Leasing out the Asian surplus

April 1998

The aircraft market is in a curious state of imbalance, with excess supply in Asia and very tight demand conditions in Europe and North America. How will this situation be resolved?

Deferral of deliveries for 1998 and 1999 is apparently very difficult, and production slot swap negotiations — such as those between MAS and Delta — do not seem to be productive. The attitude of the manufacturers is nonchalant; Airbus and Boeing give the impression that the current Asian crisis is a minor blip on a long–term upward curve.

Most Asian carriers have announced plans for selling aircraft. Some airlines — MAS and Asiana for example — may be willing to sell their entire fleets. Thai International intends to convert its additional committed aircraft deliveries in 1998 to operating leases, and dispose of at least 17 aircraft. Cathay Pacific is attempting to sell its 747–200 fleet.

Yet anecdotal evidence suggests that the Asian carriers, confronted by a wholly new situation, are not moving fast enough in disposing of their assets. And any delay means a further decline in their asset values, and a dent in cash flow.

A further complication for Asian airlines is that stock–market analysts have started to factor in fleet values in their assessments of underlying value of airline shares. Peter Tang of Jardine Fleming in Hong Kong, for example, argues that because earnings forecasts have become so impossible to calculate, much more attention has to be paid to balance sheet ratios. Hence the adjusted net asset value (75% of the theoretical second hand value of the fleet plus investments minus net debt) of Cathay Pacific works out at HK$7.30 a share as at mid–March compared with the actual price of HK$6.50.

For the leasing business, however, the Asian crisis presents an opportunity. It may be possible to purchase aircraft en masse from Asian carriers at prices which reflect the distressed conditions of those carriers and then lease them out to Western airlines at close to peak rates. Or they could be leased back to the Asian carriers whose main concern at the moment is probably to secure an injection of dollars.

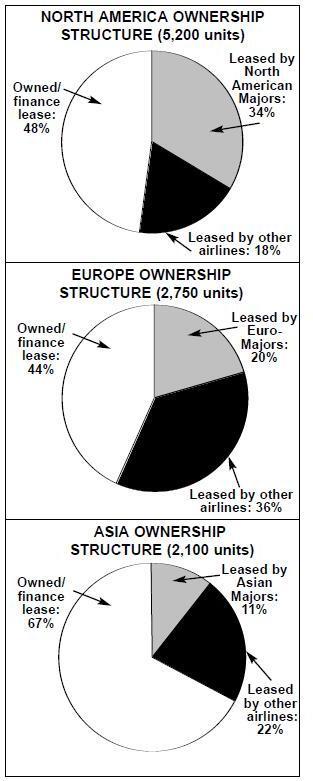

The pie charts on page 3 represent Aviation Strategy’s estimate of the ownership/ leasing structure of commercial aircraft fleets in the three main regions of the world. Whereas 52% of the North American fleet and 56% of the European fleet is on some form of operating lease (from a leasing company, a bank or even a manufacturer), this percentage reduces to just 33% for the Asian fleet.

Perhaps more significantly, jets leased to North American Majors accounted for some 34% of the regional total, compared with 20% for the Euro–Majors and just 11% for the Japanese and Southeast Asian Majors

Historically, the leading Asian carriers have not used the operating lease to any great extent for a number of reasons. First, cash–flow has been consistently strong, enabling outright purchases; second, fleet flexibility has not been priority in a largely regulated environment; third a high proportion of the Asian fleet consists of widebodies, which lessors generally have not supplied. This could now be about to change.

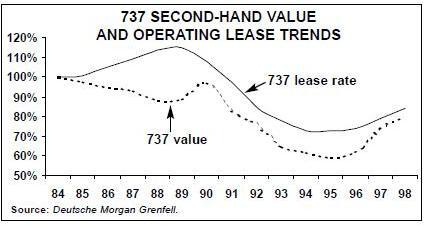

For the banks and leasing companies, however, there is a substantial risk involved in exploiting the Asian situation. It is probable that second–hand values for narrowbodies are at or close to their cyclical peak (see graph, left); values for widebodies are almost certainly past their peak and on a downward track.

Facilitating the dispersal of the Asian surplus means increasing the supply of secondhand aircraft in the West, which, despite currently strong market conditions, will inevitably put downward pressure on prices. A further danger is that too many lessors will start chasing opportunities in Asia. Less sophisticated players will enter this new market, creating a speculative bubble. In addition, it should not be forgotten that there is one other very weak sector of the aviation industry — US new entrants — which could also boost the supply of second–hand narrowbodies.