Recession time?

April 2001

Suddenly a global recession threatens. In the US consumer confidence seems to have evaporated with the collapse in the price of new technology companies on the NASDAQ. Europe with less exposure to the stock markets is mostly unaffected as yet, but Asian economies, having recovered strongly from their regional crisis, are starting to look wobbly again.

While the portents are ominous, it shouldn’t be assumed that a recession is inevitable. The economic fundamentals remain sound — the OECD forecast produced at the end of last year predicted 2- 3% real GDP growth for most in the developed economies including the US — and the bursting of the e–commerce financial bubble should have come as no surprise. With inflation still well under control, the US Fed has the opportunity of boosting the economy with another half–point cut in interest rates. The Japanese, meanwhile, are desperately trying to kick–start their economy by cutting interest rates to zero.

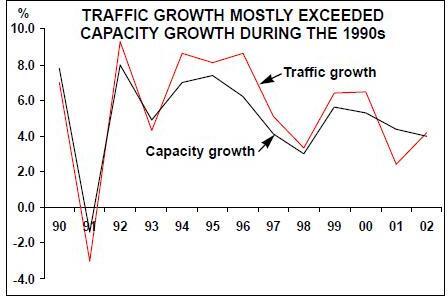

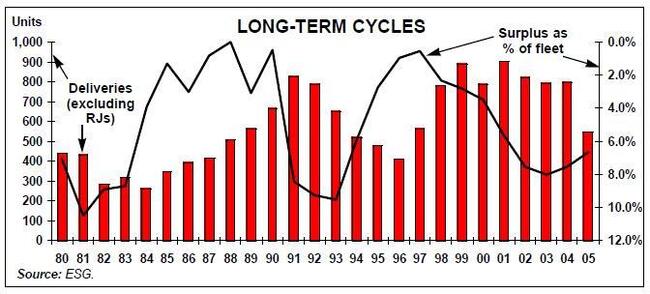

However, assuming that some form of recession reduced global traffic growth to 2.4% this year and 4.2% next year (compared to around 6.5% in the past two years) then a serious surplus in the aircraft market emerges. This is illustrated by the graph on the next page, which is based on calculation made by ESG.

As usual the traffic slowdown coincides with a period of peak deliveries (and we have excluded the 400/year RJ deliveries from the chart). The result is that the aircraft surplus (defined as the difference between jet supply and the number of jets required at optimal utilisation) leaps from about 540 last year to 930 this year and to over 1,300 in 2002. In relative terms the surplus will peak at about 7–8% of supply compared to 10% in the early 90s.

This suggests a softer airline recession compared to the collapse of the early 90s. There are other important differences as well. First of all, there is an obvious way to dissipate the surplus this time round — through the scrapping or sale to the Third World of the remaining non noise- compliant 727s and 737s; nearly 500 of these types are currently available for sale or lease.

Generally, the major airlines have become much more adept at managing capacity over the past decade through conservative fleet addition strategies, downsizing, rightsizing and greater reliance on operating leases. The key to survival in this recession may come down to what proportion of an airline’s costs are fixed and what proportion are variable.

The leasing companies were blamed, probably justifiably, for contributing to the extent of the supply demand imbalance and artificially inflating asset values. This time they are being seen in a more positive light, as providing a means of smoothing the cycle by facilitating the movement of aircraft between regions in line with demand fluctuations.

Lessors have two ways of looking at the impending recession.

On the one hand, in a recession the credit ratings of airlines tend to fall markedly while those of the leasing companies, backed by financial giants like Gecas and AIG, remain solid, so improving the attractiveness of their product.

On the other, they will have to deal with slumping asset values and distressed clients. They may be forced into running airline operations (Awas, for example, has its own AOC).

A recession will be the acid test for two contrasting and currently relatively successful strategies — rapid expansion of capacity and traffic around a hub system à la Air France and downsizing, total business focus à la BA. Early indications from the US are of a clear downturn in business travel, in terms of business class seats sold and also in terms in business volumes as teleconferencing and other e–communications become more sophisticated.

Although e–commerce financing may have precipitated this recession, the full impact of e–distribution on the airline business has yet to be felt. Greater use of the internet will help keep selling costs down, saving which are likely to be passed onto the passenger via lower fares, which should hopefully boost traffic volumes. Orbitz now due for launch in June could be a major break–through, representing a shift in e–distribution from its DOS phase to its Windows phase, according to its owners. (Its detractors say it’s nothing but a conspiracy of the US majors.)

In Europe and the US, a recession will afford the low–cost carriers the opportunity to gain market share from their full–service rivals, both because of their cost advantage and because of the greater price–sensitivity of passengers. Unless, of course, the low cost carrier has the wrong strategy or weak financing, in which case it will go bankrupt.

Bankruptcy is a real prospect for a disturbing number of European and Asian flag carriers in a recession. Governments again will face the invidious choice of bailing them out or facing the social and political consequences. However gruesome the prospect, the EC will have to re–open some of its state aid files.