Iberia - the Air France story repeated?

April 2001

Iberia is the latest European carrier to be fully privatised. It hopes to emulate the performance of Air France by transforming itself from an inefficient, state–supported flag–carrier to a commercially successful airline with an important role in a global alliance.

The Spanish state holding company, SEPI, is selling its 53.9% stake in the airline to both institutional and private investors. The remaining 46.1% of the airline was sold in March 2000 to a group of core shareholders — British Airways (9%), American Airlines (1%), the employees (6%) with the remaining 30.1% being held by a number of large Spanish companies.

The pricing of the issue was subject to much press, commercial and political debate. The initial price range of between €1.71 to € 2.14 per share would have valued Iberia at between € 1.56bn and € 1.95 bn ($1.39bn to $1.74bn). Although the local retail demand (private investors) appeared adequate, with indications of a 1.5 times over–subscription, institutions were highly critical of what they perceived to be overpricing of the issue. So at the beginning of April the price was lowered to € 1.19, capitalising the airline at € 1.1bn, at which price the issue was three times over–subscribed by the institutions.

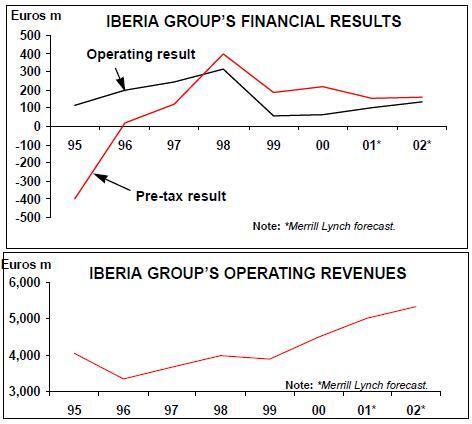

For potential investors, the main sales message was Iberia’s potential for above average growth and the management’s ability to continue to deliver profits post the airlines' dramatic financial turnaround. At a Merrill Lynch conference in March, Enrique Dupuy de Lome Chavarri, Iberia’s Finance Director, held out the potential for double digit EBITDA growth in the next two years. Although Iberia is the sixth largest European carrier, it is firmly in the second rank of European airlines behind the big three — British Airways, Lufthansa and Air France. It is smaller than KLM and Alitalia in RPK terms, but ahead of Swissair, Virgin Atlantic and SAS.

Iberia’s specialist role has always been as being the main carrier from Europe to the South American market. Unfortunately, the pace of economic development of South America has been disappointing, as the major countries, Brazil and Argentina, continue fail to fulfil their immense potential. However, Iberia has been increasing its share of the Europe–South America market and now holds a top–ranked 15% market share, some five points ahead of Air France and British Airways.

IATA predicts that the Spanish scheduled market will be the fastest growing of the major global air travel markets between 2000 and 2004. Its forecasts show the Spanish international scheduled passenger market growing at 6.5% p.a. for the period 2000–2004 and the Spanish domestic market by 10.2% p.a. over the same period. One reason is that Spain remains well below the European average in terms of airline passenger journeys per head of population at just over one journey versus an European average of over 1.5 journeys per head. Like Air France, Iberia growth in the 1990’s was stifled by poor financial health and by restraints placed upon the carrier by the European Commission. Again like Air France, this holds out the prospect of Iberia achieving above average traffic growth rates through re–gaining "natural" market share. Also, just as Air France has benefited hugely from its uncongested hub at CDG, Iberia enjoys has more or less unfettered growth potential at its Madrid and Barcelona hubs.

Madrid–Barajas has permission to double its existing two runways to four by 2004, and airbridges are set to increase from 40 today to 97. Iberia operates a five–wave system at Madrid but connecting traffic is hampered by the fact the airline operates from three separate terminals. By 2004 Iberia and its oneworld partners will be housed in a single new terminal.

At Barcelona Iberia operates a three–wave system. By 2004, Barcelona will have added a third runway and double the number of available airbridges to 48. A new terminal is scheduled to open in 2005.

Like Air France, Iberia proved slow to adapt to the liberalised regulatory environment and needed to be rescued through government state aid injections which totalled € 1.4bn since 1992. The EC took a close interest in the affairs of Iberia when the airline returned for a second round of state aid in 1994, with some lame excuses about "exceptional circumstances". The conditions imposed by the EC forced Iberia to tackle fundamental problems. Under new management headed by ex–General Electric executive Xabier de Irala, excessive costs were attacked; during the period 1994 to 1996 Iberia shed 15% of its staff, and salaries were frozen.

The EC also required Iberia to sell its Latin America investments, which had proved to be a disastrous cash drain on the carrier without providing any significant market benefits. Its stake in Aerolineas Argentinas has been reduced from 83% to 0.35% and has been fully provisioned; the 38% stake in Ladeco was sold in 1998; and Viasa, in which Iberia held a 45% stake, went bankrupt in 1997.

Iberia enjoys a 70% share of the Spanish domestic market, the second largest domestic market in Europe (behind France). With a recorded growth rate of 13% in the year 2000, the Iberia management expects that future domestic growth rates could continue to be double digit, and that the Spanish market will in turn overtake the French market. The former domestic carrier,Aviaco, was consolidated into the Iberia Group some years ago (Iberia bought the 67% of Aviaco it did not already own from SEPI in 1998 for €234m), and Iberia also owns two regional carriers, Binter Canarias and Binter Mediterraneo. Its franchise agreement with Air Nostrum extends Iberia’s control over the domestic market, but its recent attempt to buy the second largest carrier, Air Europa, has failed.

The Air Europa/Iberia negotiations apparently foundered for two reasons. First, as part of the deal Air Europa chairman Juan Hidalgo would have received 10% of Iberia which other shareholders objected to. Second, Iberia’s pilots were concerned about the impact of incorporating Air Europa personnel.

Iberia presently enjoys a lower cost base than its scheduled northern European rivals rivals thanks largely to its lower labour costs. Iberia’s financial traumas in the first half of the 1990s ensured that employees were forced to accept almost draconian terms to keep the company afloat. Perhaps the greatest challenge facing management is to ensure that future wage agreements do not undermine the progress made. It should also be remembered that international traffic flows to Spain are dominated by UK and German charters (about 80% of the total) whose unit costs Iberia cannot hope to match.

There is potential for the airline to improve productivity. Average aircraft utilisation is presently a somewhat pedestrian 7.6 block hours per day, and the management have targeted an 18% increase to 9 block hours per day. Pilots have also undertaken to fly 20% more block hours per month.

Iberia is also looking to the Internet to reduce distribution costs. Currently 1.5% of passenger revenues are derived from the Internet. The target set by management is to achieve direct ticket sales of between 28% by 2003, 7% through Iberia.com and 21%through virtual travel agencies.

Competitive threats

The Spanish market is being targeted by the fast growing low cost airline sector. Both Go and easyJet serve Spanish destinations from the UK and Switzerland. So far perhaps Europe’s most aggressive low cost competitor, Ryanair, has avoided the Spanish market probably because it has been unable to complete any airport deals in the country. Spain’s airports are almost exclusively controlled by publicly owned AENA, and so far it is not willing to break its strict pricing policy.

A high–speed rail link is set to open between Madrid and Barcelona in 2004. This route today accounts for 25% of total domestic passengers in Spain (5m passengers in 1999) and has strong business element (42% of the total), which accounts for yields on the route being 28% ahead of the domestic average. Iberia operates a shuttle service on the route and enjoys a 78% market share. It is Iberia’s belief that when the rail service opens it may lose 20% of its market share on the route.

Iberia is the only carrier with a concession to operate handling services at all 37 of Spain’s major commercial airports. The introduction of competition in the market, following EC directives, has reduced Iberia’s share of third party ground handling to 65%. In March 2000, 15 of Iberia’s sole handling concessions were opened up to competitive tender, with Ineuropa and Eurohandling providing the prime competition.

Alliance silence

It is interesting that the sales message being pushed the airline’s management and by the investment bankers which are in charge of the privatisation process places little emphasis on the alliance front. In March 2000, British Airways acquired a 9% stake in Iberia and American Airlines a 1% stake which secured Iberia’s position in the oneworld alliance, which it joined in September 1999.

Iberia estimates that the incremental feed generated from its oneworld alliance partners (it is assumed mostly BA and American) is some Euro € 120m in annualised revenue benefits, which amounts to 3.3% of total passenger revenues in 2000. A potential re–launch of oneworld this year, with closer co–operation between BA and American, should generate more revenue in the future for Iberia.

BA and American were able to negotiate a very prudent deal with Sepi when they acquired their respective stakes in Iberia. Although they bought into Iberia at Euro 3.50 per share it was agreed that this price would be reduced to match the price upon flotation.

Both carriers therefore look set to receive a substantial rebate on the consideration they paid to Sepi in March and December 2000. BA’s rebate is estimated to be in the order of €100m.

Future strategy

Management is focussed on trying to increase average yield through network and product developments. Passenger yields at Iberia are perceived to be below European averages (adjusted for stage length). For example, Alitalia, which has a similar aver–age stage length to Iberia, enjoys average passenger yields that are 6.3% above Iberia’s.

At present only 14% of Iberia’s intra- European traffic is premium, a proportion which Iberia hopes to improve through the introduction of "variable geometry" seating in new aircraft which will permits a 25% increase in business capacity. On Iberia’s long–haul routes, only 9.3% of its passengers fly in business class cabin versus an estimated European carrier average of 13%. A target of a 3.6% improvement in nominal unit revenues has been set for 2003 versus the year 2000.

Future capacity growth will be aimed at re–capturing and improving market share in the Spain–Europe markets, and consolidating its number one position in the E u r o p e — L a t i n America markets and the Spanish domestic market.

Merrill Lynch estimates show Iberia increasing capacity (ASKs) by 10.2% in 2001, 7% in 2002 and a further 7% in 2003. The plan is to increase frequency rather than establishing new routes, again with the aim of improving the attractiveness of the network to the business traveller.

The impact of the fleet renewal programme will see the average age of the fleet fall from the current 9.1 years to 7 years by 2003. In addition significant cost savings are expected from a reduction in the number of types from nine to six.

The fleet plan has some in–built flexibility, which will be a source of comfort for investors given the uncertainty of the economic and traffic outlook. A combination of the non–exercise of options, the non–renewal of operating leases and the termination of contracts of aircraft which are expected to be wet leased during the period would see a 2003 year end fleet of 152 aircraft, 16% less than the current plan.

| Euros m | 2000 | 2001* | 2002* | 2003* |

| Group revenues | 4,489 | 5,010 | 5,344 | 5,652 |

| Group op. profit | 66 | 103 | 137 | 165 |

| Operating margin | 1.5% | 2.1% | 2.6% | 2.9% |

| Pre-tax profit | 221 | 155 | 162 | 190 |

| Pre-tax profit margin | 4.9% | 3.1% | 3.0% | 3.4% |

| Domestic European Long- Network | ||||

| Destinations | haul | total | ||

| 34 | 41 | 26 | 101 | |

| Average daily frequency | 296 | 144 | 24 | 464 |

| Daily frequency increase | 20 | 42 | 4 | 66 |

| % increase in frequency | 6.8% | 29.2% | 16.7% | 14.2% |

| Forecast revenue mix 2003 | 34.5% | 32.2% | 33.3% | 100.0% |

| 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | |

|---|---|---|---|---|---|---|---|

| Long-haul | |||||||

| 747 | 9 | 9 | 10 | 9 | 9 | 7 | 4 |

| 767-300 | 2 | 2 | 2 | 2 | 2 | ||

| 340-600 | 8 | 9 | 12 | 15 | 18 | 19 | 20 |

| 350-400 seater | 4 | 7 | |||||

| DC-10 | 4 | 6 | |||||

| Short-haul | |||||||

| A300 | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| 767 | 8 | 15 | 18 | 18 | 16 | 16 | 12 |

| 727 | 28 | 26 | 12 | 2 | |||

| A321 | 2 | 4 | 9 | 11 | 18 | ||

| A320 | 22 | 32 | 43 | 53 | 64 | 68 | 70 |

| A319 | 4 | 4 | 4 | 4 | 4 | ||

| MD88 | 13 | 13 | 13 | 13 | 13 | 13 | 13 |

| MD87 | 24 | 24 | 24 | 24 | 24 | 24 | 24 |

| DC-9 | 25 | 16 | 7 | ||||

| 757 | 6 | 6 | 6 | 6 | 6 | 8 | 8 |

| TOTAL | 155 | 164 | 159 | 155 | 173 | 180 | 186 |