LanChile: fast reaction to crisis restores investor confidence

April 2000

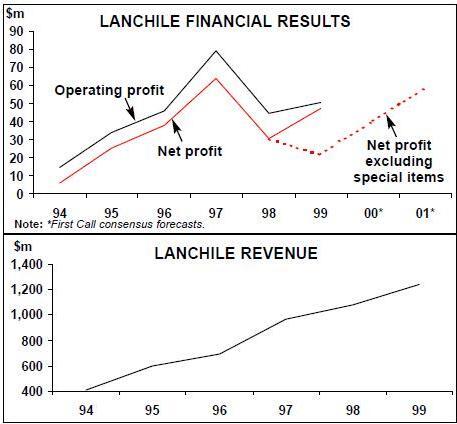

Since its successful IPO in November 1997, LanChile has brought only grief to its initial US investors. Its net earnings have plummeted from $64.1m in 1997 to $21.8m (excluding special gains) last year. And its share price, after virtually collapsing in 1998, is still some 40% below the IPO offer price of $14.

Investors had welcomed the opportunity to buy into the first Latin American carrier to be listed on the New York Stock Exchange and one that was clearly among the region’s most promising operators. Lan’s net earnings had increased strongly and steadily, despite 40% annual capacity growth in the mid–1990s. It had a strong balance sheet, streamlined fleet, favourable labour contracts, low unit costs and high efficiency. Smart management strategies had helped secure strong positions in different market segments. A new marketing alliance with American looked set to ensure success in the important Chile–US market.

However, investors should take heart as the past two years' problems have stemmed entirely from external factors. First, the Asian crisis in late 1997 precipitated economic problems throughout Latin America. Chile, which had been recording 7% annual GDP growth, plunged into economic recession in late 1998. Conditions worsened last year and Chile is still struggling to find the momentum to pull out of recession.

The timing of the IPO was unfortunate in that the Asian crisis happened about halfway through the LanChile roadshow. Instead of postponing the offering, Merrill Lynch, the leading underwriters, decided to go ahead under a revised pricing and marketing strategy.

The other new problem faced by LanChile in 1998 was sharply increased competition on US–Chile routes. In particular, Continental’s entry to the New York- Miami–Santiago market with significantly lower fares had a devastating impact on yields in one of LanChile’s most important markets.

In fact, the Chilean carrier should be commended for containing the crisis so well. A 2% net margin is no mean feat in such a challenging economic and competitive climate, when also fuel prices are at an extraordinarily high level.

Lan’s ability to cope reflects two special attributes — flexibility and the ability to react quickly. For example, in 1998 the airline was quick to slash domestic capacity by 15% and to diversify into new profitable international markets.

The full integration of its passenger and cargo businesses has given LanChile flexibility to adjust to market conditions. In 1998, when passenger demand weakened but the cargo market remained strong, the airline swapped one of its passenger aircraft orders for a freighter. Last year, when the passenger yield fell by 10% and passenger revenues inched up by just 1.9%, cargo revenues rescued the situation with 35.5% growth.

Thus virtually all of Lan’s 14% total revenue growth in 1999 came from cargo. This was possible because of new cargo routes and higher cargo yields, reflecting a fuel surcharge introduced in October and increased presence in high–yield markets.

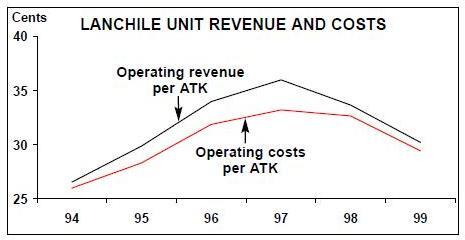

Despite a 22% surge in fuel expenses last year, operating costs per ATK fell by 9.7%. This was attributed to general cost controls, as well as savings derived from a closer integration of Ladeco and Fast Air Carrier. The two subsidiaries were formally merged in 1998, eliminating duplicate functions and creating additional operating synergies and tax benefits.

As competition intensified in 1998, LanChile invested $30m to upgrade its product and corporate image. This included new seats and entertainment systems, a new logo, refurbished aircraft interiors, improved catering and an upgraded FFP. The airline has continued to rank high in international passenger surveys and has either improved or maintained its market shares in all of its geographic regions.

Last year’s important investments for the future included the launch of 49%-owned subsidiary LanPeru (an $1.8m loss related to start–up costs was recorded in the fourth quarter). Lan also signed a joint venture agreement with Lufthansa to create a world–class flight training centre in Chile.

Much of this has to be credited to a strong management team, which consists of professionals of many nationalities and is led by Enrique Cueto as CEO. Cueto, who headed Fast Air for 12 years before his family acquired a controlling stake in LanChile in 1994, was last year voted the most admired head of a Latin American airline in a survey conducted by a US research firm.

Of course, Lan was a well–administered and soundly structured state–owned company in the first place. One of the biggest handicaps suffered by many of its regional counterparts is that their privatisations were botched affairs, leaving them with unacceptably high levels of debt. In Lan’s case the sale proceeds were used to strengthen its already healthy balance sheet. It got its first private–sector owners in 1989, when the government sold a 51% stake to a consortium that included SAS. The sale of the government’s remaining holding and the SAS stake to the Cueto Group completed the privatisation in 1994.

Since the IPO, LanChile’s strong financial profile has been reflected in its credit ratings. In 1998 Duff & Phelps gave it investment grade BBB ratings. These were reaffirmed only a few months ago, when DCR specifically noted the company’s "ability to manage difficult economic conditions and leverage its own capital resources in order to strengthen its competitive position in Latin America". The investment grade ratings have given Lan access to lower–cost financing and more flexibility in terms of financing sources. This and the $70m IPO proceeds, the $60m raised through the securitisation of credit card receivables last year and continued profits have enabled Lan to finance a major capital expenditure programme over the past two years.

Its balance sheet remains relatively strong, with total assets of $971m, long–term liabilities of $467.4m and shareholders' equity of $261.3m at the end of 1999. Both assets and long–term debt have increased substantially over the past three years due to the outright purchase of five new 767- 300ERs.

Nevertheless, the two recent rallies in LanChile’s share price — in the second quarter of 1999 and at year–end — are just as difficult to explain as the collapse of the price from $14 to $3-$4 within six months of the IPO. For the past year, Chile’s recession has probably been at or near its bottom, while fuel prices are now a major concern for a carrier that has hedged only a small percentage of its fuel requirements. Most analysts now rate it as a "hold" (given the recent escalation of its share price).

While analysts continue to be bullish about LanChile’s longer–term prospects, rating it as a "long–term buy", the range in earnings forecasts is rather wide. This reflects uncertainty about fuel prices and the timing and strength of Chile’s economic recovery. The First Call consensus estimate is a net profit somewhere between $32m and $49m for 2000 and $49m-$70m for 2001.

Diversified revenue base

A recent report from Merrill Lynch listed four main positives. First, Lan will benefit from Chile’s and the region’s economic recovery. Second, the code–share deal with American will boost traffic. Third, capacity reductions stemming from leased aircraft contract expirations will boost load factors. Fourth, cargo operations will continue to substantially benefit the carrier. One of LanChile’s greatest strengths is its highly diversified business, both in terms of route areas and market segments. In 1998 (the latest year for which a breakdown is available), 46% of its operating revenues came from Chile–US routes, 23% from domestic operations, 15% from the rest of South America, 14% from Europe and 3% from the Pacific.

The 1997 acquisition of Ladeco gave the two carriers a combined 74% domestic market share, which has been maintained. While Lan has long dominated the Southern Cone, its market share between Chile and the rest of Latin America was a healthy 59% in 1998. On the highly competitive US routes, Lan slightly improved its market share to 44%.

Freight accounted for 38.4% of operating revenues last year, up from 31.6% in 1998. The unusual strategy of integrating passenger and cargo dates back to the 1994 arrival of the new CEO with extensive cargo experience. Cueto had built Fast Air from scratch into a major regional force before others realised the potential value of cargo. Consequently, the LanChile/Fast Air combine now dominates the region’s booming cargo market and has a large lead over the nearest competitor.

The airline recently launched Houston as its fourth US cargo gateway (the others are Miami, New York and Los Angeles), carrying mainly perishables northbound and high–tech goods southbound. Its worldwide cargo headquarters are in Miami, where it is building a new $52m cargo facility due to open later this year.

Flexible fleet strategy

The new management’s initial priority was to streamline the fleet (from six aircraft types in the early 1990s to just three by 1997) and to expand and modernise the long haul fleet. The fleet is now standardised on the 767–300ERs/freighters on long haul routes and the 737–200s in short haul markets, while the DC8–71Fs operated by LanChile and Fast Air are in the process of being phased out.

The past two years have seen the addition of three more 767–300ER passenger aircraft, which Lan has long favoured especially for their capacity to carry both passengers and cargo, and two new 767–300 freighters. The third and final 767 freighter is due to arrive in August.

In early 1998 the airline decided to switch to the Airbus A320 family to replace its 737- 200 short haul fleet over the next five years, with deliveries beginning in the fourth quarter of this year. The $840m firm order for the initial 20 aircraft was part of the famous $4bn joint purchase negotiated with TACA and TAM, which gave the small operators the sort of prices and flexibility usually only enjoyed by the largest carriers. LanChile especially valued the flexibility with regard to aircraft types and delivery dates.

As part of its plans to modernise the long haul fleet, in August 1999 LanChile placed an $800m firm order for seven A340–300s, which it will take on operating lease beginning in the third quarter. The type enjoys commonality benefits with the A320s, is ideal for ultra long flights over the Pacific and will facilitate a major upgrade in product and service quality on European and US routes.

Global alliance prospects

These orders indicate that LanChile’s capital needs over the next few years will be substantial (even when taking into account that some of the aircraft will be leased). However, risk has been minimised by securing flexible purchase contracts, which will come in handy if Chile’s economic recession continues. LanChile and American had a frustrating two–year wait before being able to start properly implementing the code–share alliance signed in September 1997. But they were able to link their FFPs in April 1998, which has no doubt helped Lan retain market share in the face of new competition from Continental and Delta. And Chile limited the damage by making the open skies deal with the US contingent on the DoT granting antitrust immunity for the Lan/American alliance.

While waiting for the final regulatory approvals, LanChile began code–sharing with American’s partner Canadian, as well as oneworld member Qantas, in 1998. It has also significantly expanded its own services from the US West Coast and recently signed a code–share agreement with Alaska to extend its reach in that region.

The first phase of code–sharing with American began in October, covering both carriers' Santiago–Miami services. This was followed by the formal signing of the Chile- US open skies ASA. The second phase in November saw the addition of American’s flights from six or so other major gateways, and the third and final phase is expected to be completed during the first half of this year. LanChile believes that the code–sharing should begin to have "material impact" on passenger traffic by the end of 2000. However, perhaps the biggest potential benefit is that the deal has paved the way for Lan to join the oneworld alliance later this year.

Continued regional emphasis

The invitation to join was a recognition of LanChile’s quality and potential as a world–class carrier. It will have the prestigious role of being oneworld’s sole representative of South America. In preparation, it recently signed a contract with Amadeus to obtain the reservations and distribution capabilities that will make its systems easier to integrate into those of other oneworld members. The imminent oneworld membership seems to have made LanChile more determined than ever to consolidate and further strengthen its position within the Southern Cone (Chile, Peru and Argentina) and elsewhere in Latin America.

In the first place, this has meant cooperative deals with other Latin American operators. Codesharing with Aeromexico, Mexicana and Brazil’s TAM began in 1998. This was followed by code–sharing with Varig last year on Santiago–Brazil routes and on Brazil–Japan services routed via Lima and Los Angeles. (Varig, of course, is a member of the Star alliance, but the cooperation may be route–specific enough to survive.)

LanChile has been on the forefront of pressing for liberalisation and open skies ASAs in the region, as it believes it can only benefit from more opportunities to compete. Within the all–important Southern Cone, it is pleased with the way things are working out in Peru but is having problems in Argentina.

A new liberal agreement between Chile and Peru two years ago facilitated a substantial increase in Santiago–Lima flights and enabled LanChile to serve New York and Los Angeles from Lima. It was able to get a foothold in a market that offered significant potential for tourism and business travel growth.

LanChile subsequently decided to consolidate its presence there by teaming up with Peruvian partners to launch LanPeru. After a long wait while the Peruvian government tried to sort out flag carrier AeroPeru’s fate, the new venture finally took off in July on two domestic routes with 737–200s leased from LanChile.

In November LanPeru entered the lucrative Lima–Miami market with a daily service utilising a 767–300 wet–leased from LanChile, and it hopes to get more international routes when the government starts reallocating more of AeroPeru’s licences. This month (April) it plans to add its third domestic city.

LanPeru has reportedly secured 30–40% initial market shares on its three routes, which sounds very promising as it faces intense competition from the US majors on the Miami route and other new entrants and established operators domestically.

Speculation is now mounting that LanPeru might provide the blueprint for similar ventures elsewhere in Latin America. According to the March issue of AvNews, sources in Santiago say that LanChile has "filed in a number of countries" to replicate LanPeru and that it has initiated paperwork to create "LAN Argentina".

Over the past year, LanChile has been frequently mentioned as a potential investor in Aerolineas Argentinas. Both are American’s code–share partners and Argentina is a very important market for Lan. Last summer the two forged a cargo cooperation agreement which envisaged Lan purchasing cargo space on all of Aerolineas' flights.

But Aerolineas' owners have put the deal on hold while the carrier is being restructured. According to AvNews, Aerolineas' board has also vetoed any equity injection by Lan. There are concerns about market domination and about the failure to agree on an open skies regime. Also, Argentina has suspended its liberal foreign ownership rules in an apparent effort to keep unwanted foreign investors at bay. However, as AvNews points out, LanChile only needs to find like–minded Argentine investors, prepared to participate to the tune of 51%, to go forward with LAN Argentina.

| LANCHILE FLEET PLANS | |||

| Current | Orders Remarks | ||

| fleet | (options) | ||

| 737-200* | 25 | 0 | To be replaced by A320 family |

| 767-300EREM | 13 | 0 | |

| 767-300ERF | 0 | 1 | |

| 767-300F | 2 | 0 | |

| DC8-71 | 3 | 0 | Being phased out |

| A319 | 0 | 11 (9) | First 4 in 4Q 2000 |

| A320 | 0 | 11 (9) | |

| A340 | 0 | 7 (7) | Deliveries in 3Q 2000 |

| Total | 43 | 30 (25) | |

| Source: ACAS. | * Includes 10 Ladeco 737-200s | ||