs on order (most of which will be leased — 13 from GECAS and 11 from ILFC), the first of which was delivered in March 2005, with the last due to arrive in October 2007. They are being used to bolster capacity on long–haul routes to the Asia/Pacific region.

- 18 A340–600s are on order, although whether these will be delivered depends on Airbus’s plans to "upgrade" the slow–selling model. The latest indication from Emirates is that these aircraft may be swapped for even more A380s, partly because the traffic growth of some routes originally designated as A340 routes has already turned them into A380 possibilities.

- 45 A380s are on order — 43 passenger variants and two freighters, at a list price of $13bn.

The first aircraft was to be delivered in October 2006 but last summer that date shifted to April 2007, and although Emirates is likely to gain financial compensation from Airbus, the delay has forced the airline to juggle its scheduling and route launches. When they do arrive, the A380s will be used on routes such as to Auckland, which is currently served with A340- 500s and 777–300s. Emirates is also interested in the potential stretched version of the A380 — the 900 — which would seat up to another 100 passengers. If the 900 goes ahead, Emirates would switch some of its 800 orders to the new variant, according to Tim Clark, president of Emirates airline.

- Emirates is expected to make an order for mid–range aircraft soon, and although other aircraft (such as the 777–200LR) were considered, most observers see it as a straight fight between the A350 and the 787. An order for up to 50 aircraft was expected last year, but nothing has materialised yet, and no doubt both Boeing and Airbus are competing hard on discounts.

Additionally, Emirates' cargo operation — SkyCargo — which operates four leased 747- 200s and two leased 747–200Fs, bought three converted A310–300Fs in 2005 and will receive two A380 freighters at the end of the decade, which will be used on high–density cargo routes to North America and the Pacific region. Altogether, Emirates is committed to paying around $37bn at list prices (The actual price paid might be closer to $22bn) for the 121 aircraft on outstanding order, a financial commitment that has some other airlines debating where that money will come from. Emirates counters that is will not have to stretch itself to pay for the new equipment as it has strong cash flow and has never had trouble raising debt when required. As at March 2005, the group’s long–term debt totalled $2.4bn (10% up on March 2004), but cash and cash equivalents stood at $2bn at the same date, 14% up on a year earlier, and cash rose considerably in the six months to the end of September 2005,to $2.6bn.

Emirates is innovative in its external funding — in July 2005 it financed an A340–500 via a $120m 12–year lease with the China Construction Bank Corporation, while last year Emirates also issued the first ever Islamic bond to be launched by an airline (known as a "sukuk"), and the $550m seven–year debt was 50% oversubscribed. The sukuk is being used to finance Emirates' new engineering centre at Dubai airport as well as a new corporate headquarters, both of which will be completed this year. The airline is also in talks with the government- backed Dubai Aerospace Enterprise about financing some of the A380s (and DAE, helpfully, is chaired by Sheik Ahmed).

Altogether, Emirates has raised more than $7bn to expand its operations since the late 1990s, from a variety of sources including commercial debt (28%), European export credits (25%) operating leases (20%, with approximately a third of the fleet currently on operating leases) bonds (13%) and Islamic funding (10%).

Emirates may raise another $500m in 2006 through a bond issue, but the sheer size of the investment needed for equipment (a new aircraft will arrive virtually every month until the end of the century) may be behind the group’s informal assessment last year about a possible IPO.

Capacity push

1 However the new aircraft are funded, Emirates will undergo a substantial increase in capacity over the next five years — approximately 20% pa growth in seat capacity. Eight new destinations are being added through 2006, although a planned route to Copenhagen, scheduled to launch in October 2006, has been postponed. Although regional feeder routes are continuing to be built up (for example, a route to Thiruvananthapuram in India started in February 2006 and to Addis Ababa in March, while a service to Bangalore begins in October), in the long–term the priority for the airline is to grow its long–haul network, whether the fatter A380 routes or the longer range and thinner 777 routes.

Although Emirates code–shares with up to a dozen airlines — including Air India, Continental, JAL, and Thai Airways (with the latest being Korean Air, which started in October 2005) — and in late 2005 began interline e–ticketing with American, it continues to rule out joining a global alliance (in particular resisting informal approaches from Star), claiming that not only can it see no long–term benefit from joining one, but that participation would lead to reduced profitability.

Maurice Flanagan, Emirates group president, encapsulates the strategy: "Dubai is the perfect location for a global hub, especially as we develop our operations to North and South America. We have an Open Skies agreement with the US — including intermediate fifth freedom rights — and we can connect any two points in the world with one stop only, in Dubai.

And our A380s, A340–600s, and Boeing 777- 300ERs will eventually connect sectors of at least 12 to 14 hours each, which takes in from Dubai many of the points we serve, or will serve, in North and South America, Australasia and the Far East."

Indeed passengers handled at Dubai airport are forecast to grow from the current 25m by 10%-15% a year for the next 10 years, with growth split between TOD (tourist oriented directional) and transit traffic. A 12% annual growth rate would result in 78m passengers passing through Dubai in 2015.

A massive building boom is underway in Dubai, with an estimated $100bn of construction projects planned for the next few years.

This will draw in an even greater number of workers from the Indian sub–continent and south Asia, and plans for economic growth may even be accelerated now that Sheikh Mohammed is the new Emir of Dubai after the death of his brother, Sheikh Maktoum, in January.

Some observers, including Aviation Strategy (November 2005 issue) have ques–tioned the scale of the capacity build–up by Emirates and the other Middle East super–connectors. Emirates' projected growth rate is similar to that being achieved by the most successful of the European LCCs, while the operating profit margin has recently been around 12% which is better than any of the LCCs apart from Ryanair. What Emirates is in effect producing is a radical change to the long–haul network airline model.

Although the Middle East market is still the most profitable for Emirates in terms of margin (see table, left), it is the long–haul routes to the Asia/Pacific region, Europe and the Americas that provide almost two–thirds of revenue and more than half of profits. The Asia/Pacific region alone accounts for 28% of revenue, and in 2005 Emirates added capacity on routes to Hong Kong, Bangkok, Sydney and Singapore (on the latter increasing weekly flights to 42 at what is Emirates' gateway to Australia and New Zealand), and launched direct flights to Jakarta and Kuala Lumpur.

Emirates also operates passenger routes to Osaka, Manila, Seoul and Shanghai, while in 2006 a daily Dubai–Beijing service launched in February using A340–300s, and a Dubai–Nagoya route will commence in June, initially with 777–200s before switching to A340–500s.

Another target for expansion is North America. In November 2005 Emirates doubled frequency on its Dubai–New York service (to two flights a day), which is believed to be one of its most profitable routes. A planned route to San Francisco was postponed after rising fuel prices, but this is back on the agenda for 2006, as is Los Angeles and Houston.

Also in February 2006 a route started to Abidjan in Cote d'Ivoire, increasing Emirates' African network to 12 destinations.

The future

According to Sheikh Ahmed, Emirates group chairman, the airline is set to return to a high rate of profit growth this financial year (2006/07), with an increase of 13% being targeted. However, "High fuel prices remain the single largest threat to Emirates' achievements of its financial goals." In 2005 the airline implemented a series of cost cutting measures, such as a freeze on recruitment other than pilot, cabin and engineering crew, and also introduced a fuel surcharge. Against the jet kerosene impact, however, there is the economic benefit of the influx of petro–dollars into the UAE.

Crucial to Emirates' future success is the reaction of competitors to the planned increases in capacity. Most airlines will not be prepared to allow Emirates to dominate long–haul sectors, and Virgin Atlantic, for example, launched a service to Dubai from London Heathrow in March (to become a daily service in June), with a 12% market share target on the route. At the other end of the globe, the immediate strategy of the Australasian airlines appears to be to encourage governments to block unrestricted access by Emirates to their markets while at the same time encouraging transpacific tourists to stop over at Australia and New Zealand, rather than fly quickly on to Dubai. SIA is perhaps best able to resist Emirates through a reliance on feed into Changi from south–east Asia — a market that Emirates cannot directly tap into.

Emirates currently appears to be the price leader in all the main markets that it competes in , and the A380 will add a new dimension, with suggested fares of €400 for a return UKAustralia flight on Emirates. In a straight fight between Emirates A380 and BA’s 747s, for example, the lower unit costs (14% claimed at Direct Operating Cost level) plus Emirates'other cost advantages, will mean that BA will have to think very carefully about just how much it may be willing to cut fares.

Lufthansa faces another problem in that Emirates is targeting cities like Hamburg and Düsseldorf, offering direct service to the Middle East and, of course, connecting service to Asia, without connecting at Frankfurt or Munich, which is necessary on Lufthansa’s network.

Emirates has floated the possibility of a long–haul LCC, presumably with 550–plus economy seats. Tim Clark, president of Emirates airline since 2003, first raised the idea back in 2004, and last November he said that Emirates had been analysing the launch of a long–haul LCC based on A380 equipment.

It had even gone so far as to have a working name for the concept — Emirates Express — although Clark also said the project had now been set aside for the immediate future.

Segmenting its traffic into separate airlines (about 20% of Emirates' traffic is in premium classes) would be difficult and could well have unforeseen cannibalisation effects. It is also possible that the entire suggestion was intended to cause more consternation among competitors. Given its aggressive aircraft investment programme, it has become very unlikely that Emirates will be tempted to invest in airlines.

Emirates bought a 44% stake in SriLankan Airlines in 1998, but this does not appear to have provided a financial return nor any strategic benefit.

Perhaps the greatest threat of all to Emirates comes from closer to home — from the other airlines emerging in the Middle East, and specifically in the UAE. There is growing trade and tourism within and to the Middle East and the Indian sub–continent, and a frenzy of new hotel construction in Dubai over the next few years anticipates a rise in both leisure and business travellers to the area.

That means a growing challenge from others, including Etihad Airways and Qatar Airways, the latter of which has ordered two A380s and which will make use of the $5.5bn investment in the New Doha International airport. And then there is the new airport at Jebel Ali itself, which with six runways will handle up to 145m passengers a year when it is completed (with the first runway on target to be operational in the first quarter of 2007), and will presumably attract plenty of competition for Emirates if it is to be commercially successful.

| Emirates Fleet | Emirates orders (options) |

|

| 747-400F | 6 | |

| 767-300ER | ||

| 777-200 | 3 | |

| 777-200ER | 6 | |

| 777-200LR | 10 | |

| 777-300 | 12 | |

| 777-300ER | 12 | 40(20) |

| 777F | 8 | |

| A300-600F | ||

| A310-300 | 1 | |

| A310-300F | 3 | |

| A330-200 | 29 | |

| A340-300 | 8 | |

| A340-500 | 10 | |

| A340-600 | 18 | |

| A380-800 | 45 | |

| Total | 90 | 121(20) |

| A310-300FA330-200A340-300A340-500A340-600A380-800 Total |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| A310-300 | 1 | |||||||

| A330-200 | 29 | 29 | 27 | 24 | 20 | 13 | 4 | 1 |

| A340-300 | 8 | 8 | 8 | 8 | 8 | 8 | 8 | 8 |

| A340-500 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 |

| A340-600 | 8 | 12 | 12 | 12 | 12 | 12 | 12 | |

| A380-800 | 9 | 14 | 21 | 34 | 43 | 43 | 43 | |

| 777-200 | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| 777-200ER | 6 | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| 777-300 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 |

| 777-300ER | 23 | 31 | 37 | 43 | 44 | 46 | 51 | 54 |

| 777-200LR | 3 | 9 | 10 | 10 | 10 | 10 | 10 | |

| A310-300 F | 3 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| A380-800 F | 2 | 2 | 2 | 2 | 2 | |||

| 747-400 F | 5 | 5 | 5 | 4 | 3 | 3 | 3 | 3 |

| 747-400ER F | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 747-200 F | 1 | 1 | 1 | |||||

| 777-200LR F | 1 | 6 | 8 | 8 | 8 | 8 | ||

| Total | 101 | 129 | 149 | 165 | 176 | 180 | 176 | 176 |

| Revenue | Operating profit | |

| Middle East | 16.4% | 25.7% |

| Europe & Americas | 36.7% | 33.6% |

| Far East/Australasia | 27.8% | 21.3% |

| W. Asia & Indian sub-continent | 9.7% | 9.4% |

| Africa | 9.4% | 10.0% |

| 100% | 100% |