Starting up airlines: The grey art of business planning

Over the years we have been involved in numerous airline start-up projects, constructing business plans or critiquing others as part of due diligence. Here are some thoughts on the essentials of the process.

Imagination knows no bounds when it comes to start-up airline proposals. Examples of some of the more challenging ideas: converting a Mriya (a six-engine giant Soviet freighter) into a flying casino with round-the-world schedule, taking in London, Hong Kong and Las Vegas; buying up a fleet of obsolete DC-9s, attaching floats, building mid-ocean refuelling stations, and offering an exciting transatlantic service.

Such concepts were kerosene-fuelled nonsense of course. But, on the other hand, applying conventional wisdom to new projects sometimes betrays a failure of imagination, a lack of appreciation of how markets will react to new business models.

Some airlines that are now global leaders were almost strangled at birth. Back in the 90s many experienced UK-based analysts and financiers failed to understand the LCC concept, assuming that easyJet and Ryanair would go the way of the previous generation of independent carriers — Dan-Air and Air Europe — and be forced out of business by the all-powerful flag-carriers. Experts were wheeled in to apply their industry experience, usually gained at BOAC or perhaps Imperial Airways, to the upstarts: Southwest might well work in Texas, certainly not in northwest Europe.

Near identical attitudes were encountered when LCC start-up plans were first introduced in Asia and the Middle East. This is where much of our experience was gained in the 2000s — building from scratch business plans for Air Arabia, based at Sharjah in the UAE, and SpiceJet, where the original Indian investor group split into two and created IndiGo as well — two LCCs for the price of one.

There were many other projects which didn’t work — some didn’t deserve to work, others were frustrated by bureaucracy and vested interests — for example, Al Tayyar, a Saudia Arabian LCC start-up project, failed partly because the civil aviation authority opened up the (substantial) domestic market to new entrants but then imposed hideously complicated public service schedules on new entrants.

The LCC model has now gone global but there are still a lot of potential markets. For instance, Nigeria has great potential (woefully underserved local air demand, the Lagos-Abuja-Port Harcourt triangle, huge population, an emergent wealthy middle class, terrible surface transport, etc) for an indigenous LCC — and always will have, a cynic might add. We have worked on LCC start-up projects for the Nigerian and West African market, where it all looks so promising on paper but then local politics and conditions tend to frustrate.

Consultants do not start airlines; entrepreneurs do. No one is going to invest in a start-up purely on the basis of a consultant’s analysis, no matter how brilliant. Investors and financiers need to believe in the ability of the airline sponsor to develop the plan, to feel fully confident that he or she can deal with the inevitable setbacks, that as well as commercial ability he/she has political skills. Ultimately, backers have to be confident that they will achieve their required RoI.

Airline entrepreneurs come in a wide range of personality types, from thoughtful introverts to hyperactive obsessives, but one characteristic usually impresses investors — willingness to take personal risks themselves, putting their own money into the start-up.

Entrepreneurs and consultants

It is the role of the consultant to turn the entrepreneur’s vision into a coherent form by subjecting it to the discipline of the spreadsheet. This is not always a smooth process. Quite often, the numbers just do not add up and often it’s difficult for enthusiastic airline proponents to accept this fact, which is why there has to be a good working relationship between the sponsor and the consultant.

Original concepts can be torn up and replaced with something sounder. Tony Fernandes’ original idea for Air Asia was as a full-service long-haul carrier before an ex-Ryanair adviser, Conor McCarthy, turned it into a short-haul LCC, luckily for Mr Fernandes.

Occasionally, investors understand the economics but make a political decision. As an example, our analysis of Air Lituanica presented to Vilnius City Council and Chamber of Commerce, containing some hardened businessmen with international experience, clearly showed that the proposed Regional Jet operation, no matter how efficient, would probably lose bucketfuls of money in the first three years before maybe, possibly, scraping break-even. Still local political and business interests prevailed — Lithuania was due to assume presidency of the EU, memories of Soviet occupation and fear of isolation from the West prevailed, the LCC newcomers in some Lithuanian markets, Wizz and Ryanair, could leave at any moment — so Air Lituanica was set up. It operated for about two years.

Consultants, with the exception of guru-types, normally come with clever models that can be adapted to different start-up projects. The basic purpose of any model should be to prove the basic concept through a detailed operational and financial projection of costs and revenues, with unit costs tested for accuracy, schedules for practicality and revenues for reasonableness. The model should be able to answer questions like: Can the start-up maintain a significant cost advantage against the competition and resist competitor reaction? Is the network scaleable? What is the best estimate of required capitalisation, taking into account start-up costs, capex, two or more years of operating losses, contingencies etc?

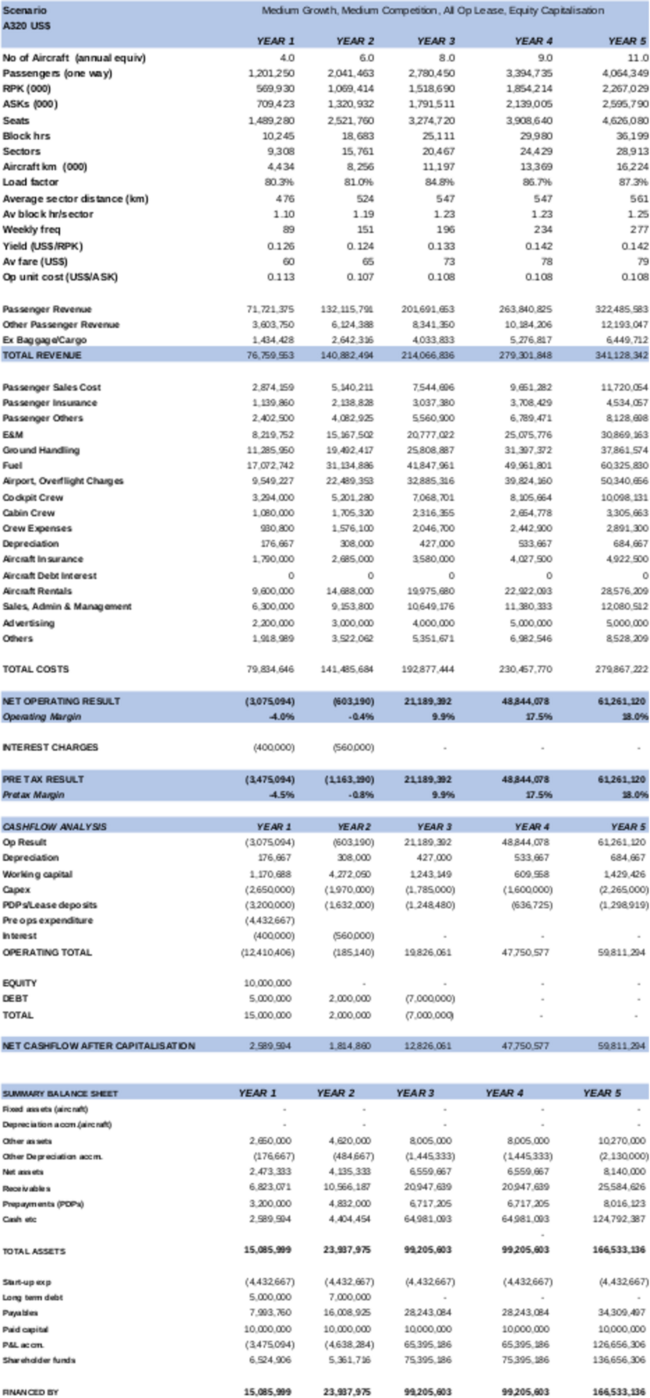

Aviation Strategy has its own specialised model, which evolved over many projects. It’s not particularly complicated, written in excel, with no black box equations, but it works. Extracts from the model are plastered over these pages. The key characteristics of our model are:

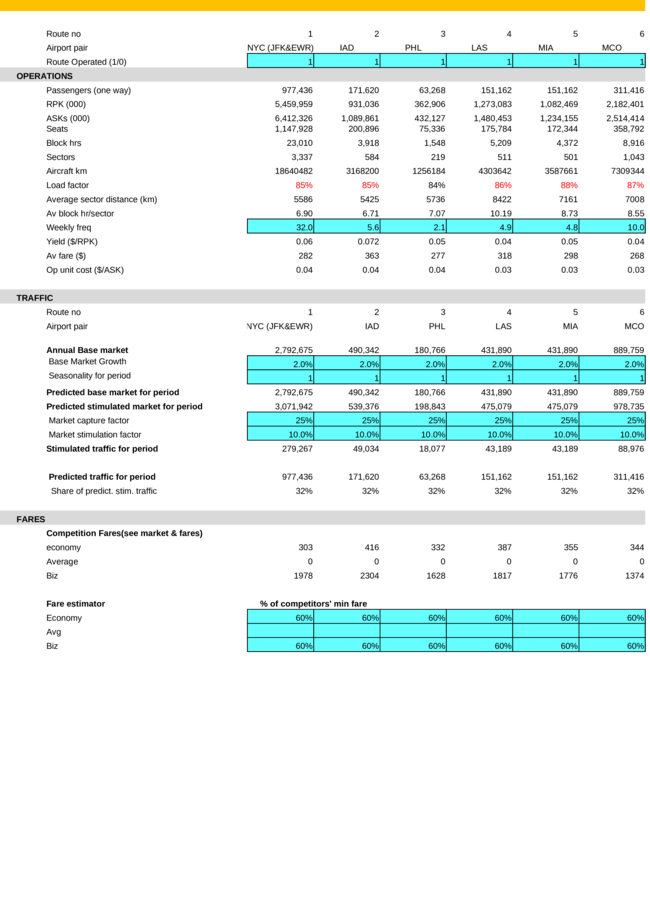

- It uses a bottom-up approach, going from individual routes to the network. The P&L numbers on page10 are the sum of dozens of individual route P&Ls. It can be run on an annual, seasonal or monthly basis.

- It is integrated, combining traffic, schedules, capacity, competition, pricing, operating costs, aircraft choice, utilisation, crewing efficiencies, aircraft financing options and capitalisation. All the elements are inter-connected. To illustrate: change market share on one route in Year 1 and the balance sheet in Year 5 changes (if you are anal enough to look at enough decimal points).

- It is flexible, designed to allow immediate testing of alternative assumptions. This is very important, as the robustness of any airline proposal can only be judged by stressing it. If you feel like, you can easily change, among many other things: market shares, demand growth, pricing by bucket, scheduled flights by route, aircraft type, average aircraft utilisation, fuel and other cost inputs, aircraft pricing, fleet lease/owned balance, debt/equity capitalisation, contingency, etc, etc. But make sure, for example, that if you decide to increase aircraft utilisation, you also check that the model doesn’t also show pilot hours exceeding regulatory limits.

- It is a low cost model, and is designed for LCC-types. But LCC-types have evolved from the classic narrowbody, short-haul only to: long-haul, regional, business-only, etc. The basics are that the airline has to fly one aircraft type only, and that it is essentially a point-to-point operation (the model is not suitable for complex hub and spoking).

Business Plan issues

Here are some of the issues and problems involved in building the business plan.

Forecasting revenues is always contentious. The first step is usually to come up with an estimate of the current core traffic, ie point to point only, on each route in the proposed network, using capacity schedules, CAA data, MIDT, whatever is available. If there is no air traffic, then be imaginative. The Indian bureaucracy provided a wealth of information for potential LCCs — meticulously compiled statistics on AC1 and AC2 (air-conditioned) train passengers throughout the sub-continent — the target customers who would be attracted by a reasonably priced air ticket for a 1½-hour flight rather than 14 hours in a train carriage.

How much of this traffic the new LCC could win depends on setting and maintaining fares at, say, 30-50%, below full service incumbents. Again, any data source that is available is used to estimate the incumbent’s average fare, or fares — for instance, standard, peak and discount. To get to the traffic estimate for the LCC, the model requires that you input your estimates for market capture, market stimulation, market diversion (from other modes). This forces the forecaster to be explicit about the relationship between pricing and volumes on each route. It also enables assumptions to be challenged on a detailed level; routes differ — price-sensitive leisure routes can usually be stimulated, business-orientated routes may be price-inelastic; the incumbents may be entrenched or vulnerable.

Having come up with a first estimate of traffic by route, the next step is to build the schedule. Inputting frequencies by route generates the seat capacity on each route (depending of course on the size of the aircraft deployed) by year, by season, by month. The aim is to achieve a frequency which generates slightly more seats than the predicted passenger volumes. Load factor is an output, not an input, in our model.

So now we have the passenger revenues by route (simply average LCC fare by generated traffic) volume. Add in ancillaries and others (more of this later) and we have total revenue.

The key cost drivers emerge from the traffic and capacity analysis — Passengers, RPKs, Flights and Flight/Block Hours, which directly or indirectly distribute costs among the network’s routes.

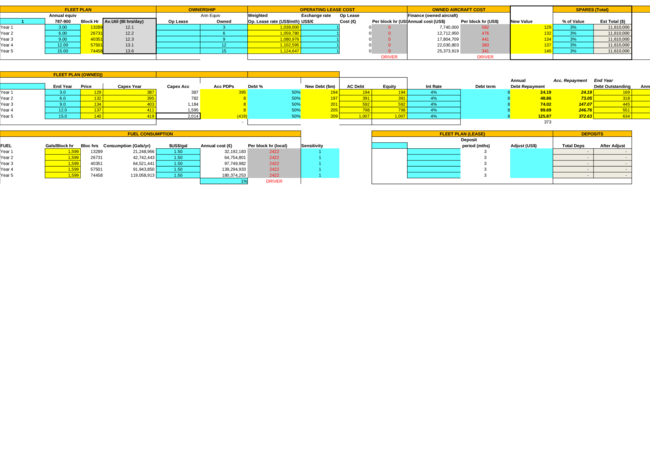

The total block hours generated by the network each year is used to provide the fleet plan — simply by dividing the total hours by a target annual utilisation per aircraft (this will have to be refined later when a detailed schedule has been drawn up). A similar process generates the number of cockpit and cabin crew required, as well as inputting into the requirement for line engineers.

Aircraft questions

A key question: to lease or to buy? In general, an owned fleet will work out less expensive in terms of interest/rental payments over time, and many investors prefer ownership as it puts some fixed assets on the balance sheet. Although a start-up is unlikely to achieve deep discounts from the OEMs, they can be surprisingly generous if they perceive major growth potential.

On the other hand, operating leasing, if that option is available, makes sense in terms of preserving precious capital for developing the operation — a starting fleet of four new narrowbodies will use up about $60m of capital if purchased (assuming 70% debt) whereas operating lease deposits would only be about $4m.

On the issue of aircraft choice, the model can inform the decision process. If the OEMs’ presentations of their competing offers — different types, different pricing, different operating claims — can be distilled down to a some basics — price, seating, MTOW, maintenance costs, fuel burn -then these data can be inputted to the model and a quick estimate of the viability of various options outputted. On a high level, this can be very useful as a negotiating tool.

What should be an obvious comment about the most important cost element, fuel: use the most recent, or the last 12 month average, adding in taxes and delivery charges at the main airports, and stick to this per gallon or per litre cost throughout the forecast period. Adjusting the unit cost to reflect “oil market forecasts” produces nonsense. Scenarios can be run on different kerosene prices, but then you also have to estimate the elasticity effect, how much of a price change is absorbed by the passenger and how much by the company (a clue: about 50/50).

Airport related costs — landing changes, passenger and aircraft handling — can make or break an LCC start-up. The rates that can be achieved at a regional or secondary airports (as opposed to Heathrow or Frankfurt) may bear no relationship to the rack rates or those published in online databases. For the purposes of modelling you can use target rates but be prepared to justify how the discounts are arrived at. Or use the model in discounted rates/ guaranteed traffic growth negotiations with the airport management.

Overhead in an LCC operation is mostly management. Imputing each position and annual employment costs focuses the mind on what “lean management” really means. As a rule of thumb, the number of total employees per aircraft should work out in the mid 30s for a short haul LCC, otherwise it isn’t an LCC.

Quality rather than quantity of managers is critical, and this has proved problematic. Note that FastJet, in its original form, was staffed with managers recycled from other failed start-up airlines who then preferred to stay at London Gatwick rather than basing themselves in Tanzania. Indigo, the LCC private equity fund, may have found a solution by utilising ex-Ryanair expertise. Ex-pat talent returning home worked brilliantly when Rakesh Gangwal was enticed from US Airways to IndiGo, the Indian LCC.

Having sorted out all the revenues and costs, the next big question is how to turn a loss-making airline, which it will be in its early years into a profitable one, which investors tend to insist on. In terms on modelling, there is only one basic way to turn a loss-making start-up into a profitable airline — the growth in unit revenue has to exceed the change in unit cost. As the airline grows, marginal changes in load factor, or yield, can translate into large change in profit margins — if unit costs are rigorously restrained.

But, after the first two years, it is difficult to find economies of scale — the company should have been set up with a low proportion of fixed to variable costs, and should have started using best industry practices, so unit costs cannot be expected to fall significantly. Although It may just be possible to ramp up utilisation rates if the airline has been set up with spare capacity in order to ensure a regular, reliable operation in the early days — an important consideration.

The revenue side of the business plan/forecast is inevitably more speculative than the cost side. Still the combination of the sponsors’ local knowledge and the consultants’ expertise should give solidity to the forecast. Beware the line that refers to ancillary revenue or just other revenue. In the model, this is often just a simple number based on other LCCs’ reported unit ancillary income or a small percentage figure. It is worth checking how much this revenue line, which generally does not have a linked cost line, is driving the start-up’s profitability. If it is substantial, make sure that you understand exactly what “ancillary” means.

Finally, there is the LCC’s all-important capitalisation. Inadequate capitalisation causes bankruptcy. The quantum of equity and debt provided has to cover start-up costs, all capex, working capital, cash losses over at least two years, contingency, etc. Our model signals insufficient capitalisation simply by working out when the start-up is about to run out of cash and alerting the planner with a mild electric shock.

This article appeared in Aviation Strategy Issue #247 June 2019.